- Buyers with down payment assistance save an average $17,766 over the course of the loan.

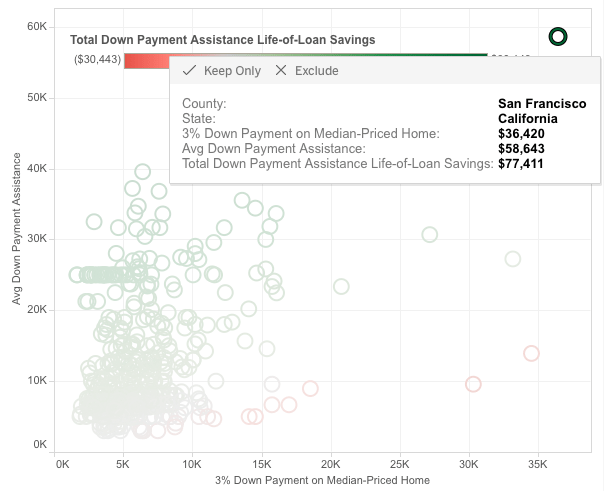

- In San Francisco County, buyers with assistance realize $77,411 in total savings.

- Miami and New York buyers with down payment assistance also saved more than $50,000 over the loan term.

First-time homebuyers are struggling to scrap together a down payment with massive rental rates, student loan debt, lack of wage growth and high-priced homes.

But all hope is not lost. While they offset high barrier of entry, most markets also realize down payment assistance saves when compared to providing 3 percent down alone.

ReatyTrac and Down Payment Resource (DPR) teamed up in the Down Payment Assistance Affordability study to find not only do down payment assistance programs help U.S. renters (literally) get their foot in the home buying door, they save an average $17,766 over the course of the loan.

“I think many homebuyers don’t know about these programs, and just knowing about them is the first step,” said Daren Blomquist, senior vice president of RealtyTrac. “The study shows that in the majority of markets, getting down payment assistance helps with the down payment itself and the cost of homeownership over the long term.”

Compared to those who don’t opt for down payment assistance, the thousands in savings represents 41 percent of average wages.

The money saved extends to both the down payment and the mortgage. Buyers using down payment assistance programs save $5,965 on a median-priced home initially, then $11,801 on the monthly payments over the life of the loan.

The study assumed if the average down payment did not cover 3 percent, buyers dug into their own pockets to supplement. If assistance was greater than 3 percent down, it’s assumed they would put the higher amount toward the down payment in full, resulting in lower monthly mortgage rates.

Down payment assistance saves most in California, Miami, NYC

In San Francisco County, buyers with assistance realize $77,411 in total savings. And in Orange County within the LA metro, they save $74,268.

Miami and New York buyers with down payment assistance also saved more than $50,000 over the loan term.

In LA and Miami, buyers see a savings of more than 130 percent of annual wages.

Markets with the biggest assistance

In all 513 counties, down payment assistance averaged $12,423 — twice the average $6,424 average 3 percent down payment for a median-priced home. Oftentimes, financial assistance keeps buyers from tapping into savings or retirement accounts.

In some metros, assistance is larger than 3 percent down, creating a lower interest rate. In LA County, the average down payment assistance is $39,964, compared to the $15,450 needed for a median priced home. In Chicago’s Cook County, the average assistance is $8,058 compared to $6,090 for 3 percent down alone. Houston metro’s Harris County provides an average $16,521 in assistance, while 3 percent down payments are $5,985.

Headwinds with reaching 3 percent down

Not all markets are that generous. In Manhattan, the average assistance is $13,917 compared to the $34,500 required for 3 percent down. In Fairfax County of D.C., the average assistance is just $5,000, compared with $14,100 for 3 percent down.

Although less dramatic, the average assistance in Baltimore County is $6,173 compared to $6,210 needed for 3 percent down.

In Marin County in the San Francisco Bay Area, the average is just $9,571, compared with the $30,000 needed for a 3 percent down payment. But, in San Francisco County, the average assistance is $58,643, compared to $36,420 needed.

“It’s a combination of high price and differing down payment assistance programs,” said Blomquist. “There may be some very local programs, but there may also be state and federal programs as well.”

Working with buyers on down payment assistance

The harsh reality, Blomquist says, is agents might struggle to find entry-level priced homes for these buyers due to inventory issues. Plus, in a competitive market, sellers view smaller down payments as less appealing. A 3 percent down buyer often ends up an afterthought.

But by working with lower down payment buyers, assistance or not, agents are able to expand their client base. Not to mention, helping buyers navigate down payment programs is key to increasing conversions. If they can’t afford to buy, that’s one less client.

“It’s one of those things that’s not injected in the process of buying a home, at least for most agents that I know. But it probably should be given the market we are in,” he said.

While it’s more time consuming, which could deter agents, it’s worth the involvement.

“It potentially expands the client base and should increase conversions for agents, especially agents who may be having difficulty converting leads to sales because the leads aren’t qualifying for the home prices that are in that market,” said Blomquist.