- ShowingTime has just purchased its second real estate analytics company over the course of a few months: MRIS subsidiary RealEstate Business Intelligence (RBI).

- MRIS says the sale will allow the MLS to focus on the MRIS-TREND consolidation and MRIS's subscribers will keep the same services they've had.

- ShowingTime may make more acquisitions this year, but in the meantime, the company will offer unique reports that integrate showing and sales data.

ShowingTime is definitely not just a showing management company anymore. The Chicago-based firm just acquired its second real estate analytics company in less than six months: MRIS subsidiary RealEstate Business Intelligence (RBI).

ShowingTime bought up analytics firm 10K Research and Marketing and a former competitor, BookAShowing.com, in the fall. And the firm may not be done.

Michael Lane

ShowingTime President Michael Lane told Inman the firm is considering other acquisitions, but any purchase would have to be “complementary” to what ShowingTime is currently offering. The company has about 800,000 subscribers nationwide.

“If we see an opportunity that is a good strategic fit for us, then we would consider it,” he said.

“The thing that’s interesting to us is deepening our connections with our existing customers.”

Case in point: most of ShowingTime’s 110 or so MLS customers either use RBI or 10K for their market statistics, Lane said.

The MRIS/RBI history

Rockville, Maryland-based MRIS (also known as Metropolitan Regional Information Systems) is a ShowingTime customer. MRIS launched RBI in 2012 in a bid to leverage its comprehensive MLS data into products for agents and brokers. The MLS has some 45,000 subscribers.

MRIS CEO David Charron told Inman RBI was “absolutely successful” in MRIS’s market, but “didn’t have the resources to efficiently address opportunities on a national level.”

“Big data is not for the faint of heart,” Charron said.

ShowingTime is “ready to make significant investments in big data and frankly we weren’t prepared to make those investments. That’s not where our competency is. It’s tough to build a competency,” he said.

David Charron

Moreover, MRIS is currently focused on its merger project with neighboring TREND MLS, called “MLS Evolved.”

“Right now, all the resources we have should go to making our customers successful and making the Mid-Atlantic consolidation happen,” Charron said.

“We’d worked too hard to get this far for us to marginalize [RBI]. ShowingTime made a fair proposal to us. We kept all the services to our customers that they already have. It really has to do with focus and our need to not dilute that focus.”

Deal includes SmartCharts and MarketView 360

The deal closed on Friday. ShowingTime declined to disclose financial terms of the deal. All RBI employees have been retained, according to Lane. He declined to disclose how many employees RBI has.

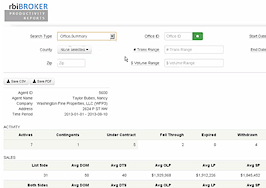

RBI offers two main products: SmartCharts (also known as MARKETrends) market statistics for agents and teams, which counts 142 MLSs representing nearly 500,000 agents across North America as customers; and MarketView 360 (also known as SmartCharts for Brokers), which ranks the offices and agents that do the most transactions in a certain area according to particular search criteria.

This helps brokers recruit top agents, monitor their competition and benchmark their company’s competitive performance in the market, according to the company.

SmartCharts will complement ShowingTime’s 10K market stats offering. The company’s “medium-to-long term plan is to consolidate those into one product line with no changes in the short run,” Lane said.

MarketView 360 is “new” to ShowingTime’s offerings and “would be a natural thing for us to build on,” Lane said.

“MarketView 360 is just for MRIS customers currently. There’s an opportunity to offer that nationwide. We have a very large customer base of brokers and MLSs that we could offer that product.”

Three in one — eventually

All three products will continue to be offered on their own for now, but will eventually integrate showing data. ShowingTime has already started to take advantage of its 10K acquisition by offering unique reports to customers of both ShowingTime and 10K, such as the Charleston Trident MLS.

“The showing appointment data is very complementary to sales data with the exception of showing data being much more timely and forward-looking. Sales data is more backward-looking,” Lane said.

The reports say how many showings there were on average before a listing went pending in a certain area, for instance, according to Lane.

Excerpt from ShowingTime’s 2015 Annual Report for Charleston Trident MLS

“It’s an exciting addition to combine RBI’s offering with our current analytic tools,” said ShowingTime CEO Scott Woodard in a statement.

“Using market knowledge wisely helps agents differentiate themselves. We’re looking forward to offering more never-seen-before reports to customers.”

When asked whether ShowingTime hoping to expand beyond showing systems, Lane said, “Right now, this is what we’re focused [on.] [RBI] is a natural extension of what we do because it’s a completely software-based offering. It’s complementary. We’re considering other things beyond that, but as of right now this is what we’re focused on.”

Editor’s note: This story has been corrected to note that ShowingTime has about 800,000 subscribers, not 200,000 as previously stated.