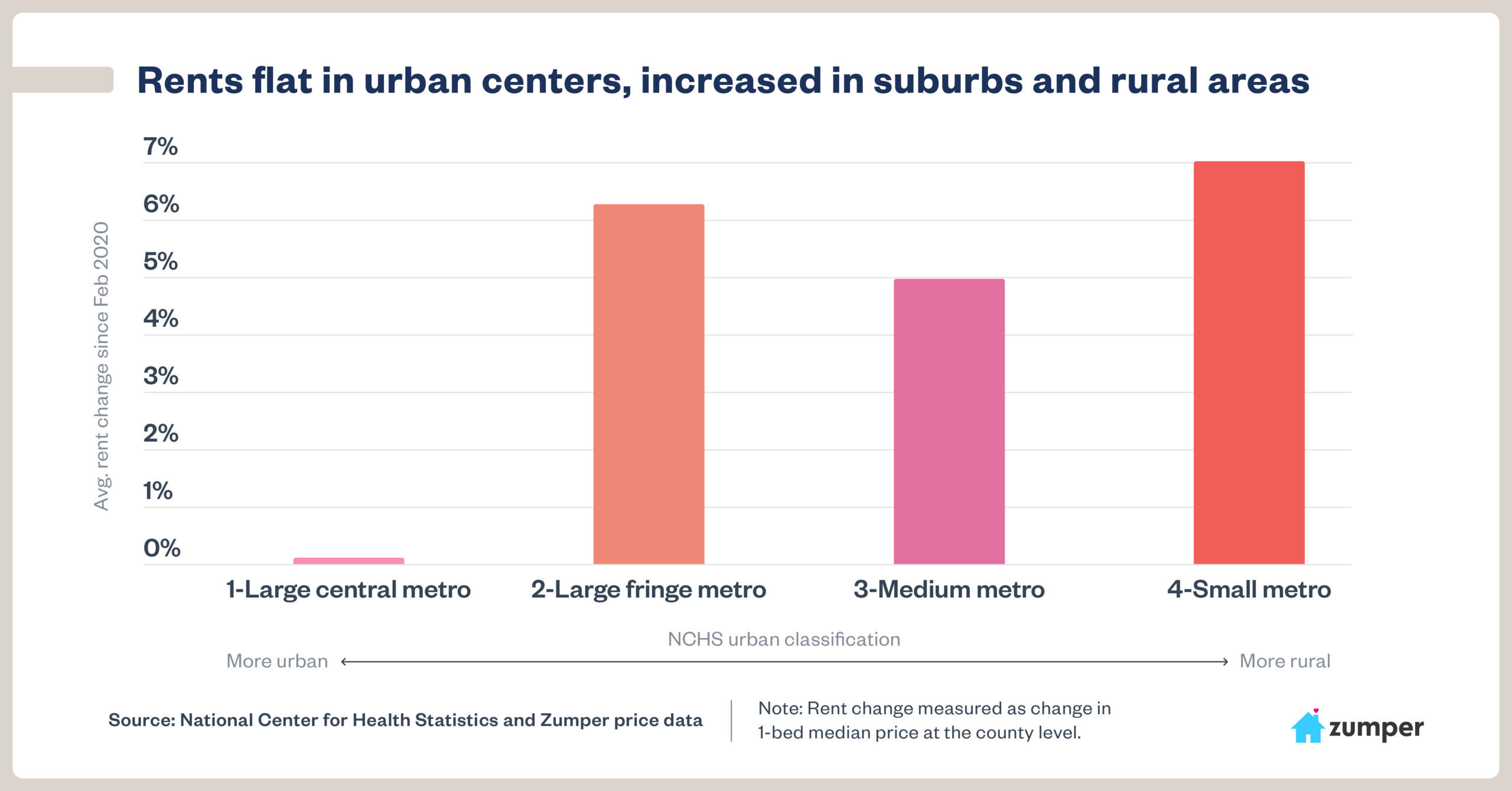

In response to the pandemic, many city-dwellers fled to the suburbs or rural areas for more space and fresh air. That preference away from urban areas has led to a split in urban and suburban/rural renting trends, with suburban and rural rent growth well outpacing urban rent growth over the last year, according to rental listing site Zumper.

Since last February, rents have remained relatively flat in larger metro areas in the U.S. However, rents continued to grow in suburban (large fringe and medium metros) and rural areas (small metros) since then, with suburban rents outpacing urban ones by about 5 to 6 percent, and rural rents outpacing urban ones by about 7 percent.

“This pattern is very different from historic standards,” Neil Gerstein, Zumper data analyst and author of Zumper’s report, wrote. “Typically rents grow at a constant average percentage across the board or rents grow faster in urban areas in times of rapid urban growth. The pandemic set off a series of trends — notably migration away from large, expensive cities — that caused rents in the suburbs and rural areas to outpace rents in urban areas.”

As renters sought to leave expensive metro areas, secondary cities gained a lot of attention during the pandemic. In particular, places like Newark, New Jersey; Cleveland, Ohio; Indianapolis, Indiana; Providence, Rhode Island; St. Petersburg, Florida; Durham, North Carolina; and St. Louis, Missouri, all began seeing rapid price gains during the pandemic. However, that growth also largely peaked by the end of 2020, Zumper noted. Since then, rent growth in these cities has mostly declined, aside from in Durham and St. Petersburg.

The trend reversal for these cities, as well as new growth in markets that were previously declining, may be an indication that, one year after the pandemic’s declaration, markets are making strides to where they once were. Boston and Washington, D.C. saw significant rent drops during 2020, for example, but during March 2021, those cities saw one-bedroom median rent increases of 2.0 percent and 5.1 percent, respectively.

During the month of February, one- and two-bedroom units saw rent growth at a national level, with one-bedrooms gaining 0.6 percent over the course of the month to a median rent of $1,248, and two-bedrooms gaining 0.8 percent to a median of $1,514. Those prices were up 2.2 percent and 2.9 percent, respectively, from the year before.

Out of the 100 most expensive metro areas in the U.S. analyzed by Zumper, St. Petersburg and Durham saw the greatest one-bedroom price increases month over month. In St. Petersburg, they increased 6.7 percent from February to March, and in Durham, they rose 5.7 percent from the month before.

Overall, pricey coastal markets like San Francisco and New York remain most expensive for one- and two-bedroom apartments (they are the No. 1 and No. 2 most expensive markets, respectively), even with double-digit year over year declines in rent prices.

Indianapolis, Indiana, and Lexington, Kentucky, tied for the greatest month over month decrease in one-bedroom rents at a decline of 5.1 percent. Newark, New Jersey, followed with one-bedroom rents dropping 4.9 percent between February and March.

Wichita, Kansas, and Akron, Ohio, tied for least expensive one-bedroom rents, with price of $600. That price is down 9.1 percent year over year in Wichita, and 1.6 percent in Akron.