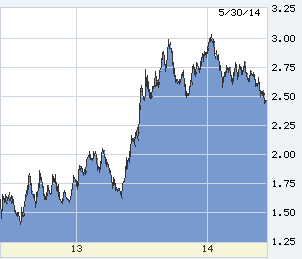

Many threads, much confusion. Most important, a simultaneous event and indicator: the 10-year T-note broke below 2.47 percent, mortgages to low-fours. The chart could not be more dramatic; if not a temporary head-fake, long-term rates can fall a long way.

We will know next week. Next Thursday the European Central Bank meets, and will announce new stimulus of some kind. Next Friday we’ll get U.S. May payroll data. A big 24 hours.

Explanations for the drop in long rates are inventive. The favorite of gold bugs, central-bank haters, and inflation bogeymen: Bond investors are idiots.

A more sensible thought, but likewise mistaken: “Geopolitical risks” have driven rates down. But Ukraine is suddenly off-screen: It has a new and capable president, and Vladimir the Stupid is in rapid retreat, covering failure with a giveaway gas deal with China. Today U.S. authorities confirmed Russian troops are headed back to their barracks.

Stick with simplicity: Long-term rates follow long-term prospects for economic activity and inflation. They go down, rates go down.

The U.S. is in the best shape of the four big global economic zones. That’s why our long-term rates are so high. German bunds today trade 1.36 percent, and Japanese government 10-year bonds are 0.575 percent.

“Best shape” is relative. All here expected first-quarter GDP to be revised down, but negative 1 percent was steep. The usual suspects still say, “Nothing but weather.”

We’ll see about that. April personal income gained 0.3 percent, a little under forecast, but April spending fell 0.1 percent. If there is a second-quarter snap-back of deferred demand, it’s mighty thin. April orders for durable goods appeared to hold the big March gain, but the April show was puffed by defense, a one-time order for 10 new Virginia class nuclear submarines, $1.7 billion apiece.

No one knows what the European Central Bank will do next week. Mario Draghi has been in hold-me-back mode for years (Germans happy to comply).

The euro bond market is shouting: no matter what, too little to late. The very worst financial marker for an economy is falling rates on sovereign debt while rates on private borrowing rise and lending contracts. European bank lending in April shrank for the 24th straight month.

Japan is a hopeless case, held together only by internal solidarity, the legendary Mrs. Watanabe refusing to leave the yen for a real currency, the yen rising in relative value while China and Europe devalue.

China’s newest rebalancing road bump: Prices of homes have begun to fall. The rest of the BRICS are too soft to pull anything, Brazil at the edge of recession and social trouble, South Africa in recession, and India embarking on reform unattainable for 55 years.

Damned glad to be here! And to profiteer on the woes of others, but be suspicious of U.S. log-rolling. One source of optimism is the stock market, but bubbling to new highs despite shaky earnings and the largest fraction of negative-earning IPOs since the last tech collapse has more to do with stock buy-backs than an accelerating economy.

It’s an election year, and every left-leaner on the econ beat is tub-thumping the economy to help floundering Democrats. The screwball theories of their counterparts on the right have long since drove away everyone but the choir, so mainstream publications are unusually tilted, The New York Times worst-affected. Monday brings a new econ-political circus: The EPA will join the carbon wars, unloading expensive rules on the nation’s utilities.

The Democrats are going to run on inequality and carbon. They’re not going to do anything about either, just run on them. CO2 could be deadly, but we have no way to know at what pace or extent.

The price mechanism since the 1970s has produced extraordinary conservation and substitution, and self-calibrated with incomes. Oil is too expensive for generation, so we stopped; renewables are up to 13 percent, gas 27 percent, nuclear 19 percent. Cheap coal is the tough one, still 39 percent, expensive to clean up or to squeeze out.

Laudable efforts to wean us from carbon have always run the risk of cost beyond ability to pay, trebly so in a weak economy. At this moment this nation needs jobs and rising incomes more than anything, and without them can’t get done anything of importance.

10-year T-note last two years. It’s a reach to think we can go back to the all-time lows, having been there so recently.

For clarity, the 10-year in just the last year. Hold below 2.47 percent through next week’s news, and there is no chart support whatever between there and 2.00 percent.

Lou Barnes is a mortgage broker based in Boulder, Colo. He can be reached at lbarnes@pmglending.com.