- Here's a recap of pending home sales, existing home sales, price indices and studies from NAR, S&P Dow Jones, Zillow and Trulia.

Every month, economists release a number of indices, reports and analyses of the housing market, and it can be difficult to keep up with them all.

Thankfully, the National Association of Realtors (NAR) recapped the month in its new Housing Minute monthly video series.

August existing-home sales declined 1.3 percent to a seasonally adjusted annual rate (SAAR) of 5.44 million — down from 5.51 million in July, and home sales prices rose 5.6 percentage points to $253,500.

- NAR Chief Economist Lawrence Yun said the dip in existing-home sales prices isn’t due to a lack of buyer desire or demand. Instead, it’s due to continuing issues with low inventory made worse by sluggish residential housing starts.

- “Steady employment gains, slowly rising incomes and lower mortgage rates generated sustained buyer interest all summer long, but unfortunately, not more home sales,” Yun said. “What’s ailing the housing market and continues to weigh on overall sales is the inadequate levels of available inventory and the upward pressure it’s putting on prices in several parts of the country. Sales have been unable to break out because there are simply not enough homes for sale.”

- Yun says Hurricanes Harvey and Irma have temporarily slowed activity in the South, but he expects the region to recover beginning in 2018.

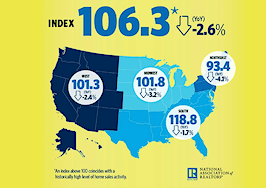

August pending home sales took a hit as well. The PHSI declined 2.6 percent to 106.3 in August from a downwardly revised 109.1 in July and declined 2.6 percent year-over-year — the lowest reading since January 2016 (106.1).

- Every region experienced a decline in contract signings, but the Northeast performed the worst.

- Yun said the housing market has “essentially stalled” and won’t improve until housing starts ramp up.

- “The supply and affordability headwinds would have likely held sales growth just a tad above last year, but coupled with the temporary effects from Hurricanes Harvey and Irma, sales in 2017 now appear will fall slightly below last year,” added Yun. “The good news is that nearly all of the missed closings for the remainder of the year will likely show up in 2018, with existing sales forecast to rise 6.9 percent.”

According to NAR’s Home Survey, consumers are feeling confident about the housing market and the economy, but that isn’t translating into sales.

- Renter sentiment has rebounded from Q2: 62 percent of renters believe it’s a good time to buy, a 10 percentage point increase. Furthermore, 80 percent of owners believe it’s a good time to sell, a new survey high.

- But once again, low inventory and sky-high home prices aren’t allowing consumers to act on their confidence.

- “The housing market has been in a funk since early spring because of the ongoing scarcity of new and existing homes for sale,” Yun said. “The pace of new home construction has not meaningfully broken out this year, and not enough homeowners at this point have followed through with their belief that now is a good time to sell.”

- Even with rent increases, the majority of renters said they’d resign their lease or look for a cheaper rental — options they feel are better than buying a home.

Despite a less-than-desirable housing market, single women are out-buying single men. In 2016, single women were responsible for 17 percent of total home purchases, 10 percentage points higher than men.

- According to Owners.com, Cincinnati is the best place for single women who are looking to become homeowners.

- Cincinnati nabbed the No. 1 spot thanks to a robust share of single women homebuyers (15.2 percent), a below average median home value ($158,100), and a relatively good median female income ($40,392). Kansas City and Dallas-Fort Worth were No. 2 and 3 on the list.

- The average age of the single woman buying her very first home in 2016 was 34 (compared to 31 in the case of single men). Meanwhile, the average age of the repeat single female buyer is 57.