We’ll add more market news briefs throughout the day. Check back to read the latest.

WalletHub’s most and least energy-efficient states:

- New York, Vermont and Minnesota were the most energy-efficient states.

- Texas, Louisiana and South Carolina were the least energy-efficient states.

- WalletHub measured the consumption of home and car energy in 48 states; Alaska and Hawaii were excluded from this analysis.

Livability’s 10 Best Cities for Singles:

- Carrboro, North Carolina; Hoboken, New Jersey; West Hollywood, California were the top three cities for singles.

- Oxford, Mississippi; San Marcos, Texas; Ypsilanti, Michigan; and Ames, Iowa were ranked 4 through 7.

- Miami Beach, Florida; Athens, Georgia; and Moscow, Idaho took spots 8 through 10.

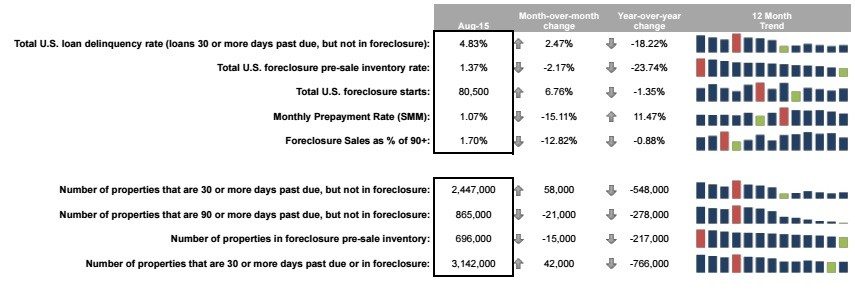

Black Knight Financial Services’ August Mortgage Monitor Report:

- Cash-out refinances were up 68 percent year-over-year in August 2015.

- The average borrower was tapping $67,000 in equity.

- Though they’re at the highest volume since 2010, cash-out refinances were still almost 80 percent below 2005 peak levels.

Weekly mortgage rates:

Powered by MortgageCalculator.org

Powered by MortgageCalculator.org

Last week’s most recent market news:

RealtyTrac’s “Why Homes Are More Affordable With Home Prices Higher” report:

- Home prices in the first quarter of the year hit their most affordable level in two years.

- The average interest rate on a 30-year fixed rate mortgage dropped 57 basis points, or 13 percent from the first quarter of 2014 to the first quarter of 2015.

- The drop in interest rates — along with wage growth outpacing home price appreciation in 32 percent of counties — meant buying a home in the first quarter required a smaller share of the average wage compared to a year ago.

U.S. Census Bureau’s August 2015 construction report:

- Construction spending during August was estimated at a seasonally adjusted annual rate of $1.09 trillion.

- This is a 13.7 percent increase over August 2014’s estimate of $955 billion.

- From January 2015 to August 2015, construction spending comprised $683.4 billion.

Freddie Mac’s Primary Mortgage Market Survey:

- The rate for 30-year fixed-rate mortgages was 3.85 percent.

- The rate for 15-year fixed-rate mortgages was 3.07 percent.

- The rate for five-year Treasury-indexed hybrid adjustable-rate mortgages was 2.91 percent.

Send market reports to press@inman.com.