- The national foreclosure rate in July was the lowest since August 2007.

- Florida, a judicial foreclosure state, had the highest number of completed foreclosures in July, at almost 57,000 statewide.

- In the Miami metro, 2.3 percent of all mortgaged homes faced some stage of foreclosure.

After years of consistent improvements, the national foreclosure rate is at its lowest level in nine years, according to CoreLogic’s July 2016 National Foreclosure Report.

Thanks to loan modifications, a healthy labor market and upward housing trends, just 0.9 percent of mortgaged homes are in some state of foreclosure – the lowest rate announced since August 2007.

“The U.S. Treasury’s Making Home Affordable program has contributed to the decline through permanent modifications, forbearance and foreclosure alternatives, which have assisted 2.5 million homeowners with first mortgages at risk of foreclosure since 2009,” CoreLogic Chief Economist Frank Nothaft said in a statement.

In July 2016, 34,000 homes completed the foreclosure process, down 16.5 percent year-over-year and 3.9 percent from the month prior. The serious delinquency rate in the U.S. sat at 2.9 percent, the lowest since May 2016, according to the report.

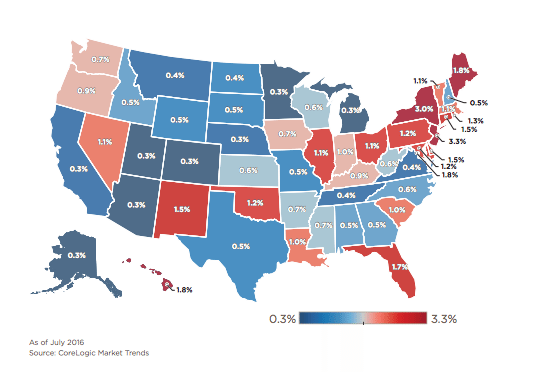

National foreclosure inventory is down 29.1 percent year-over-year, reaching 355,000 homes in the U.S. July marked 57 consecutive months of annual foreclosure inventory declines, CoreLogic says, and the majority of states (29) posted a lower foreclosure inventory compared to the national rate.

Florida foreclosures improving

Florida, a judicial foreclosure state, had the highest number of completed foreclosures from July 2015 to July 2016, at almost 57,000 statewide.

Still, Florida foreclosure inventory saw the biggest annual dip of any state, down 38.9 percent to reach 1.7 percent of all mortgaged homes. Meanwhile, the serious delinquency rate reached 4.8 percent in July.

The Miami-Miami Beach-Kendall metro posted 5,740 completed foreclosures in the 12-month period ending in July. The serious delinquency rate in the Miami metro reached 6.3 percent, while 2.3 percent of all mortgaged homes faced some stage of foreclosure — down 36.9 percent annually.