Globally, nearly 40 percent of high-net-worth individuals are ready to buy in the next three years while 23 percent are looking to sell, according to Luxury Portfolio International‘s 2018 Global Luxury Real Estate report.

By region, the most active buyers are the affluent in the Middle East, where 71 percent of high-net-worth individuals are looking to buy, according to the report, entitled “Luxury Real Estate: What Matters Most To Today’s Global Elite.” In North America, the numbers are less bullish — 30 percent of the intend to buy in the next three years and 25 percent want to sell.

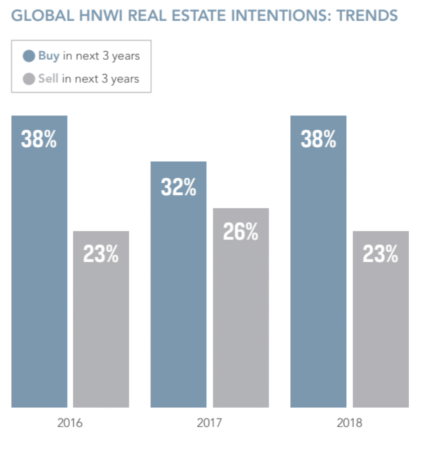

The number of high-net-worth buyers (38%) and sellers (23%) is similar to 2016 levels. Last year, buyers hovered at 32 percent while sellers stood at 26 percent, according to the report.

The number of high-net-worth buyers (38%) and sellers (23%) is similar to 2016 levels. Last year, buyers hovered at 32 percent while sellers stood at 26 percent, according to the report.

The “mismatch in purchase intent” this year will result in higher prices, less inventory and a hesitation by sellers as they try to find new homes in markets such as San Francisco, Hong Kong and beyond, according to the report, written in conjunction with research partner YouGov. Luxury Portfolio International is the luxury arm of Leading Real Estate Companies of the World, which represents 565 independent brokerages around the world.

The findings are good news for luxury agents, Luxury Portfolio International president Stephanie Anton told Inman.

“So much of the coverage we see is about the softening of the luxury property market, but the research shows the growth of the affluent has continued, with nearly 40 percent wanting to buy,” Anton said. “This is tied to growing wealth.”

The most recent Credit Suisse Global Wealth Report showed a net gain in the high-net-worth population increasing 7 percent to 36.1 million people, with a value of $129 trillion, up 10 percent.

The Luxury Portfolio 2018 report focused on a core of luxury home purchasers intending to buy in the $1 million to $4 million range. What triggers a home move for these wealthy buyers? Forty percent of respondents said it was to improve their quality of life, while 34 percent said it was for financial investment. Meanwhile, 24 percent were looking to upsize and 22 percent simply wanted a change of scenery.

The study found differences between the attitudes of wealthy North Americans and their Asian, Middle Eastern and European counterparts.

More than one-third of all high-net-worth individuals (35 percent) believe real estate is the most obvious indicator of wealth, with many European (44%), Middle Eastern (38%) and Asian (31%) individuals saying it was the main indicator. In the United States, by contrast, wealthy individuals said luxury possessions such as jewelry and designer fashion were more obvious indicators of wealth than real estate (32% vs 29%).

The Luxury Portfolio report, meanwhile, also highlighted the importance of the emotional tie wealthy homeowners feel toward their homes, with 78 percent of all those surveyed saying their residence was a home rather than just a house.

The Luxury Portfolio report, meanwhile, also highlighted the importance of the emotional tie wealthy homeowners feel toward their homes, with 78 percent of all those surveyed saying their residence was a home rather than just a house.

When broken down by global region, however, the most important criteria for the majority of American respondents in selecting a home was driven by the physical space, the lot, the location, size and layout of the house. Finding a property that offered them the best value for money was their second most important priority, followed by emotional ties to the property.

Because the real estate market in North America is so competitive, there’s a feeling that Americans need to “put emotion to the side” to make good financial decisions with their real estate purchase and ensure its long-term viability, Anton said.

Unlike their global counterparts, North American high-net-worth individuals are evenly split on their preferences for suburbs (46%) and urban centers (45%). Elsewhere, high-net-worth individuals were less enthusiastic about suburban living, with Europeans (29%) Middle Eastern (13%) and Asian (22%) homeowners all professing a desire to live in cities.