Interpretations of this week’s events are all over the lot, so before adding to the confusion, here are a few bare facts with opinion sandwiched between.

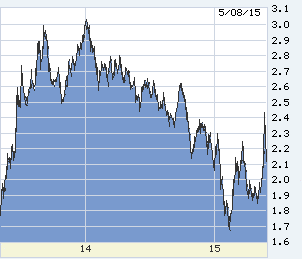

The U.S. 10-year T-note began 2015 at 2.23 percent and promptly dropped to 1.65 percent in February; by mid-March, it was back to 2.23 percent, then stable near 1.9 percent for six weeks — and in the last 10 days blew back to 2.23 percent. Mortgages are less volatile than 10s, but tracked in a range 3.75 percent to 4 percent.

That trading is a bottoming pattern. The end to a 15-month straight-line downtrend. And anticipatory to Fed liftoff, whether summer or fall or whenever.

Today the all-important monthly payroll report brought an April gain of 223,000 jobs. The consensus seems reassured, seeing a rebound after a lousy winter. But, in the rest of the report: March was revised from a poor 126,000 gain to only 85,000. April unemployment stayed the same 5.4 percent, as did the 6.6 million “involuntary part-time.” The average workweek and overtime slid, as did hourly wage growth, up only $0.03 to $24.87, just 0.01 percent, less than half the year-over-year trend at 2.2 percent.

That result should not reassure anyone. The bad-winter argument was phony to begin with and is now annoying.

The Institute for Supply Management service-sector survey for April rose to 57.8 from an already high 56.5. This sector includes most of IT (information technology), and if you’re in IT, you’re hot! The economy may not be accelerating, but many parts are just fine, thanks.

The U.S. trade deficit in March was expected to rise from February’s $35.4 billion to $42 billion. Instead, it gapped to $51.4 billion. One explanation: An L.A. port strike was settled, unloading a mass of previously floating imports. Still, the collapse in oil imports requires a lot of sneakers to offset.

Another explanation for the import surge and economic softness: The outside world devalued against the dollar last year, roughly 20 percent. In the old days, before there were electrons, global trade took a long time to adjust to currency manipulation, and then to readjust currencies to changed trade. Back in the days of inflexible production lines and inventories, global supply chains worked like 10,000 miles of elephants, trunks holding tails. Each leg of currency/trade adjustment took a couple of years to play out. Now? Mouse-clicks at light speed.

The last year’s currency events is crucial to understanding: The dollar roared up because the Fed intended to lift off simultaneous with other central banks’ opposite easing by last-ditch QE (quantitative easing). Then, the currency move plus QE forced down long-term rates everywhere. That whole process overshot, and now has rebounded. The euro fell from $1.40 last year to $1.05 in March, now back to $1.12.

And the overshoot in international bonds has been spectacular. Europe is showing signs of life, which one would sure as hell expect after a 30 percent devaluation. At the beginning of 2015, the German 10-year traded at 0.5 percent. At the onset of European Central Bank QE in March, its yield fell to 0.05 percent. In the last week it rebounded to 0.55 percent.

Right or wrong, global credit markets — interest rates — are now beginning to price in the probability of economic recovery and withdrawal by central banks.

They are also pricing in volatility. Liftoff first by the Fed, and then withdrawal elsewhere is going to be disorderly. The Fed has been at zero for seven years. A new generation of kids at trading screens, algorithms running brightly and then insanely … neither the kids, the algorithms, nor their parents experienced with what’s coming.

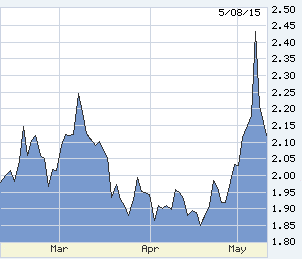

There are many volatility-scare stories circulating, but I’m a disbeliever. We’re just headed for old-time volatility, maybe magnified by regulation thinning markets. Not sure about that. But for sure, this: On Thursday on its way to settling at 0.57 percent, the yield on the German 10-year ran to 0.786 percent and back. One day! And maybe this: Some sources show the U.S. 10-year flickering up to 2.42 percent Thursday, then back to 2.23 percent.

Be very careful floating a mortgage rate, now. And no regrets if you catch a spike — super-spikes and V’s are likely to be common during the new age of liftoff.

Here’s the U.S. 10-year T-note, back two years showing the entire, long slide. See that thing way over on the right?

Many bond-market authorities say the spiked trades didn’t happen in the Treasury market on Thursday, but the market feeds into The Wall Street Journal say they did. Here is a closer look, three months back. As a “technical” matter, 10s stopped rising at the close of business Thursday at the same 2.23 percent as January and March. Lots of uncertainty about that consistent point of stoppage … signs of a new drop ahead, or rise?

There is no ambiguity about the violence of bottom and rebound in German 10s. This snapshot is intraday Thursday.

And the Atlanta Fed sees no rebound in GDP (gross domestic product) at all. None of my worry about higher rates is valid if the U.S. stays in a swamp like this.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.