Fannie Mae and Freddie Mac’s federal regulator has proposed risk-based capital requirements for private mortgage insurers that homebuyers are required to use when making down payments of less than 20 percent on home purchases financed by mortgages guaranteed by Fannie and Freddie.

The Federal Housing Finance Agency proposes conducting risk-based evaluations of each Fannie and Freddie-approved insurer’s portfolio, to make sure each has enough capital to pay claims “under a scenario of significant market stress.”

The evaluations would apply “high-risk feature multipliers” for loans with debt-to-income ratios above 43 percent, and for mortgages that are not fully amortizing, lack full documentation, or involving purchases of homes not owner-occupied when the loan was originated.

The risk-based evaluations, which could limit the number of mortgages that private companies are able to ensure, “are designed to reduce taxpayer risk by strengthening the role of private insurance in the mortgage market,” FHFA said in a statement. “We anticipate sufficient industry capacity to meet the needs of high-LTV borrowers and are seeking input on the potential impact of these draft requirements.”

Shares of two private mortgage lenders — MGIC Investment Corp. and Radian Group Inc. — were down sharply this morning, as investors weighed whether their capacity to underwrite new policies could be limited if the FHFA adopts the standards as proposed.

At the beginning of the housing downturn, private mortgage insurers quickly lost the financial strength ratings that Fannie and Freddie had previously required. In 2011, one of the nation’s top three private mortgage insurers, PMI Mortgage Insurance Co., was placed in receivership by regulators.

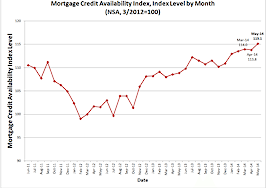

When private mortgage insurers tightened underwriting standards during the downturn, they lost much of their market share to FHA and VA loan guarantee programs. FHA has been hiking premiums to shore up its reserves, and shift some of its business back to private mortgage insurers.