- For housing, there are two ways to lose population: “natural loss,” the excess of deaths over births; and “net migration,” people moving away.

- Population loss correlates to price declines, and population gain to appreciation, so the housing market looks very different depending on what's happening in your area.

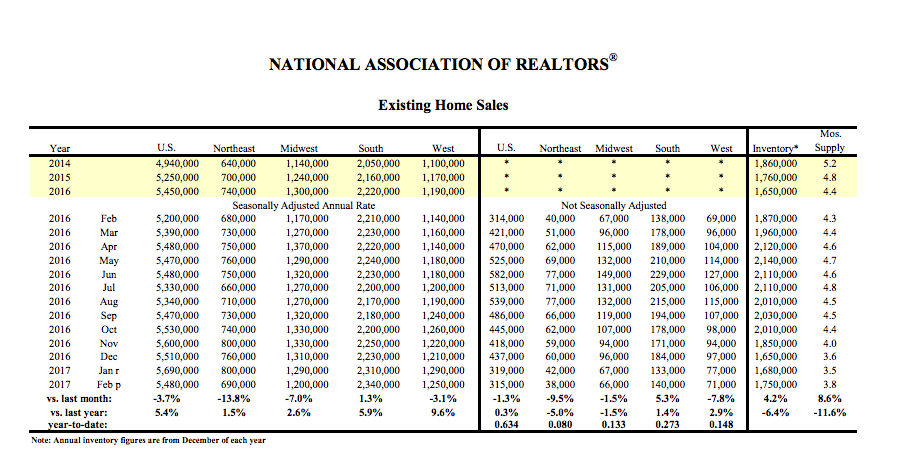

This week the National Association of Realtors announced February sales of existing homes had fallen 3.7 percent from January, based on an estimated, seasonally adjusted and annualized 5.48 million homes, the decline attributed to a shortage of homes for sale.

Blah, blah, blah. That could be the first paragraph of any national housing report in the last five years.

Fractional change in a huge market. Blah. Inventory scarce. Blah.

NAR people, could we try a little harder — perhaps shed some descriptive light?

Economic trends between red and blue counties

The most interesting single piece of overall U.S. economic data this year has been derived from politics.

Brookings analysts — along with all the rest of us — noticed the county-by-county election map, an ocean of red with little blue islands floating in spots, and dug deeper. What might be the differences in economic trends between red counties and blue ones?

There are 3,056 counties in the U.S. In 2000, 659 of them, 21.6 percent voted for Gore, and those counties represented 54 percent of U.S. GDP.

In 2016, 472 voted for Clinton, 18.3 percent, but their share of GDP had risen to 64 percent.

Politics aside, the economy is lousy in the Trump-majority counties. So is housing — these are not places with a shortage of for-sale inventory. The hot portions of the U.S. are more concentrated than ever.

Migration out

The University of North Carolina dug deeper yet. Between 2010 and 2014, 53 percent of U.S. counties lost population.

More important, especially for housing, there are two ways to lose population: “natural loss,” the excess of deaths over births; and “net migration,” more people moving out than in.

Migration is a shorter-term affair than birth and death, and hence has more impact on housing supply and demand. UNC found 61 percent of U.S. counties suffered net out-migration.

The states with net population loss, or nearly so, are:

- Connecticut

- Illinois

- Maine

- Mississippi

- Vermont

- West Virginia

Of all states ranked by five-year rates of home-price appreciation (FHFA), these six rank in the poor half of the nation’s weakest 17 states — the only ones to have appreciated less than 20 percent in the last five years, even in the general rebound from the housing bust.

The reverse is true also, population gain correlating to high appreciation.

Appreciation in fast-growing states

In the three fastest-growing states, price appreciation in the last five years:

- Arizona: 66 percent

- Florida: 60 percent

- Nevada: 92 percent!!

All three are partly distorted upward by bubble-rebound, but these are still extraordinary numbers.

Colorado, Texas, Utah, Washington and Idaho each posted gains between 41 percent and 59 percent. Only North Dakota lagged among big population gainers, up only 33 percent because the prior five years had been nuts as fracking exploded.

I know Colorado best, my home. We rank top-five for population growth, yet nearly half of our counties are losing population. Half of Colorado counties have fewer jobs than in 2008.

Our economy at the moment is as good as any in the U.S., yet the whole thing is taking place in a Front Range north-south corridor, Denver in its center, barely 15 miles wide by 75 miles long — 1,125 square miles in a state one hundred times that size.

Boulder County lies within that zone, 24 square miles. Half is mountains and national forest, not buildable. Half of the other half has been bought by government and preserved as open space.

The rest was built-out 15 years ago, 320,000 people and no room for more, but more pouring into the corridor around us. In the FHFA’s House Price Index, a total of 258 cities, price appreciation back to 1991, the winner for largest gain is Boulder, Colorado: 341 percent.

We have become a nation of two economies, two sets of politics, and heaven knows, two housing markets.

Going deeper

As you read through the monthly blah-blah-blah of housing, take time to Google one step deeper.

Our increasingly tech-based economy clearly flourishes in cities which get to critical mass of some sort — some combination of people, talent, employers and quality of life. Purchasing power grows there, land becomes more and more scarce, for-sale inventory drops to nothing and prices rise.

Outside these zones we have the 19th Century running in reverse — people in large numbers leaving, headed for cities. Wagon trains not headed out, but in to an entirely different frontier, leaving behind more houses than people.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.