In May, we’ll go deep on money and finance for a special theme month, by talking to leaders about where the mortgage market is heading and how technology and business strategies are evolving to suit the needs of buyers now. A prestigious new set of awards, called Best of Finance, debuts this month too, celebrating the leaders in this space. And subscribe to Mortgage Brief for weekly updates all year long.

As most of you are aware, the Federal Housing Finance Authority recently revamped upfront fees for mortgages backed by Fannie Mae and Freddie Mac, leading to significant backlash from some critics who suggested that borrowers with good credit will now be paying more than borrowers with bad credit.

And as these voices grew louder, Congress stepped in, with Republicans holding a hearing and introducing several bills aimed at repealing the fee changes, which are tied to the borrower’s credit score and loan-to-value ratio.

On May 10th, the FHFA announced that it was backing down from plans to implement another risk-based fee based on Aug. 1. Lenders complained that particular fee, which was to be based on the borrower’s debt-to-income ratio, would be challenging to implement. In dropping plans for a DTI-based fee, Fannie and Freddie’s federal regulator said it wants public input on whether it should continue to link upfront guarantee fees to the mortgage giants’ capital requirements.

But FHFA Director Sandra Thompson continues to defend the other fee changes that the agency began rolling out last year — including the most recent changes announced in January and implemented this month to recalibrate fees to new credit score and loan-to-value ratio categories.

So what’s going on?

Well, periodically the FHFA raises the upfront fees that the Agencies charge borrowers for the purchase and refinance of mortgages that they guarantee, and these fees are called Loan Level Price Adjustments — or LLPAs.

In April of 2022, these fees went up for several types of loans including ones in expensive markets that have a higher conforming loan limit than seen nationally, and they also raised fees on second home mortgages.

But to support affordable housing, Fannie and Freddie were ordered not to charge upfront fees to borrowers taking advantage of mortgage programs including HomeReady, Home Possible, and HFA Advantage. First-time homebuyers who don’t exceed income limits in their market also get a break from upfront fees.

So the new round of fee increases that were implemented this month had many believing that it was just another subsidy given to households with lower credit that’s being paid for by households with better credit.

But is that really an accurate statement? I don’t necessarily think so.

First off, the FHFA HAD to increase fees this year simply because they needed the money to cover higher capital requirements that went into effect last year – but that’s a topic for another day.

