Are you set up for success in 2016? Join 2,500 real estate industry leaders Aug. 4-7, 2015, at Inman Connect in San Francisco. Get Connected with the people and ideas that will inspire you and take your business to new heights. Register today and save $100 with code Readers.

Federal Reserve Chair Janet Yellen gave her semiannual monetary testimony to Congress twice this week, to the House and Senate separately, and continued her chant: “If the economy performs as we expect, then we will begin to normalize policy in 2015.”

Threats and threats … and interest rates fell. The disconnect between the bond market, Fedspeak and data is driving traders to distraction.

Long-term rates fell too far last winter, rebounded in May, and since have stayed put — just directionless chop.

Sometimes two things are true but in conflict. From childhood, my dad — in a tired voice — advised maintaining a high tolerance for ambiguity.

In one truth, the Fed is right to want to lift off. Staying at zero percent cost of money open-ended is a bad idea — at minimum, a risk of creating financial market bubbles. The Fed has been at zero for seven years, and there is no telling how many roaches have sneaked into the kitchen.

So toss a quarter-point bug-bomb in there and see who scampers out from under the fridge. The military calls it “reconnaissance by fire.”

There is also wisdom in Chair Yellen’s line, “If we raise rates gradually now, there is less risk that we will have to raise them steeply later.” It is reasonable for the Fed to take out some insurance.

OK. I’m down with all of that. But this, too, contrary: The only sign of acceleration in the economy is the falling rate of unemployment. But even it is flawed because wages are not rising as they should with falling unemployment.

Some sectors are hot, like autos, but fueled by very bad lending, and soon everyone who wants a new car will have one, and cheap used cars will begin to pile up. Every general metric of the economy was supposed to accelerate now after suppression by a bad winter, and instead all are flattening — retail sales worst of all.

The deepest weakness in the liftoff proposition, “If the economy performs as we expect …” Expect? It has underperformed every one of your forecasts since 2006. The worst of the worst: the Fed’s insistence that inflation is headed up toward its 2 percent target. Not.

Nevertheless … unless an economic stall, especially in the monthly hiring numbers, the Fed is going to pull the pin on the quarter-point. And I think that’s priced into today’s long-term rates. The next grenade is not, and certainly not the one after that.

The bond market does not believe in a chain of “normalizing” hikes toward 4 percent, no matter how gradual. Paul Kasriel, retired chief economist of Northern Trust, has been predicting gross domestic product (GDP) growth by using a bank credit and reserves model, and his latest blog says 0.25 percent liftoff will be “one and done.”

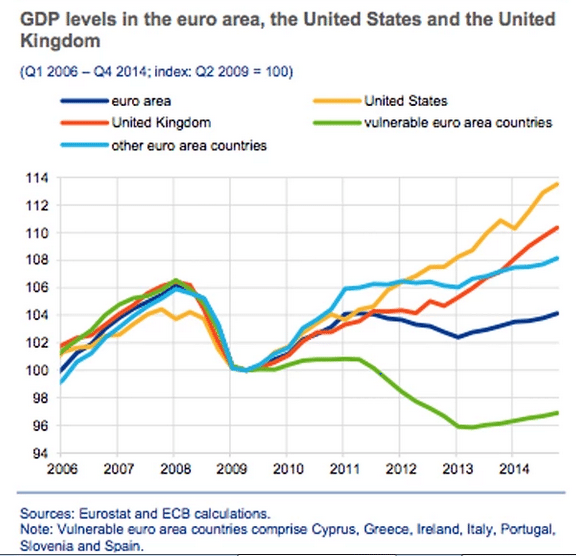

I think the Fed and its models are stuck in a pre-1995 world, long gone. The U.S. is more subject to external pressure than ever before, external events and competition, and more so every day.

There is good external news. The Iran deal is an excellent thing, even if it fails. It is encouraging to see so many nations work together so long and so hard. The U.S. disengagement from the Middle East, installing training wheels on nations there, a very good thing.

The Trans-Pacific Partnership trade deal is a good thing, especially to see President Obama at long last discover how to work with a Congress controlled by opponents.

The rest of the external news this week … sigh and hope it passes. German leaders since 1945 have done all they can to appear jolly people in a beer garden. This week the mask fell away, and the there was the beast, fangs bare.

An International Monetary Fund (IMF) report after the new Greek “deal,” very much out of IMF character, clubbed Germany and its policies. Germany is so ugly that Europe is unable to speak about it.

China presents economic risks that have contributed to this week’s rate decline. Not its stock market, which in terrible embarrassment it will prop no matter what, but in another official deceit: It announced 7 percent economic growth in the last quarter, which nobody believes. Maybe half that. If that.

As China slows, so do its purchases of imports from emerging nations and Europe. We will feel that here, if only in falling commodity prices, and falling currencies relative to the dollar — all anti-inflation.

I take a very dim view of gold as an investment, hedge or trading device, so I am pleased by its unwind — which may or may not reflect reduced inflation pressure, but sure as hell does not indicate increased inflation. It’s also pleasant to hear less from gold bugs.

The 10-year T-note this past week (above).

The 2-year T-note is the Fed-predictor (chart two years back). Nothing here but 0.25 percent liftoff and disbelief in a next step.

The 10-year T-note two years back. Stalled.

Inflation is falling. See “external pressures,” and the fracking revolution still in its infancy.

The consumer was supposed to come roaring back after artificial suppression by a bad winter. I don’t even see a “meow” in retail sales.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.

Inman Connect San Francisco is right around the corner — register now and save $200!

Start Inman Connect SF off right! Choose from three powerful events on Aug. 4. Reserve your spot now for Agent Connect, Broker Connect and Tech Connect.