- Aside from homeowner’s insurance, first-time buyers should consider flood insurance, umbrella coverage, earthquake insurance and valuable items plus.

Buying a home is a huge deal. It’s not only a sanctuary to raise a family in, but it’s also an investment in one’s future.

New homeowners want and need insurance to protect this investment. Here are five types of insurance first-time homeowners should consider to protect their home.

1. Homeowner’s insurance

Compulsory for homeowners with mortgages, homeowner’s insurance can be separated into five key areas that owners are protected against: damage to the home, personal property, liability, medical payments and loss of use.

- Dwelling coverage: Pays for damage to your home and unattached structures, such as sheds, fences and garages up to the limit you specify.

- Personal property: Repairs or replaces the contents inside your home, such as furniture, appliances and clothing, should they be damaged or stolen.

- Liability protection: Protects you should someone injure themselves on your property and then file a claim against you.

- Medical payments: Covers the medical bills associated with an injury that occurred on your property, such as co-payments, MRIs, CAT scans, EKGs, etc.

- Loss of use: Pays for living expenses should your home be too damaged to occupy while repairs are being made after you have filed a claim.

2. Flood insurance

Flood insurance fills in the gaps not covered by homeowner’s insurance. It covers flood damage caused by hurricanes, torrential downpours and other natural events.

Many homeowners believe they don’t need flood insurance because they don’t live in a high-risk area. This is not true; floods top the list as the no. 1 natural disaster in the United States with 20 percent of claims coming from moderate to low-risk areas.

Owners can choose to purchase an NFIP policy that protects your home and personal property or one over the other. The former protects your home up to $250,000 in damages while the latter covers personal property up to $100,000 in damages.

You never know when a flood may strike so it’s important to protect your assets before something happens.

3. Umbrella coverage

Provides additional liability coverage above the limits set by your homeowner’s insurance policy. Should the homeowner limit get exhausted, umbrella will kick in.

It provides coverage for bodily injury, property damage, slander, libel, malicious prosecution and other personal liability situations.

4. Earthquake insurance

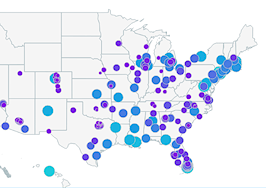

An optional coverage that protects your home in the event of an earthquake. Western states are more prone to earthquakes, but eastern states have a relatively lower risk.

Some insurance companies consider earthquake insurance an add-on to a standard homeowner’s policy while others may make you purchase as a stand-alone insurance.

To aid in deciding whether or not to purchase, take a look at this helpful map below:

5. Valuable items plus

Provides higher limits for more valuable items that exceed the limits set by your standard homeowner’s policy. These items could be engagement rings, cameras, computers or expensive antiques.

Valuable items coverage provides you extra peace of mind should they be stolen or damaged.

In short, the elements of nature can be unpredictable. No matter what hand life or the weather deals, homeowners should be financially prepared to handle any situation.

Kathy Francioso is a personal lines manager at H&K Insurance Agency Inc. in the Boston area. Follow H&K on Facebook or Twitter.