- Pinch yourself as reminder that the U.S. is in uniquely good shape in a world of trouble elsewhere.

- The greatest risk to the U.S. now is the Fed’s loss of face, and failure of Fed Chair Janet Yellen’s term.

The story lead for once is not China — not directly. Overnight action by the Bank of Japan has pushed long-term U.S. interest rates down to the lowest levels since last April, the 10-year T-note to 1.92 percent, and mortgages 3.75 percent.

Pinch yourself as reminder that the U.S. is in uniquely good shape in a world of trouble elsewhere. Our housing market is picking up gradually, home prices rising a few times the rate of inflation, unemployment so low the Fed is worried about it, and here arrives a new gift from outside. Lower rates!

Without public warning, the Bank of Japan (BOJ) has joined the European Central Bank (ECB)– and Swiss, Swedish and Danish central banks — in the land of negative interest rates. Banks in Japan will be charged 0.1 percent on any funds left on deposit with the BOJ.

BOJ Governor Haruhiko Kuroda: “Risks were growing that the slowdown in the Chinese, emerging and resource-producing countries, which has caused volatility and instability in financial markets since the beginning of the year, may hurt confidence among domestic companies.”

Domo arigato, Kuroda-san. Thank you on several grounds. Our stock market has found some solid ground on the BOJ news, although there is no reason to believe the BOJ action will succeed in stimulating Japan (maybe the U.S.!). Thank you for the courage to take action even if symbolic, pushing your governors to a 5-4 vote, and acknowledging Japan’s dire situation. And thank you for mentioning the ripples outward from China’s unfolding fiasco.

A technical aside on negative rates. In a time of deflation, the money in your wallet will be worth more tomorrow than today, and the day after, and after. Why spend it if its purchasing power is rising? Anything I want to buy will be cheaper next week. Why borrow if I must pay back my loan in money worth more than the money I borrowed? Negative rates are intended to push money out of banks and into lending and spending.

Why doesn’t it work, or hasn’t yet? Japan’s most fundamental problem is a population shrinking 1 percent per year, and rapid aging by those still alive, thus a smaller and smaller workforce producing and consuming. Every year now, Japan’s GDP comes out of the gate in negative 1 percent or deeper drag.

The ECB problem is partly different, all economies external to the German core throttled by the euro; but most are also far along in their inevitable slide to Japanese demographics.

Negative rates may be working and we can’t tell (we are running experiments without control subjects). Quantitative easting (QE) demonstrably worked here, providing credit while banks could not, and by hosing down a fire-sale in credit markets. QE has not worked elsewhere: Japan’s problems are too big, and Europe is too inflexible. On balance, several years of emergency action by central banks, now approaching hysterical has bought time toward an unknown future. Their action combined with incipient deflation has pulled Japan’s 10-year bond to a new record 0.102 percent on Friday, and the German version to 0.327 percent (not a new record, but soon). U.S. 10-year Treasurys have followed.

Here in the U.S., the economy has clearly decelerated, GDP (gross domestic product) growing less in each of the last three quarters. The Q4 result of 0.7 percent growth masks still-good consumer spending at 2.2 percent. We’re just buying things produced by others. More cautionary, Q4 PCE (personal consumption expenditures) core inflation stayed at 1.2 percent, and the most-broad measure of employee compensation rose only 0.6 percent.

I’ve been avoiding this next part. The Fed. There are some holdouts in the commentariat, creationists who think the Fed should raise rates no matter what. Everyone else is trying to maintain dignity while guessing if the Fed will cut its pace of future hikes, stop altogether, or reverse. I don’t know, either, and it’s unseemly to pile on criticism of officials trying hard but mistaken.

But, the greatest risk to the U.S. now is the Fed’s loss of face, and failure of Fed Chair Janet Yellen’s term. She and other leaders there must quickly offer to the nation a heavily revised view of the global economy and U.S. implications, and I fear they’re not up to it.

U.S. 10-year T-note in the last week.

U.S. 10-year T-note in the last two years. A run back down to the all-time low was inconceivable only one month ago, now approaching probable.

The Fed-sensitive 2-year T-note in the last six months. These traders fear the Fed as nothing else, but their market says the Fed’s plan to raise the Fed funds rate 1 percent per year for the next three years has passed into history. The history of really, really bad thinking.

This is what deflation in progress looks like. And it is progressing.

Mentioned above, the Employment Cost Index is inclusive of soft compensation like benefits. Sustained inflation without increased incomes is impossible. The Fed’s focus on too-low unemployment as an imminent threat to too-fast wage growth and inflation will no doubt be true someday, but not this decade.

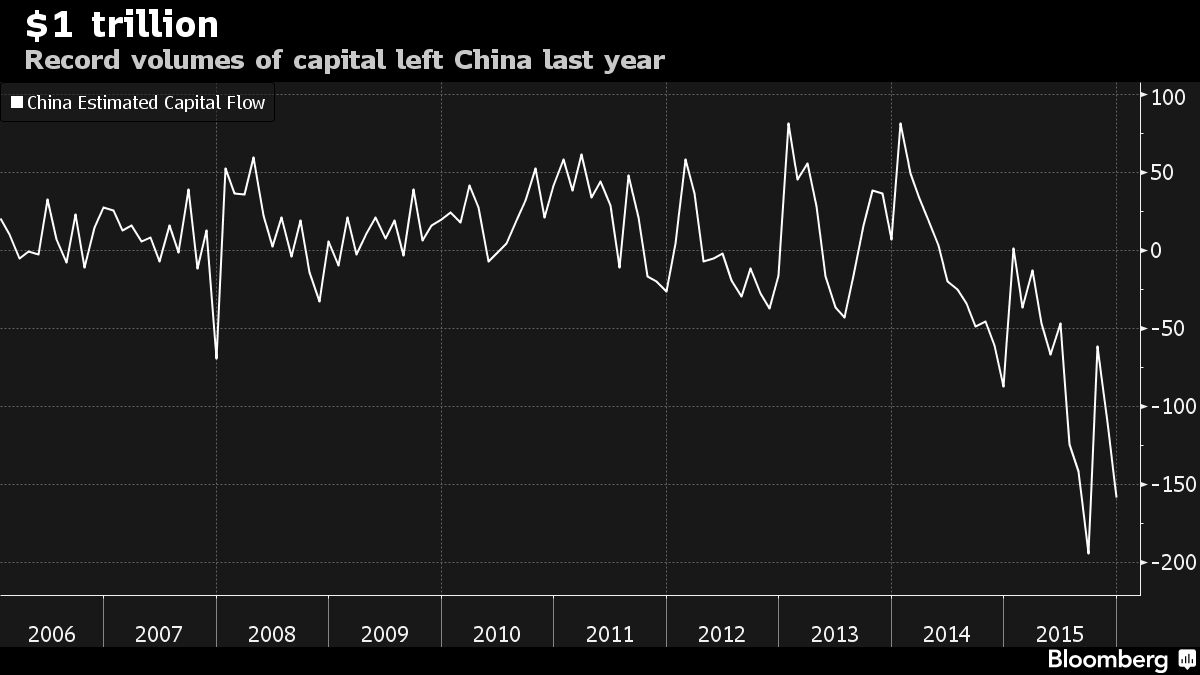

China, China, China … these two charts show money flooding out of China and diminished reserves. In the last few weeks apologists have tried every conceivable excuse to say “everything is fine, all normal,” and it’s not. The BOJ action now creates a new leg to currency war and downward pressure on the yuan.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.