Check Inman every day for the daily version of this market roundup.

Weekly mortgage rates:

Powered by MortgageCalculator.org

Powered by MortgageCalculator.org

Thursday, Oct. 8:

RealtyTrac’s U.S. Zombie Foreclosure and Vacant Property Report:

- A “zombie foreclosure” happens when a homeowner moves out of the home after foreclosure proceedings have started, but then the foreclosure is held up in some way or canceled, leaving the title in the homeowner’s name.

- This phenomenon is on the decline. A RealtyTrac report shows that 20,050 properties were vacant zombie homes at the end of the third quarter.

- That’s a decrease of 27 percent since the second quarter, and 43 percent from the same quarter last year.

Wednesday, Oct. 7:

Mortgage Bankers Association’s weekly applications survey:

- The Market Composite Index, which measures mortgage loan application volume, increased 25.5 percent week-over-week on a seasonally adjusted basis. (It increased 26 percent on an unadjusted basis.)

- The Refinance Index increased 24 percent week-over-week.

- The seasonally adjusted Purchase Index increased 27 percent week-over-week.

Fannie Mae’s Home Purchase Sentiment Index:

- The index increased to 3 points to 83.8 in September.

- The share of respondents who said it is a good time to buy a house increased 1 percentage point to 64 percent.

- The share of respondents who say it is a good time to sell increased 5 percentage points to 52 percent.

Tuesday, Oct. 6:

The Mortgage Credit Availability Index (MCAI) for September 2015:

- Mortgage credit availability increased in September.

- The MCAI increased 0.3 percent month-over-month to 126.5. (It was benchmarked to 100 in March 2012.)

- The Conventional MCAI was up 1.1 percent month-over-month, followed by the Conforming MCAI (up 0.8 percent).

CoreLogic’s August 2015 Home Price Index:

- Home prices increased 1.2 percent month-over-month in August 2015.

- They increased 6.9 percent year-over-year.

- CoreLogic’s forecast projects a 4.3 percent increase year-over-year in August 2016.

Monday, Oct. 5:

WalletHub’s most and least energy-efficient states:

- New York, Vermont and Minnesota were the most energy-efficient states.

- Texas, Louisiana and South Carolina were the least energy-efficient states.

- WalletHub measured the consumption of home and car energy in 48 states; Alaska and Hawaii were excluded from this analysis.

Livability’s 10 Best Cities for Singles:

- Carrboro, North Carolina; Hoboken, New Jersey; West Hollywood, California were the top three cities for singles.

- Oxford, Mississippi; San Marcos, Texas; Ypsilanti, Michigan; and Ames, Iowa were ranked 4 through 7.

- Miami Beach, Florida; Athens, Georgia; and Moscow, Idaho took spots 8 through 10.

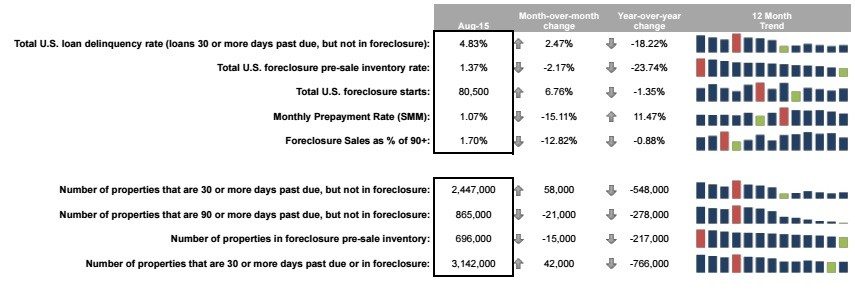

Black Knight Financial Services’ August Mortgage Monitor Report:

- Cash-out refinances were up 68 percent year-over-year in August 2015.

- The average borrower was tapping $67,000 in equity.

- Though they’re at the highest volume since 2010, cash-out refinances were still almost 80 percent below 2005 peak levels.

Email market updates to press@inman.com.