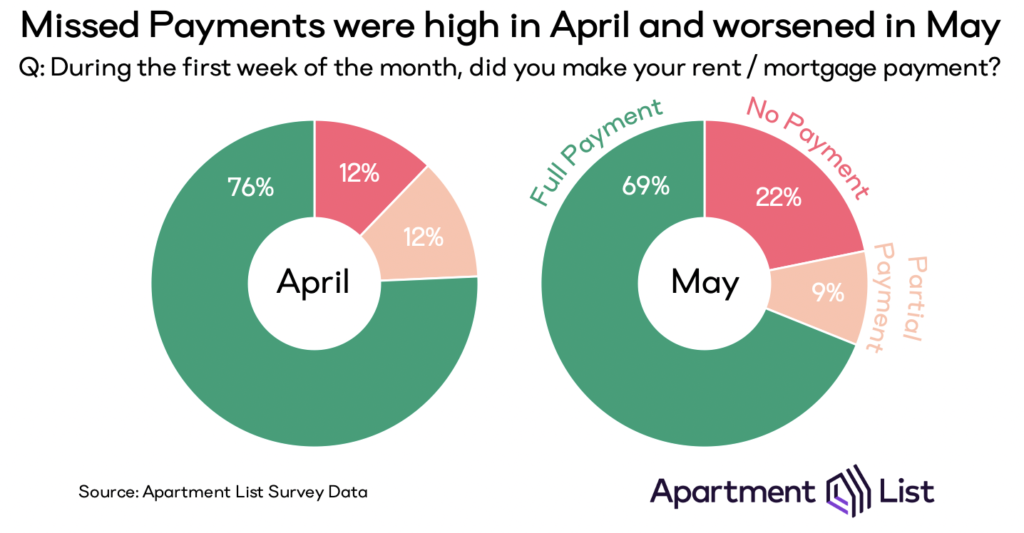

Despite a $1,200 stimulus check, nearly one-third of Americans still struggled to pay their mortgage or rent on time, according to an Apartment List report released Thursday. Thirty-one percent of renters and homeowners made a partial payment or skipped a payment in May — a six percent increase from April.

“Nearly 1 in 4 Americans were not able to pay their housing bill in the first week of April, as COVID-19 upended much of our economy and imposed financial strain on millions of Americans,” wrote Apartment List Chief Economist Igor Popov. “In the weeks since, millions more workers have filed for unemployment benefits, stoking a fierce debate around when it will be appropriate to ‘reopen the economy.'”

“Amid this backdrop of continued economic instability and fears of worsening housing affordability, the pandemic’s second round of housing payments came due on May 1st,” he added.

Even with significantly more average wealth, homeowners and renters fared the same in May with 22 percent of each group unable to make housing payments. Nine percent of Americans made a partial payment, and 69 percent paid their bill in full, a seven percent decrease from April.

In light of a worsening financial outlook, mortgage lenders and landlords have been offering payment arrangements in the form of mortgage forbearance or deferred rent payments.

“Seven percent of mortgage loans are now in forbearance, and 10 percent of renters state that their landlord or property manager proactively lowered their May rent,” the report read. “Forty percent of renters who have not paid their May rent report that they have agreed to terms for reduced or deferred rent with their landlord.”

Five percent of renters who deferred part (12.1 percent) or all (12.2 percent) of their rent to the end of April followed through, and Apartment List expects a similar trend for May although it may be more difficult.

“While it’s certainly promising that many missed April payments were made up over the course of the month, we see evidence that renters and homeowners who struggled last month are continuing to have difficulty,” Popov wrote. “In fact, financial strain is spreading even to those that made their April payment in full.”

When it comes to payment rates for May, Apartment List said stimulus checks made little difference. The non-payment rate for those who received a check was only three percent lower than those who didn’t. However, when the data is broken down between renters and homeowners, renters seemed to benefit more.

“Among renters who received their stimulus checks, 71 percent paid their May rent in full, compared to 64 percent of those who did not receive one,” the report read. “For homeowners, meanwhile, delinquency rates are nearly identical across those who have and have not received aid.”

Apartment List said non-payment rates among stimulus check recipients may reflect a reliance on mortgage forbearance and eviction moratoriums for housing security, so the $1,200 can be used for other needs such as food and medication.

Despite April and May’s rocky starts, renters and homeowners seem to be optimistic about their ability to pay on time in June. Twenty-eight percent of renters and 22 percent of homeowners are “somewhat confident” in their ability to pay, even if their state extends shelter-in-place orders.

Fifty-one percent of renters and 68 percent of homeowners are “very or extremely” confident they’ll pay their full rent or mortgage in June.

Looking forward, Apartment List said June’s non-payment rates will depend on federal and state governments’ ability to slow the spread of coronavirus and jumpstart the economy.

“With that said, the strength of the housing market continues to depend on factors outside of its control — namely, the spread of COVID-19 and the associated toll on public health,” the report concluded. “If a renewed surge in cases leads to a second round of social distancing, it could overwhelm the economy and exhaust the limited buffer of savings that many Americans are currently depleting to continue making their housing payments.”

“If, on the other hand, testing, treatment, and collective behavioral change can catalyze a smooth return to work and relative economic normalcy, the dynamism of the housing market may bounce back quickly.”