Let’s take a look at the changes that were made

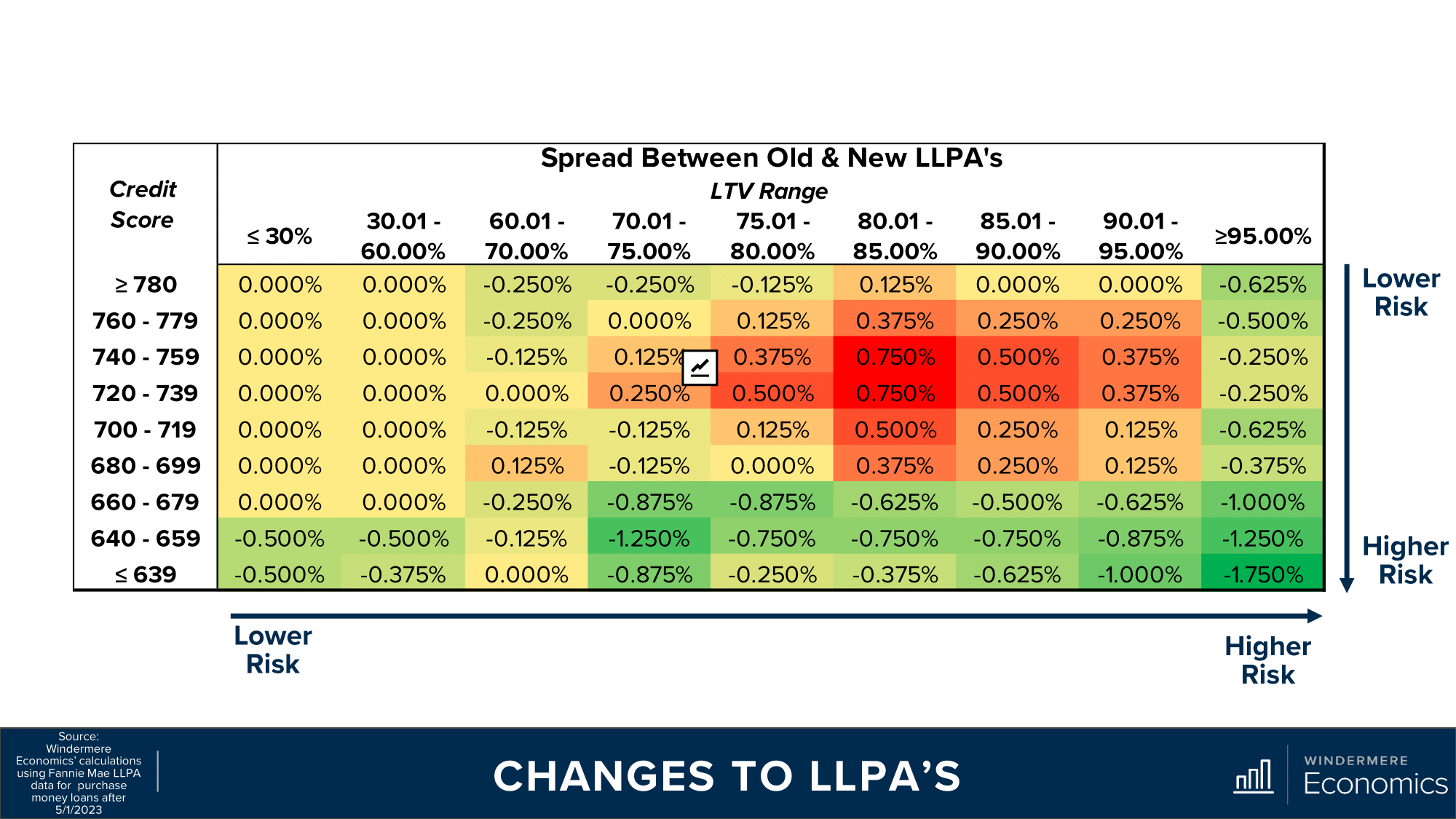

The matrix you see here shows you the difference between the fees that were in place before, and the new fees based on the borrower’s credit score and loan-to-value ratio. Remember, this is not the actual fee itself, but the spread between the old and new pricing.

And, as you can see, on face value it really does look to benefit borrowers with lower credit scores and penalize households with better credit.

For example, a household with a credit score of between 640 and 659 would see savings across all loan-to-value ranges versus a household with a credit rating of 740 to 759 who would be paying the same or more in all bar two scenarios, with fees increasing between 0.125 percentage points and three-quarters of a percentage point.

But is this really something to be worried about?

There are two things that stand out to me, and the first is that a household putting down less than 20 percent has to buy private mortgage insurance so, in reality, these households are actually less of a risk to the agencies than those who don’t, so isn’t it right that they should pay less in fees?

Secondly, although I can’t disagree with anyone who states that families with lower credit will see fees go down and – generally speaking – they will go up for those with better credit, but people are confusing the CHANGE in the fee with the ACTUAL fee itself.

What I am saying is that low-credit borrowers aren’t paying less than high-credit borrowers. It’s just the spread in the rates between households with lower credit and those with higher credit has simply got smaller.

There is absolutely no scenario where someone with lower credit gets a lower fee. Let me show you.

