We’ll add more market news briefs throughout the day. Check back to read the latest.

U.S. Census Bureau/U.S. Department of Commerce’s August 2016 construction data:

- Construction spending during August 2016 was estimated at a seasonally adjusted annual rate of $1,142.2 billion.

- This is 0.7 percent below the revised July estimate of $1,150.6 billion.

- This is also 0.3 percent below the August 2015 estimate of $1,145.2 billion.

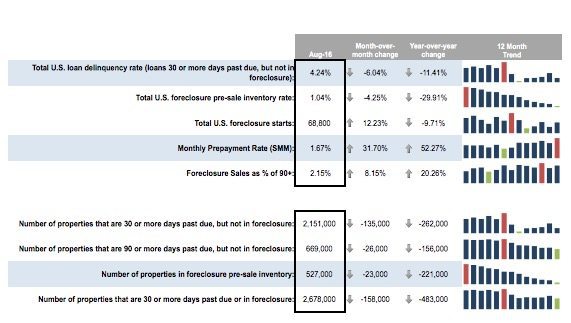

Black Knight Financial Services’ Mortgage Monitor for August 2016:

- The national delinquency rate fell by just over 6 percent month-over-month in August 2016.

- Delinquencies were at 4.24 percent in August 2016.

- The inventory of loans in active foreclosure continued its 19-month consecutive downward trend.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

[graphiq id=”kPkTJrAnX5r” title=”Average Home Equity Loan Bank Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/kPkTJrAnX5r” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Bank Rates by State | Credio”]

[graphiq id=”dP0v3iYOnH” title=”Average Home Equity Loan Credit Union Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/dP0v3iYOnH” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Credit Union Rates by State | Credio”]

Most recent market news:

National Association of Realtors Pending Home Sales Index (PHSI) for August 2016:

- The index declined 2.4 percentage points to 108.5 in August from July.

- The index was 0.2 percent lower in August 2016 than August 2015 (108.7).

- The index is currently at its second-lowest reading in 2016, after January (105.4).

Ten-X Residential Real Estate Nowcast:

- September sales will fall between seasonally adjusted annual rates of 5.1 million and 5.44 million.

- This is down 1.2 percent from August.

- This is also down 5.1 percent from one year ago.

- The 30-year fixed-rate mortgage (FRM) averaged 3.42 percent with an average 0.5 point for the week ending September 29, 2016.

- This is down from last week, when it averaged 3.48 percent.

- One year ago, the 30-year FRM averaged 3.85 percent.

Email market reports to press@inman.com.