Homeowners across the country will soon see a live offer through Zillow’s homebuying and selling platform replacing the Zestimate on Zillow’s flagship Zillow.com platform.

It’s something the company has long-teased and just one of multiple ways the company is driving customer acquisition costs down for its Zillow Offers platform, which just posted a profit on the homes it sold for the first quarter in company history.

“This year, many customers in Zillow Offers markets will see that their Zestimate is a live initial offer from Zillow Offers,” Zillow CEO Rich Barton said Wednesday during the company’s fourth-quarter and year-end earnings call.

“This will begin to realize the big hairy audacious goal that we set 15 years ago when we launched Zillow, of putting an actual price on every rooftop” Barton added. “As the Zestimate begins to move from fantasy to reality, we are one small, but important, step closer to delivering on that [big hairy audacious goal].”

A live offer is essentially Zillow’s initial offer on a home. The final offer would be subject to Zillow’s own appraisal and other conditions, but the live offer would be the first step a homeowner takes towards selling to Zillow.

The Zestimate, meanwhile, is an automated valuation model that just attempts to estimate what the home might get on the open market.

Zillow has long been clear it’s not in the flipping business. But nearly three years after it launched its direct-to-consumer homebuying and selling platform Zillow Offers, the company is finally making money on average on each home it buys and subsequently sells, according to the company’s fourth-quarter earnings report.

Driving down customer acquisition cost, among other macro trends, has been a key part of that.

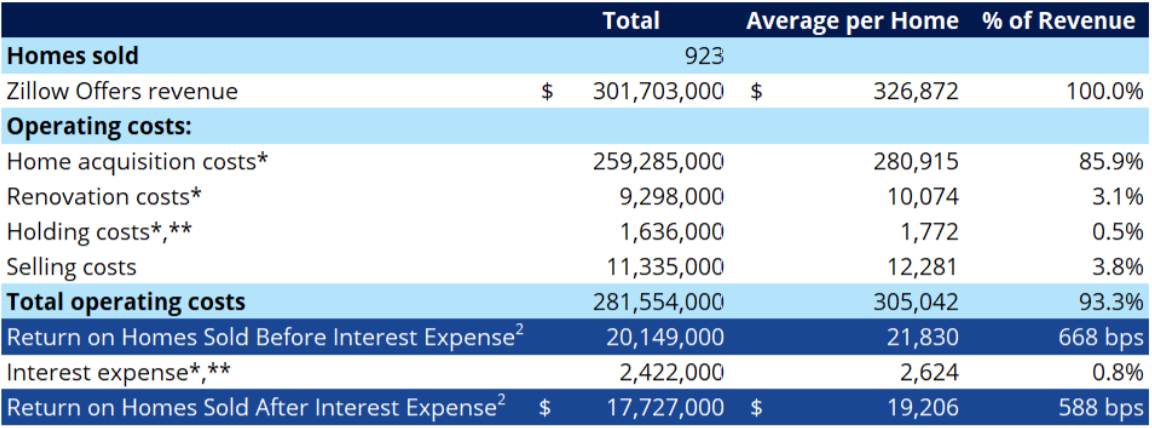

In a letter to shareholders, Zillow revealed it made, on average, a return of $19,206 per home sold in the fourth quarter of 2020.

The financials on Zillow Offers transactions from the company’s fourth-quarter shareholder letter. | Credit: Zillow

Zillow calculates the figure by taking the total profit from the homes it sold in the quarter, subtracting the cost it paid — only for the homes it sold — as well as renovating cost, holding cost, selling cost and the interest paid.

Zillow Offers’ strong performance was attributed to a number of factors, including stronger-than-expected home price appreciation, a higher portion of homes sold that were acquired recently — due to the company pausing transactions in the early days of the pandemic and entering the quarter with low inventory — and improved operational rigor across the business, which includes assessing the right level of renovation, according to a shareholder letter.

Essentially, Zillow Offers is benefitting from the blazing housing market, the same as any homeseller.

The company is also reaping the rewards from the closing services division it launched in late 2019. Zillow’s closing services division expanded to 25 markets in the past 12 months, and the vast majority of the company’s customers are now using that in-house closing service.

“Homes revenue benefited in [the fourth quarter] from customers increasingly using Zillow Closing Services when purchasing a home from Zillow Offers as we add capacity to meet demand,” Barton said, in the letter to shareholders. “Zillow Offers unit economics also benefits from reduced home acquisition costs when we use Zillow closing services for homes we purchase.”

The increased profitability of the Zillow Offers segment was not wholly unexpected, thanks to the hot housing market, but some of the price acceleration that boosted the profitability of the platform may be temporary, according to Allen Parker, Zillow’s chief financial officer.

The renovation, selling cost and holding cost segment improvements, however, include “some real operational improvements that are durable,” Parker explained.

“We’re constantly learning and improving over time, which results in continual improvements in the customer value proposition of our offers,” Parker said.

The increased profitability also does not reflect a big change the Zillow Offers platform is currently undergoing, which is the migration from having partner agents manage the Zillow Offers transactions to managing them in-house with licensed agent employees.

The company began making that change in the first quarter of 2021, so the shift’s overall impact on economics will likely be a bit more clear in 2021.