Sticking to a script that economists and real estate analysts had long anticipated, outgoing Federal Reserve Chairwoman Janet Yellen on Thursday announced a modest benchmark interest rate hike of between 1.25 percent and 1.50 percent, a move widely perceived as a reflection of confidence in the U.S. economy.

The 25 basis point hike, announced at the conclusion of the Central Bank’s two-day Open Market Committee meeting, was supported by all but Chicago Federal Reserve Bank President Charles Evans and Federal Reserve Bank of Minneapolis President Neel Kashkari, who called for rates to stay unchanged. This is the third such hike in 2017 and sets the stage for what will likely be three to four adjustments in 2018.

“In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-1/4 to 1‑1/2 percent,” according to a statement issued following the committee meeting. “The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.”

“Overall we continue to expect that the economy will expand at a moderate pace,” said Yellen, also noting that Fed inflation forecasts for 2018 rose modestly from 1.6 percent to 1.7 percent.

National Association of Realtors Chief Economist Lawrence Yun voiced cautious optimism, but raised concerns that the move would lift mortgage rates, including the 30-year fixed mortgage rate, in the new year. It currently hovers at 3.9 percent and could rise by 25 basis points in the near-term.

“There will be juice added to the economy in the months ahead as a result of the expected passage of a massive tax cut,” said Yun. “It remains to be seen whether the effects are long-lasting or just for a short period of time. However, with the unemployment rate already at a low of around 4 percent, there is not much room to go further down. That means inflationary pressure will slowly develop. That is why the Federal Reserve today raised the short-term interest rates and will likely do so three more times in 2018.

“The longer-term interest rates, like the 30-year fixed mortgages rate, will therefore be nudged higher in 2018,” Yun added. “Economic stimulus will help with job creation and housing demand, but higher interest rates threaten to cut into housing affordability in 2018.”

On Thursday, Ruben Gonzales, an economist at Keller Williams, said he did not foresee dramatic rate increases in 2018.

“We don’t anticipate dramatic changes in rates in the near term barring discontinuity in Federal Reserve policy resulting from the change in leadership set to take place next year,” said Ruben Gonzalez, an economist at Keller Williams who said the increase was “well-communicated to markets” leading up to Thursday’s announcement.

The rate hike comes as Yellen prepares to step down as chair of the Fed. Nominated by President Barack Obama to succeed Ben Bernanke in 2014, she helped guide a fragile economy following the Great Recession by deploying fewer interest rate increases than many of her predecessors to offset high unemployment at the time.

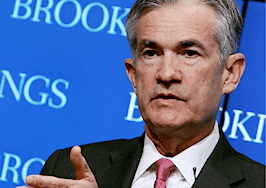

Yellen’s likely successor, Jerome Powell, a member of the Federal Reserve’s Board of Governors since 2012, is expected to be confirmed by the Senate and take the helm as the Central Bank’s 16th chairperson upon Yellen’s retirement from the Fed on Feb. 3. He is largely viewed as a moderate who would carry on Yellen’s legacy of moderate rate increases while favoring legislation that would roll back post-2008 banking regulations.

“I’d like to note that although I have one more FOMC meeting to attend in the new year, this will be my last scheduled news conference,” said Yellen on Thursday following the press conference. “Over the next month and a half I will do my utmost to ensure the smooth transition to my designated successor Jay Powell. I’m confident that he is as deeply committed as I have been to the Federal Reserve’s vital public mission.”

If he is confirmed by the Senate in the coming weeks, Powell will become the first Fed chair in four decades without a degree in economics. Prior to joining the Board of Governors, he served as a clerk in the United States Court of Appeals for the Second Circuit in New York before diving into private practice at the investment bank Dillon, Read & Co. and, a decade later, the Carlyle Group.

Along the way, he was appointed to the Treasury Department by President George W. Bush and worked at several other high-profile private investment firms before being nominated in 2012 to the Fed.

Upon his nomination in November, chief economist of Windermere Real Estate Matthew Gardner told Inman News that Powell’s continuity of vision would likely be a strength, but also warned that Powell’s ties to Wall Street could be cause for alarm.

“It’s probably as good a choice as housing advocates could have expected to get from this administration,” said Gardner. “He’s a fiscal dove, he has an interest in not raising interest rates rapidly. He’ll travel the same line as Janet Yellen in terms of raising rates — but not too quickly.”

“He’s got very close ties to Wall Street, and that is a bit of a concern,” added Gardner. “However, on the other hand, he’s on record as pushing back on proposals to allow banks to increase their leverage, which is actually a good thing, that he supports not allowing that.”

Email Jotham Sederstrom.