- After a natural disaster, homeowners should consult their homeowner’s insurance, consider building codes and costs, look into disaster cleanup and risk management, and figure out their opportunities in this stage of their life

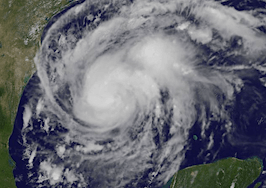

Hurricanes took “a toll on over 270,000 homes” this year.

In Texas and Florida alone, damage is expected to exceed $150 billion. Such numbers aren’t isolated to one or two events. Other hurricanes, wildfires, tornados and other natural disasters happened in 2017 that led to even more damages and repair costs across the nation.

Because of that, homeowners may need guidance about whether to rebuild or buy a new home after a disaster. Use the following six factors to help them make the decision more easily.

Homeowner’s insurance

When a disaster hits a home, homeowners ought to revisit their home insurance policy. It governs whether homeowners receive replacement cost value coverage (RCV) or actual cash value coverage (ACV).

That determination, in turn, affects how much the insurer will pay to cover damages and losses.

You should also share that insurance settlements sometimes vary by situation, as in the case of electing not to rebuild.

In addition, if a homeowner is paying on a mortgage, the settlement goes to the lien holder first and the homeowner second. If the settlement doesn’t pay off the mortgage, the homeowner may be stuck with rebuilding instead of buying a new property.

Building codes and costs

Another factor to consider is building codes and rebuilding costs. As natural disasters occur, the Federal Emergency Management Agency (FEMA) sometimes updates the codes to decrease disaster risk and save lives.

However, the codes sometimes increase rebuilding costs. Other factors affect costs too, such as top-down versus bottom-up repairs. The first almost always costs more because of labor costs — it can be much more hazardous to remove a roof and work on a destroyed structure than to rebuild a home that’s been razed to the ground by a tornado.

According to James Green, CEO of Home By Home, it may be helpful to enlist extra help to gauge potential costs and benefits to any course of action.

“Finding a qualified, experienced individual to help you navigate your specific situation will make dealing with a disaster feel less scary and overwhelming,” he said.

Disaster cleanup

Disaster assistance offers helpful advice in this area, noting that homeowners should assess home safety issues prior to cleaning and rebuilding.

As an example, if homeowners experience a house fire, they must wait for the local fire authority to give the all-clear before re-entering the premises.

Even with that permission, disaster cleanup efforts often prove exhausting. Go over that reality, as well as related costs, with your homeowners.

For example, they may need to hire a professional cleanup crew and rent an apartment or hotel room for the duration of the cleanup and repairs.

Risk management

Pablo Solomon, an internationally recognized designer and environmental artist, offers another consideration: risk management.

Prior to achieving worldwide acclaim, he lived for many years on the Texas Gulf Coast — so he knows a thing or two about natural disasters and home repairs.

Those experiences fuel his mindset that rebuilding or buying a new home rests on the likelihood of another disaster.

Solomon said homeowners should ask, “Can I restore my home to resist a future disaster or must I totally rebuild?”

He explained that some areas are simply more prone to natural disasters than others, and homeowners should keep the potential risk in mind when deciding whether to rebuild or move.

New opportunities

According to real estate broker Kris Lippi, the decision to buy or rebuild comes down to location — some homebuyers choose a home because of the neighborhood, not the home itself.

“I have had buyers settle on a house they were not in love with because it was located in a great neighborhood … [when] something catastrophic happen[s] to their home, [they see it] as a chance to build the home they really love.”

Lippi said he’s witnessed the opposite scenario play out, too. That is, the homebuyers purchase a home in a less-than-ideal location. When a natural disaster occurs, they view the event as an opportunity to move to a more desirable neighborhood.

Life stage

Similar to new opportunities, a homeowners’ stage in life can influence whether they decide to rebuild or move. Frontier home technology expert Harrison Brady said, “A retiree might not want to rebuild after a disaster, maybe because they want to move closer to the grandkids or find a place where someone cares for the lawn.”

He said young couples and singles face similar decisions.

A young couple may already have kids or plan to have them. They might prefer not to live in a region known for rampant hurricanes or wildfires.

A single person could face more of a financial decision, weighing whether rebuilding or moving serves them best in the long run.

When your homeowners encounter a disaster, they need advice. But more than that, they need a listening ear.

A large part of their home, if not all of it, vanished in a storm or fire. If you can listen to their concerns and worries before digging into insurance policies and rebuilding costs, you’ll not only help them out but also become their trusted real estate agent for life.

Alec Sears is a digital marketing expert and freelance writer in Salt Lake City. You can follow him on LinkedIn or Twitter.