We’ll add more market news briefs throughout the day. Check back to read the latest.

National Association of Realtors’ Existing-Home Sales Data for September 2016:

- Existing-home sales were up 3.2 percent in September month-over-month.

- This was propelled by a 34-percent share of first-time buyers.

- The median existing-home price for all housing types in September was $234,200.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

[graphiq id=”kPkTJrAnX5r” title=”Average Home Equity Loan Bank Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/kPkTJrAnX5r” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Bank Rates by State | Credio”]

[graphiq id=”dP0v3iYOnH” title=”Average Home Equity Loan Credit Union Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/dP0v3iYOnH” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Credit Union Rates by State | Credio”]

Most recent market news:

Mortgage Bankers Association’s Weekly Applications Survey:

- Mortgage applications increased 0.6 percent from one week earlier for the week ending Oct. 14, 2016.

- The refinance share of mortgage activity decreased to 61.5 percent of total applications from 62.4 percent the previous week.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.73 percent from 3.68 percent.

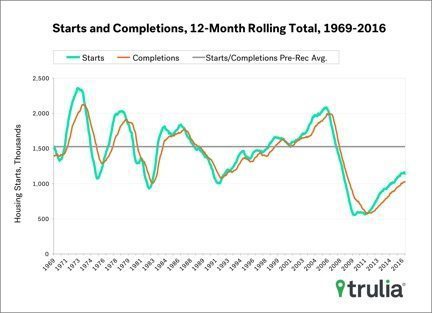

- Single-family authorizations in September were at a rate of 739,000, 0.4 percent above August 2016’s revised figures.

- Single-family housing starts in September were at a rate of 783,000, 8.1 percent above August 2016’s revised figures.

- Single-family housing completions in September were at a rate of 687,000, 8.8 percent below August 2016’s revised figures.

Ellie Mae’s Origination Insights Report for September 2016:

- The average time to close all loans increased to 48 days in September 2016 from 46 days in August 2016.

- The 30-year note rate declined to 3.750.

- Closing rates experienced a slight decrease to 71.8 percent.

Email market reports to press@inman.com.