- A tech entrepreneur's new site arms female buyers, who often get worse mortgage deals, with knowledge.

When Nicole Hamilton created Homeownering.com, the serial homeowner and tech entrepreneur had steam coming out of her ears over a real estate and mortgage industry paradox.

Nicole Hamilton

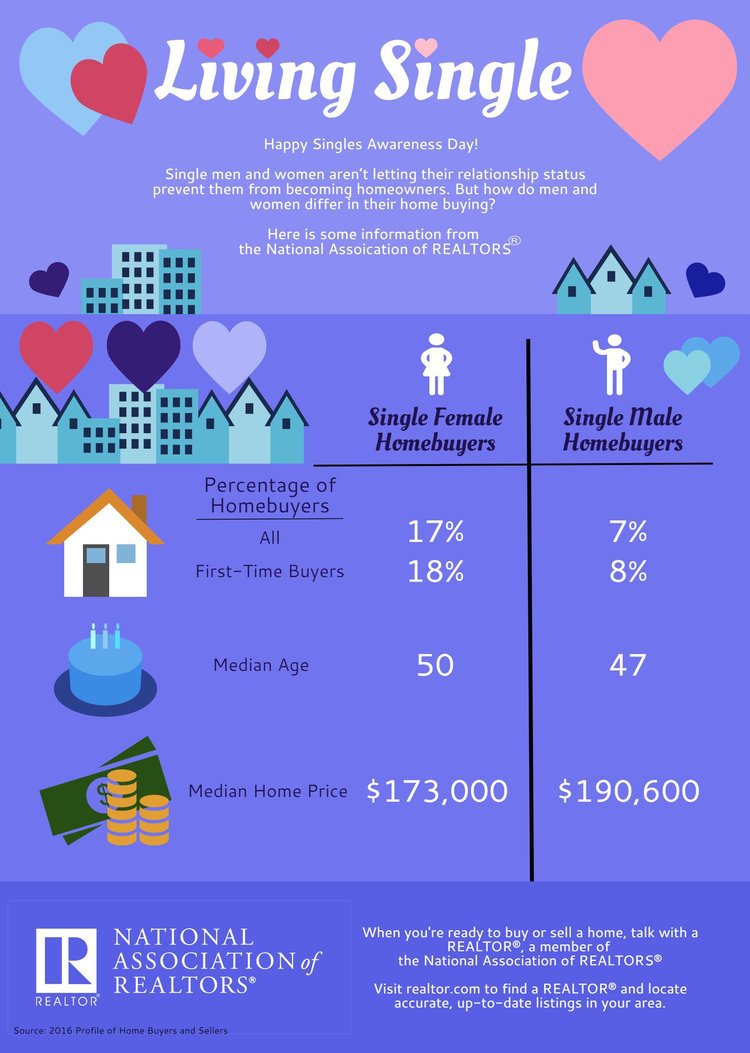

In the pie chart of homebuyer market share, single women claim a slice that’s more than double the size of their male counterparts’, but they tend to get an inferior deal on their mortgage despite better payment track records.

Indeed, the National Association of Realtors revealed that single females made up 17 percent of buyers in 2016 — that equates to one million homes — compared to the 7 percent attributed to single male buyers.

“That’s not a niche; that’s a majority,” Hamilton said, adding that this group is to be taken seriously.

“I felt it was a shame that a lot of women are out there looking to buy homes and yet get the worst deal.”

Hamilton has set up Homeownering.com for women homeowners and buyer hopefuls to better equip them with information and mortgage tools while creating a more level playing field.

She believes real estate agents can also play a role in correcting the trend potentially hindering this buyer segment, namely by advising throughout the mortgage shopping process and lending intel on their community’s best vendors and inspectors.

Screen shot from Homeownering.com homepage.

Why worse deals for women?

In addition to being more reliable when it comes to mortgage payments, women also have 3.7 percent less average debt than men, according to Experian research.

One of the main reasons they often get worse deals on their mortgages, however, is because they may have weaker credit profiles in general, according to a 2016 Urban Institute report.

In addition, the less favorable terms may be because women are less inclined to shop around for their mortgage, preferring to go with a referral, according to a paper in the Journal of Real Estate Finance and Economics, something that Hamilton sees evidence of regularly.

Coming from personal experience, Hamilton was frustrated by the way home mortgage companies talked down to her — loan officers are predominantly male — and left out what she thought was important information. This is why she set up her own business, Tactile Finance, a company that makes mortgages clear to consumers via a shareable, web-based product for loan officers.

Where Homeownering.com comes in

With Homeownering.com, the idea is to give female homeowners the full picture around home financing and provide them with better tools than mortgage professionals have offered thus far.

“We use the intelligence from our work through Tactile to make easy pathways and tools for consumers to navigate to their best financial outcome as a homebuyer or homeowner,” Hamilton said.

Screen shot from Homeownering.com homepage.

For instance, comparing quotes is very hard for consumers to effectively do because there are so many components, she said.

“We give consumers a step by step way, including scripts they can use with loan officers and tools that are easy to plug things in and really see how one quote compares with another to support the workflow that is in real life,” Hamilton explained.

As anyone who has been through homebuying or refinancing knows, the process involves a series of frustrating and tiresome steps, and you don’t know if the mortgage professional is giving you the full information or what your options are.

Screen shot from Homeownering.com homepage.

“Our goal is to 1) get you tools to get the best quote and 2) actually know that you got the best deal possible,” Hamilton said.

Screen shot from Homeownering.com homepage.

“We want to empower women to be not just able to get through in a negotiation but to have more knowledge — my mission is not put them up a few levels; we want them to be fully empowered.”

Overall, most homeowners have the majority of their net worth in their homes.

“That’s why it’s incredibly important that homeowners, including women, are in control of their home finances and are not being taken advantage of,” she added.

How real estate agents can help

Real estate agents can help their female homebuyers in two key ways: By making sure their clients do a thorough search for a good mortgage broker when qualifying, and assisting them with house maintenance contacts after the sale.

Hamilton says agents can get involved and help where they see unfairness or a buyer who has too hastily decided on a mortgage option.

“A lot of agents will refer clients to a mortgage broker, but they can do more in sending them in the direction of independent qualification information that is useful for them in their situation,” Hamilton said.

Agents can be generous with their vendor contacts

Homeownering.com aims to help women not only buy homes but keep home costs under control and to plan successfully for home improvements.

Moreover, an agent’s network of maintenance professionals can be a real help to buyers as they take on homeownership.

“One thing I’ve heard is that women lean on their inspectors more and might well stay in contact with them about maintenance issues. I thought that was really interesting and smart,” Hamilton said.

Agents who recommend a so-called “tough” home inspector could be giving a value add.

“I didn’t actually know until I bought my latest house that real estate agents know who is tough and who isn’t,” Hamilton said. “When I had my home inspected, both the buying and selling agent said: ‘Oh, he’s good and known to be very thorough.’”

An agent’s local knowledge can be really useful, too.

She added: “Something an app can’t do is give block-by-block related insight on issues other homeowners are having.

“The block I moved to in Brooklyn has common repairs among all the homes as they were built the same decade. Our selling agent lives a block over and was able to provide so much useful information.

“I love hyperlocal knowledge.”