- Altisource, the owner of an online real estate auction site and a national discount brokerage, has snapped up two rental data startups for up to nearly $25 million.

- The acquisitions will help Altisource enhance its online real estate services with a wide range of rental data.

- Altisource continues to work towards building an online real estate platform that could allow consumers buy and sell properties almost exclusively online.

Altisource — the owner of online real estate auction platform Hubzu and the recently relaunched discount brokerage Owners.com — has made yet another acquisition in its bid to build an end-to-end platform that consumers can use to buy or sell homes almost exclusively online.

The real estate giant has snapped up RentRange, a provider of rental home data, and Investability, an investment property search platform, to the tune of up to $17.5 million in cash and $7.3 million in restricted stock, according to an overview of the acquisitions presented to Altisource shareholders.

Altisource will leverage the companies to enhance some of its real estate services and products by providing customers, including users of Hubzu and Owners.com, with pricing data on rental home investments and access to investment property inventory, Altisource said in a statement.

“These acquisitions squarely support our real estate and mortgage marketplace strategy and enable us to provide valuable analytics to the home rental, renovation, sale and origination markets,” said Altisource CEO William B. Shepro in a statement.

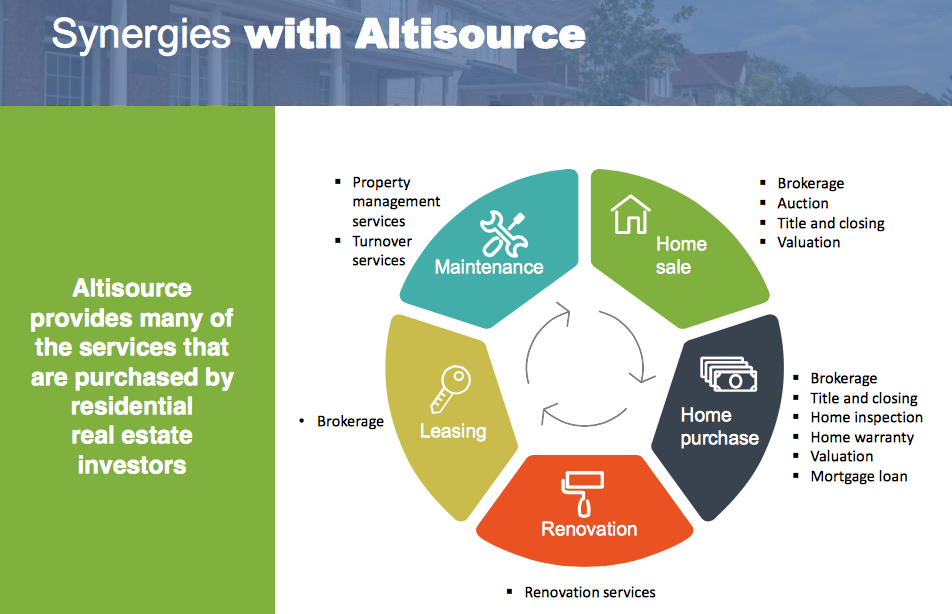

Graphic from overview of Altisource’s recent acquisitions shows the firm’s wide range of real estate services.

RentRange offers data including macro rental data and analytics, address-level rent estimates, tenant lead generation tenant rent validation and investor lists. Its customers are typically property managers and landlords, lenders and institutional investors.

Investability offers an online real estate search and acquisition platform that can generate leads and referrals for real estate professionals, as well as a subscription service to agents and investors.

The companies’ products could augment Altisource’s two online real estate platforms, Hubzu and Owners.com, with actionable data for investors and consumers.

“RentRange and Investability, when combined with Altisource’s services, offer investors the data and information they need to make well-informed decisions about the homes they’re buying, renting and managing,” Shepro said.

Screen shot of overview of Altisource’s recent acquisitions lays out Altisource’s ‘four strategic initiatives’ involving the real estate and mortgage marketplaces.

After acquiring the for-sale-by-owner website Owners.com for up to $27 million in 2014, Altisource relaunched the service as a discount brokerage offering buyers and sellers an a la carte menu of services, including remote support from in-house real estate agents.

At the time of Owner.com’s relaunch, Altisource planned to incorporate its portfolio of real estate services — including appraisal, auction, mortgage, home warranty, handyman and home inspection and repair services — into Owners.com’s offering, Eric Eckardt, formerly the vice president of online real estate at Altisource, told Inman at the time. (Eckhardt has since left Altisource to found a real state crowdfunding platform).

Altisource has also recently begun targeting consumers by tweaking Hubzu — an online real estate auction marketplace traditionally used by real estate investors to buy properties — to appeal more to everyday buyers and sellers, such as by offering buyers the ability to win auctions with bids that include financing contingencies.

Altisource’s purchase of RentRange and Investability marks at least the fifth real estate-related acquisition made by Altisource in the last two years. In addition to snapping up Owners.com, Altisource bought Equator, a mortgage software provider, for $70 million in 2013, and Mortgage Builder, another mortgage software provider, for up to $22 million in 2014, according to National Mortgage News.