In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Douglas Elliman’s revenue slid in the fourth quarter of 2022 as the company dealt with the macroeconomic headwinds affecting the real estate industry at large.

The company logged $207.3 million in revenue compared to $334.2 million in the fourth quarter of 2021. Its brokerage segment clocked a gross transaction value of approximately $7.5 billion, compared to $12.6 billion during the fourth quarter of 2021, according to an earnings report released Friday.

The firm fell short of analysts’ projections of $262.8 million in revenue during the fourth quarter.

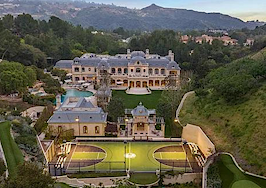

“Douglas Elliman’s team of world-class agents met the challenges of the fourth quarter, which was marked by limited listing inventory and significantly increased mortgage rates,” Douglas Elliman CEO Howard M. Lorber said in a statement. “The strength of Douglas Elliman’s balance sheet, global network of leading agents and luxury brand positions us to take advantage of opportunities as real estate markets stabilize.”

Over the full year, Douglas Elliman reported $1.15 billion in revenue compared to $1.35 billion in 2021. Its gross transaction value for the year clocked in at approximately $42.9 billion, compared to $51.2 billion in 2021.

The firm posted a consolidated operating loss of $21.9 million in the fourth quarter, up from $19.2 million in losses a year prior and a net loss of $18.4 million compared to $20.2 million in net income the previous fourth quarter. The fourth quarter marked the second straight unprofitable quarter.

It logged a net loss of $5.6 million for the full year, compared to a net income of $98.8 million in 2021.

Like other brokerages, the company has been affected by high mortgage rates and a shortfall of new inventory.

“We remain confident that the company’s differentiated platform and approach will enable us to deliver continued growth over the long term,” Lorber added.

The company has implemented cost-cutting measures in the form of a hiring freeze that has reduced its headcount through natural attrition, Lorber said on a call with company executives and investors Friday. It is also exploring reducing sponsorships, streamlining its advertisements and consolidating its office space, which Lorber said could begin to reduce rent expenses in 2023 and the second half of 2024.

“We believe that these changes will result in a nimbler Douglas Elliman,” Lorber said.

The firm’s stock price dipped from $3.95 a share to $3.65 at the opening bell of the New York Stock Exchange and currently sits at $3.60. Douglas Elliman started trading as a standalone company at the end of 2021 after spinning off from its parent company Vector, which some investors were reluctant to invest in because of its tobacco holdings.

Despite revenue slipping, company executives said on the call they believe they are well positioned to emerge from the downturn sooner than other companies due to their position in the luxury market.

“Looking ahead, we continue to believe tight supply will gradually ease as time passes and consumers adjust to higher interest rates,” Lorber said on the call. “Luxury markets are usually the last markets to enter a down cycle, and the first markets to emerge when the cycle ends.”