- The U.S. 10-year T-note now just a hair under 2.00 percent, mortgages to 4.00 percent. A little more than half of the January-February rate drop has now un-dropped.

- Different central banks have different tools still available. Europe can stumble for a long time, but Japan is nearing an end.

There are times when confusion is so deep that it’s a relief. Relax. Freedom from the struggle to understand. Just watch the show.

U.S. stocks are up now for four straight weeks. Oil is pushing $40, stocks tracking in perfect correlation. The U.S. 10-year T-note now just a hair under 2.00 percent, mortgages to 4.00 percent. A little more than half of the January-February rate drop has now un-dropped.

The European Central Bank has a fancy new headquarters in Frankfurt, but staff members are already stealing the plumbing. Mario Draghi was seen last week dragging two sinks and many meters of piping, then throwing the whole mess at assembled media, bankers, ad markets.

No one was injured. Most are still puzzled. How is it possible to launch so many emergency measures on a single morning without hitting anything? But perhaps we misunderstand Draghi’s purpose.

During the Great Depression, shantytowns of the homeless were called “Hoovervilles.” If you’re the head of a central bank, do you want the next depression named after you? Thus, useful measures exhausted, continue to appear as active as possible.

Steal Al Haig’s line after Ron Reagan was shot: “I’m in charge here!” (which was true cause for panic).

Different central banks have different tools still available. All, of course, retain last-ditch money hoses to prevent bank closures, if it should come to that. But Draghi’s sink-toss had a comedic air.

Negative rates one notch lower. We will give money to banks which make loans to businesses. We will buy 80 billion euros in European IOUs monthly, up from 60 billion, and shift to corporate bonds because the Germans won’t let us buy sovereign debt from the lazy periphery. And we hope to weaken the euro.

Results were … um … unintended. The euro jumped on the news — given Germany’s mania for exports and balanced budget, driving down the euro is like trying to make a U-boat out of the Hindenburg. Rates are already so low, hence no further effect. A German 10 pays 0.271 percent. Free money for banks to make loans, but no borrowers.

Draghi’s defiance to markets has been, “We will do whatever is necessary.” Trade against me and make my day. Last week, he lost force with these two lines. “Rates will stay low, very low, for a long period of time.”

But then, “We don’t anticipate that it will be necessary to reduce rates further.” No more, even if Europe still does not recover?

Europe can stumble for a long time. Japan is nearing an end. The Bank of Japan’s latest move to negative rates has frightened the public there. They have been saving cash like mad, afraid to invest, and now cash may lose value?

We know what the inflation endgame looks like. A friend sent to me a $100 trillion Zimbabwe-dollar bill, now in a special spot on my office wall, right under the Zehn Millionen Mark note.

The endgame in deflation is no money at all, my Mom’s memory of 1933 Oklahoma, as credit fear pushed cash to mattresses. But what happens when there is a mountain of cash in Japan’s banks, in deflation theoretically worth more every day, but the central bank helicopters trillions of yen onto the landscape? Is money worth anything?

Nobody knows. Except maybe Ben Bernanke, now a blogger at Brookings. This week, two blogs directed at China. And I do mean directed. Blunt.

If you’re going to devalue, do it big and fast. Your economic statistics are fooling no one: “It would be in China’s interest to prioritize rules-of-the-game transparency.” Better that markets know how much trouble you’re in than to guess. Your best chance: stimulate via fiscal spending.

It’s spring. Birds chirping. Daylight Savings Time and long evenings. Alone in the world, the Fed is still on normal time, the other central banks entering twilight.

Those who have wished for years that hyper-easy central banks would just sit down are getting their wish. They have bought as much time and stability as they can, and now real economies will have to deal with reality.

The entertainment watching it all unfold from here may be relatively painless fun. Or, like Mark Twain’s feeling about tarring and feathering, “If it weren’t for the honor, I’d just as soon have walked.”

U.S. 10-year T-note, two years back. Rates pulled down by super-low ones overseas, but super-low inflation here may be coming to an end. This chart shows no “lean” either way.

The U.S. 2-year T-note is the best of all Fed-forecasting devices, and it’s back on hair-trigger.

The euro through trading last Thursday night, Draghi perfectly counter-productive.

Good news. All of those people who have supposedly left the workforce … have not. Welcome back! If they continue to return, it takes the heat off too-low unemployment and potential inflation.

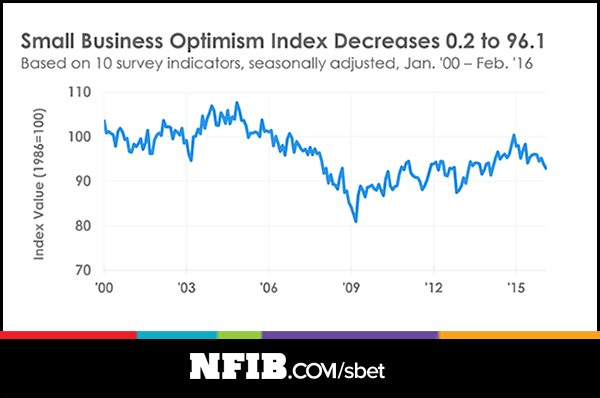

A steady slide evident in small business, but nothing dramatic.

The Atlanta Fed GDP Tracker is back to two-and-change, winter uglies over.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.