- After a high-volatility stretch early this year, markets are dead.

- The conditions which led to early-year volatility are still in place, with one exception: the Fed is off the table, no longer raising rates.

We’re back to cowboy movies: “It’s quiet out there — too quiet.”

After a high-volatility stretch early this year, markets are dead. Little movement in price, and trading volumes falling. But the conditions which led to early-year volatility are still in place, with one exception: the Fed is off the table.

The Fed’s first 0.25 percent hike in December may not have mattered much by itself, but the Fed’s insistence on a death march of hikes ahead was devastating worldwide. It took a while for Yellen and her majority to get it, and to say so, but they do. And now they have evidence of domestic slowing: first-quarter GDP (gross domestic product) grew hardly at all.

March retail sales fell 0.3 percent — so good only because auto sales are still positive. Nearly one-third of U.S. auto “sales” are now by lease, and the potential is big for an off-lease and used vehicle glut, and new inventories themselves are bloated. March industrial production was expected near break-even but fell 0.6 percent for the second month in a row.

March CPI (consumer price index), both nominal and core, arrived at 0.1 percent instead of the 0.2 percent expected. The NFIB (National Federation of Independent Business) survey of small business has rolled over — not in trouble, just rolled.

The Fed has justified its rate liftoff as largely pre-emptive. Better a little now than a lot or suddenly later. Outsiders have suggested — mercifully, not Fed officials — that it should hike now so it could cut later (huh?).

Inside and near the Fed, the discussion is about “asymmetric” risk: which is more dangerous, hiking or staying put? And the Fed has the right answer, and with thunder: Hiking is far more dangerous.

Unsaid explicitly, certainly omitting gory details: If we make a mistake on the tight side, how can we fix it? Ben Bernanke this week posted his third of three installments at brookings.edu (all in plain sight there) titled, “What Tools Does the Fed Have Left?” He’s the brightest and best-ever, but his prescriptions are not reassuring.

The International Monetary Fund was created at the Bretton Woods conference in 1944, where the victorious powers laid the framework for restoring the global economy. Only two years later as the Cold War began, the IMF became central to stabilizing U.S. allies, many of whom (Britain, Germany, Japan) were not self-sustaining until late in the 1950s. After that until today the IMF became a fire brigade to rescue nations which fell into financial sinkholes.

IMF funding is supplied by its membership, Albania to Zimbabwe, and including Russia and China. A monetary United Nations, which on other matters could not agree on the hour of sunrise, hence acutely political and reluctant to criticize any member nation until at death’s door, or even to point out collective failure to manage the world’s financial affairs.

I cannot recall warnings more direct from the IMF than this week’s. Mr. Vinals, head of the IMF’s stability division warned of “financial and economic stagnation” from a “pernicious feedback loop of fragile confidence, weaker growth, low inflation, and rising debt burdens.” Mr. Gaspar, head of the IMF fiscal division: “Risks are more considerable than they were, say, six months or one year ago.” If global GDP growth slides further, raising public and private debt levels as percentages of GDP, then “households, firms, and governments will be tempted to cut expenditures, putting further downside pressure on nominal GDP, a spiral that one must avoid.”

No kidding. So, with debt-to-GDP ratios already exhausted everywhere, central banks printing madly but the money disappearing into the mother of all liquidity traps, how are nations going to maintain expenditures?

Mr. Bernanke’s part three proposes a “Money-Financed Fiscal Program, or MFFP.” I’ve read the thing three times. I know he’s smarter than anybody, and the architect of all the alphabet-soup programs which saved our butts 2008-2009. I have worked on pronouncing MFFP, but it sounds like I’ve been gagged by Chinese secret police.

Central banks are done. Fork ’em. The next and last-ditch rescue ahead, maybe Japan first: an immense government spending binge, the debt bought entirely by the central bank. But, what’s the difference between MFFP and now?

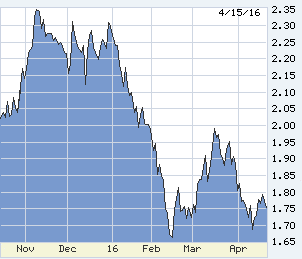

US 10-year T-note six months back. February to present shows the most gorgeous compound head-and-shoulders formation you’ll ever see. It portends another try at the lows under 1.70 percent, and if broken a visit to the all-time lows.

US 2-year T-note, the best Fed-predictor available. Traders say the Fed is done for the year.

The two NFIB charts show the small-business stall.

The idea in QE was for the central bank to buy bonds as a bridge to recovery. Japan’s outstandings are beyond any possible recovery, which means default ahead in some way. The second Japan chart above shows that the Bank of Japan (BOJ) is racing toward a no-clothes endgame, within three years to own 60 percent of all Japanese Government Bonds (JGBs). How an MFFP spasm would make that situation better is beyond me — it’s MFFP now.

China’s failing effort at rebalancing shows in this chart of corporate debt issuance. Its banks are loaded with bad corporate debt, so instruct businesses to stop borrowing from banks and issue bonds. The bonds won’t pay off any better than the loans did, and banks will buy the bonds, but it will all look different for a (little) while.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.