Appetite for purchase mortgages stayed flat last week, clocking in well below the same week a year ago as costlier mortgage insurance and tight credit continued to hamper demand.

Applications for purchase loans increased a seasonally adjusted 0.3 percent for the week ending July 18 compared to a week earlier but were down 15 percent from a year ago, according to the latest Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

Demand for purchase mortgages has lagged in 2014. One reason may be that the Federal Housing Administration is charging higher mortgage insurance premiums. For-sale inventory, mortgage rates, unemployment, and student loan debt among millennials who would otherwise be first-time homebuyers are other often-cited factors affecting demand.

Hoping to shore up the FHA’s reserves and shift market share back to the private sector, the Obama administration has tightened FHA underwriting standards and hiked annual premiums for most FHA mortgages from 0.55 percent in 2010 to 1.35 percent today. Off the record, Obama administration officials have told columnist Ken Harney they would like to see FHA’s market share pared back to 10 percent, in line with historical trends.

In a letter urging the Department of Housing and Urban Development to reduce FHA premiums, National Association of Realtors President Steve Brown recently claimed that costlier FHA insurance may have priced out between 125,000 and 375,000 renters in 2013.

Costlier FHA mortgage insurance also isn’t doing anything to help strengthen demand from first-time buyers. They accounted for only 28 percent of existing-home sales in June, the National Association of Realtors reported. Historically, that group has made up 40 percent of sales.

“For many would-be first time homebuyers, access to credit has been hampered by tight lending requirements on conforming loans (high credit score and 20 percent down payments) and by high fees and mortgage insurance premiums on FHA loans that don’t require 20 percent down payments,” said Jonathan Smoke, chief economist at realtor.com operator Move.

Private mortgage insurers, who insure loans backed by Fannie Mae and Freddie Mac when borrowers take out loans with down payments of less than 20 percent, could also be forced to raise fees in order to meet risk-based standards proposed by the mortgage giants’ federal regulator.

Though the number of people applying for purchase mortgages has dropped significantly this year, sales of existing homes have almost recovered to their year-ago level following declines throughout the fall and winter.

NAR recently reported that existing-home sales were down 2.3 percent in June compared to a year ago.

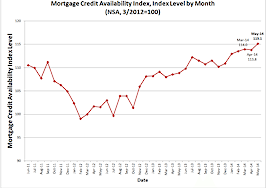

While mortgage underwriting is still tight compared to the boom years, conditions have eased in the last year, according to the MBA’s Mortgage Credit Availability Index.

Mortgage credit loosened somewhat in June as a result of a slight net loosening in lender criteria for FHA and VA loans with respect to minimum credit scores and maximum loan-to-value (LTV) ratios, the MBA said this month.