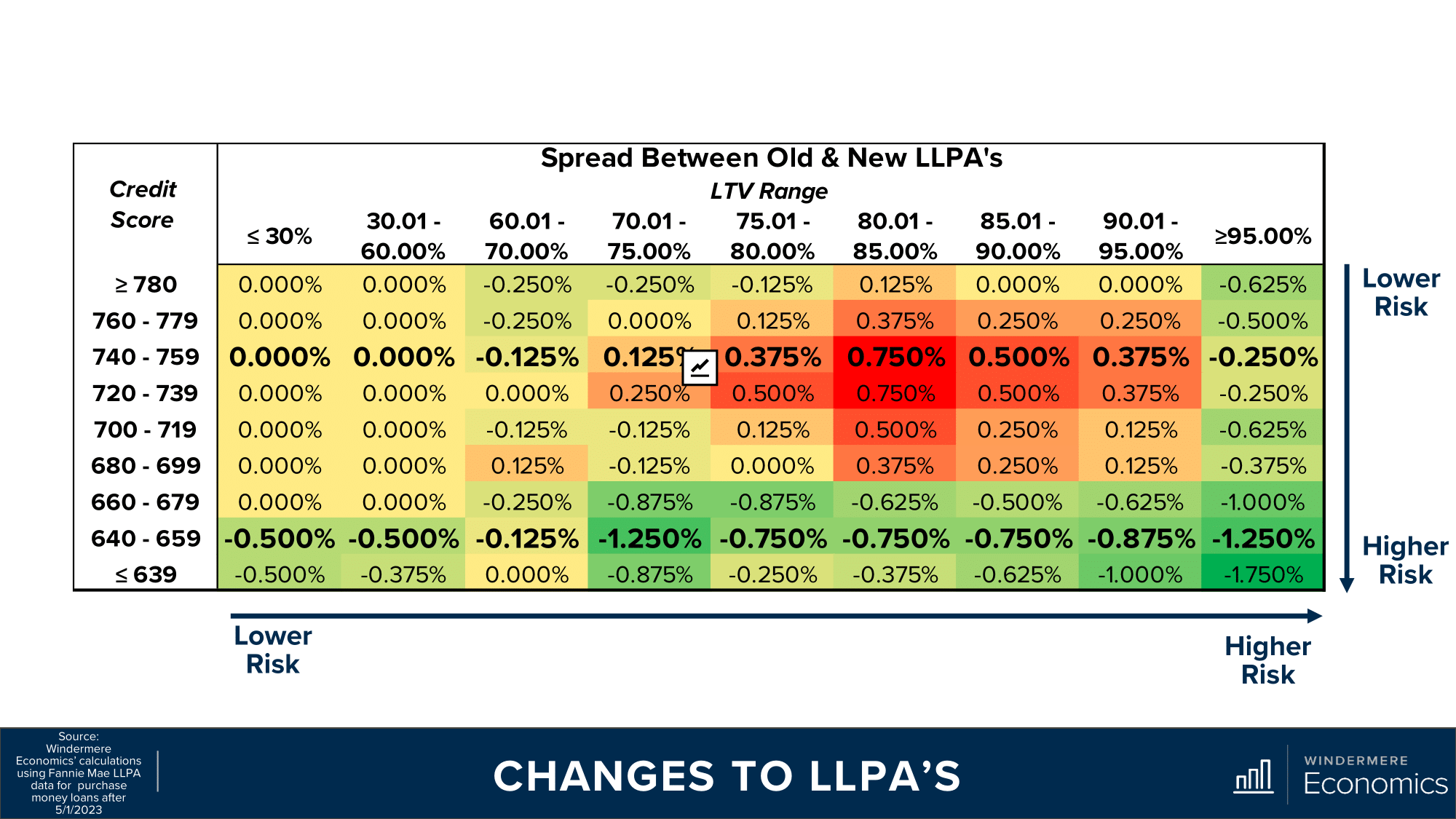

Here’s the new pricing schedule

Now, let’s say there are two households wanting to buy houses for $500,000 and both looking to borrow 80 percent of the purchase price.

One buyer has a credit score of 640, so their LLPA would be 2.25 percent of the loan amount or $9,000. The other buyer had a credit score of 740 so their fee would be 0.875 percent. That means the household with higher credit would be paying $5,500 less than the household with lower credit on the $400k loan.

No one is arguing that upfront fees for households with lower credit scores weren’t reduced, but I actually don’t see a problem with that. Remember, Fannie and Freddie’s mission is, in part, to facilitate access to affordable housing.

Moreover, these fees don’t even apply to non-conforming — or jumbo — loans that Fannie and Freddie don’t back, and they don’t impact FHA or VA loans either.

Although I certainly don’t know where the FHFA will end up in the end regarding fee changes, they did have to do something.

I just hope that future changes are presented in a way that fully describes the situation, so they can’t be interpreted in a manner which allows for headlines that don’t describe the full picture.

Matthew Gardner is the chief economist for Windermere Real Estate, the second-largest regional real estate company in the nation.