- The double-digit growth in San Francisco has steadily declined to 4 percent rent growth in the metro.

- Houston has over 27,000 new apartments coming in 2016, but may not have the job growth to accommodate new residents. Rent prices most likely to remain or even drop.

- Only 3,210 new apartments are expected in Baltimore in 2016.

Investors might want to reconsider that new development in Houston after reading AppFolio and Axiometric’s U.S. Apartment Forecast report. According to the trends report, some shining cities might be burning out by year’s end.

The latest report outlines markets where growth is significant enough to alter the business course for property managers. Looking at occupancy rates, employment, economic growth, and other data points, AppFolio, a cloud-based property management portal, and Axiometric, a research and data firm for real estate investors, believe the information can help property managers plan for the future.

Overall outlook on the apartment industry is good by all accounts in the report. Job growth is getting stronger, and more millennials are waiting to purchase homes, putting a demand on existing and new apartments.

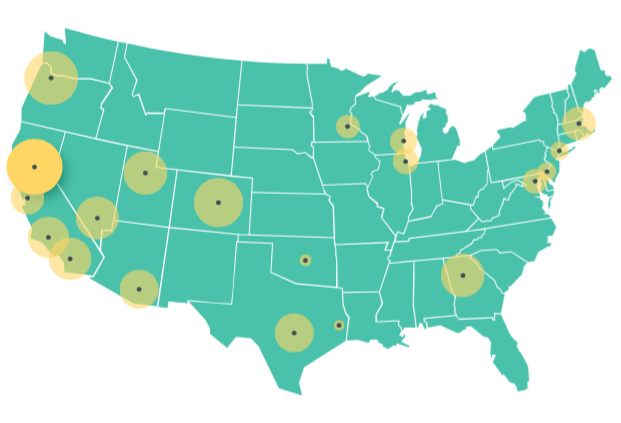

There are over 347,000 new apartments planned nationwide for 2016, according to the report, while the unemployment rate has dropped to nearly 5 percent and 200,000 new jobs have been added to the market this year. With this data, AppFolio and Axiometric conclude that rents will rise 3.2 percent nationally in 2016.

“For us, looking at these data points across the industry are critical, because it helps show where renter demands are and how that will affect the property management business as a whole,” said Nat Kunes, vice president of products at AppFolio.

Market summaries

Los Angeles rent demand is expected to decrease by the end of the year, the report says. Job growth is expected to fall from 2.5 percent to 2 percent, but AppFolio found that the 87,000 jobs that will be created will place a demand on the rental market. AppFolio also found that based on rent increases averaging 6 percent from January to April, landlords will be able to increase rent by an average 4.6 percent by the end of the year.

“The thing that stood out in the report was just how strong some of these markets are,” Kunes said. “Markets like Sacramento, markets like Portland, these top markets are really continuing to accelerate, and you’re seeing both increases in occupancy rates and rent prices, as well.”

The report found that San Francisco’s double-digit rent growth areas would mellow out — The Bay Area’s average rent growth is now averaging 4 percent per year, but by the end of the of year, the report states that number will fall to 3.7 percent for 2016’s average.

There are an expected 22,848 new apartments coming to market in New York City in 2016, with a heavy concentration on the Brooklyn area. To sustain this inventory, NYC will need to manage a projected 2 percent job growth, the report says. Rent growth in New York is expected to increase to 2 percent by the end of the year.

The report shows that Chicago landlords will not be able to increase rent prices based on low growth and demand for the 7,598 units coming in 2016. The metro averaged 2.4 percent rent growth in the early part of 2016, but that number is expected to fall to 2.2 percent overall at the end of the year.

Property owners in Baltimore can celebrate, as rent growth is expected to rise from the 2.2 percent average at the beginning of the year to 2.3 percent at year’s end. There is expected job growth of 2.1 percent, but only 3,210 new units are predicted to come to market.

The Houston area experienced a shift when oil prices dropped in 2014. There are 27,649 new apartments expected to come to market, the report says, but the growth is just not there. According to the report, rent growth is expected to drop to -0.3 percent by year’s end, down from the paltry 0.4 percent Houston maintained through the beginning of the year. Job growth is at 0.8 percent through 2016, the report says.

“These reports help people see what’s coming in the future, help them see ahead, and also make the right decisions for their business based on it,” Kunes said.