- Forget the Fed raising rates, unless Friday morning’s employment report, which showed that the economy in the U.S. created the fewest number of jobs in more than five years, is revised.

Wow. What a difference one Friday morning can make. Or did it, alone?

The 10-year T-note has broken to 1.70 percent from 1.81 percent overnight, mortgages following grudgingly to 3.625 percent, both near the lows of 2016. Poised for lower.

Forget the Fed raising rates, unless Friday morning’s employment report, which showed that the economy in the U.S. created the fewest number of jobs in more than five years, is revised. Missed California?

Begin with quibbles: to the pathetic gain of 38,000 jobs add 37,000 Verizon strikers, but subtract March/April downward revisions just as large.

In a suspicious statistic, the Bureau of Labor Statistics says a half-million people in one month took part-time jobs instead of the full-time ones they were looking for. Possible? No.

An even larger number left the workforce, quit looking for jobs altogether. If you’re not looking, you’re not unemployed, hence a drop to 4.7 percent — in theory Fed-alarming overheating.

Yes, the 4.7 percent is alarming, but only because it confirms that traditional measures are no longer reliable indicators.

So look to other data: the Institute of Supply Management reports confirm slowing in May. The manufacturing one actually beat its forecast, up to a weak 51.5, but the service sector one, also released Friday…tanked.

Down to 52.9 from 55.7, and the worst in many months.

Something happened in May, and maybe a little before. A Wall Street Journal/NBC poll found 70 percent of Americans thinking the country is “on the wrong track,” one of the three worst readings since the Great Recession began.

U.S. politics makes great conspiracy theory, but I’m stickin’ to the old story: The outside world has more impact on the U.S. than the Fed considers. In defense of the Fed, in new circumstances it is forced into back-look forecasting, which heightens the risk of colliding with all sorts of surprising forward objects.

The picture overseas

Brexit is more globally unsettling than politics here. The vote is June 23, and the opponents of exiting the European Union (EU) have bungled their campaign into creating exit votes by the bale.

The “stay” crowd — upper crust, leftist, the Conservative Prime Minister, the Canadian head of the Bank of England, and on Friday Chase’s Jamie Dimon, of all people — has run a scare campaign. “If the United Kingdom (U.K.) leaves the EU, economic life in the U.K. will end!” Hyperbole has brought disbelief and another thought from a tough and independent people: If we have sold our birthright in such dangerous fashion, all the more reason to take it back.

On Thursday, Angela Merkel read from the book of gifted German diplomacy: Countries outside the EU “will never get a really good result in negotiations.” Wonderful. Stay in the EU as do as we say, or leave and do as we say.

Even if Brexit loses, its damage to the EU has been considerable. Europe has not had a great month.

NATO has tried to assemble four battalions (with support units, 2,000 soldiers each, max) to rotate in and out of the Baltics as a deterrent to Czar Vladimir. NATO may have found three, but not a fourth. Turkey is headed to dictatorship.

The EU has sharply criticized right-leaning Poland and Hungary as un-EU. This week the ECB said it would wait on increased stimulus (now buying $800 billion in bonds annually), but did not foresee inflation rising to 2% for two more years.

The Organisation for Economic Co-operation and Development this week said it is worried that the world is caught in a “low-growth trap.” Thanks, guys. Had that.

A puzzled-looking Shinzo Abe acknowledged that next year would be a poor time for a scheduled tax increase, and postponed it to October 2019. Might as well be 2219. The whole deal in Abenomics (and Draghinomics) has been to jolt the patient back to life, inflate away some debt, get the economy growing faster than new debt, and generate more tax revenue.

Remember Cleese as the proprietor of a pet store, and a customer trying to return a dead parrot? “Dead, I tell you.” (Whacks the deceased on the counter). Cleese: “Got a quiet one, did you? Just sleeping.”

Little noticed: Global bond markets rallied before each of the last two U..S employment reports, a dangerous and unprecedented thing to do, but markets have been ahead of the Fed and correctly contemptuous of its forecasting and tightening mania. Friday’s U.S. bond rally is just another leg of the global one: German 10s reached a new all-time low, 0.074 percent, Japan’s -0.098 percent (yes, minus), pulling down our 10s.

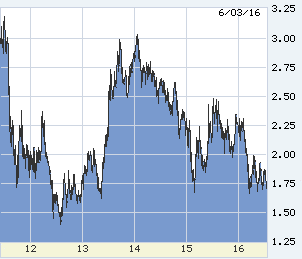

10-year US T-note in the last week

10-year US T-note in the last week. As above, you can see the rally going into today’s job report — and rallying into the universal assumption that the Fed would tighten in June or July. Bonds rallying into tightening say it’s the wrong thing to do.

The 10-year in the last five years, again on the threshold of the all-time low.

The 10-year in the last five years, again on the threshold of the all-time low.

The 2-year T-note, the best Fed-forecaster available, in the last week.

The 2-year T-note, the best Fed-forecaster available, in the last week. At a yield of 0.78 percent for the next two years, these traders forecast no tightening at all in 2016 nor into 2017.

The ECRI (Economic Cycle Research Institute) sees no recession warning in U.S. data, and it’s probably right.

The ECRI (Economic Cycle Research Institute) sees no recession warning in U.S. data, and it’s probably right.

The problem is not here, it’s overseas. If the globe goes into recession, we will feel it here.

The ECRI also provided this global chart. The problem is not here, it’s overseas. If the globe goes into recession, we will feel it here. The 20-nation composite has been in free-fall in 2016.

The Atlanta Fed GDP tracker concurs with ECRI on US conditions.

The Atlanta Fed GDP tracker concurs with ECRI on US conditions. The tracker is current through Friday’s data releases.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.