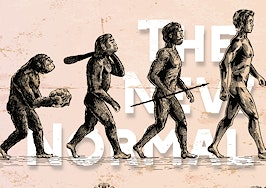

“The New Normal” is a multistory Inman series exploring what’s returning to normal after the pandemic fades and what will never be the same. Join us June 15-17 when we take the conversation live at Inman Connect.

There’s getting the business, then there’s doing the business. In real estate, it’s the doing that justifies agents’ earnings. Getting deals done is hard.

The National Association of Realtors’ (NAR) April 2021 Confidence Report said that 9 percent of home sales ended up getting cancelled, and the vast majority of all deals — 76 percent percent—contained contingencies.

There are number of things that cause real estate deals to become challenging or collapse, including but not limited to:

- Negotiations over repairs

- Anxious buyers or sellers

- Financially insecure buyers

- Title concerns

- A bad appraisal

- Physical condition of the home

- Property boundary disputes

- Fixture definitions

Yet, the industry continues to conduct business in the same way, by supporting buyer-centric protections that invite as much risk to the sanctity of the transaction as they’re trying to avoid.

Maybe the way we’ve always done it is not the best way to do it. In other words, what if real estate transactions could be less of a hassle?

We’re in an age of hyper-aware buyers and sellers. The former is armed with volumes of market and housing data, and the latter has multiple, non-traditional companies they can hire to liquidate their home, each coming to light as a result of “the way it’s always been done.”

With every sight-unseen offer, iBuyer sale, Knock Home Swap and contingency-free contract that graces a seller’s inbox, one more cornerstone gets chiseled away from the foundation of the traditional sale.

Agents need to rethink how they market their services, and brokers, associations and even NAR have to dedicate serious energy to rethinking how they communicate their value proposition. Here’s why.

Smarter buyers, smoother deals

The new, less-hassle transaction starts with the buyer. It’s not all about automating escrow.

Buyers’ growing comfort with making offers that eschew inspection and financing contingencies, as well as multiple property visits (or even one), will lead to shorter escrow periods, in turn reducing the number of risks that can lead to a sale going sideways.

It’s everyone’s data

“In the new normal,” wrote Inman contributor Cara Ameer, “transactions will continue to move fast with buyers doing most of the legwork in house hunting, resulting in less back-and-forth and faster decision-making.”

The process of house hunting today is largely conducted online by the buyer. This is for the best, as its devolved into an exercise of who can send who the same listing first. The agent’s value in this initial step has dwindled considerably.

Outside of coming-soon properties or in-house pocket listings (where allowed), buyers and agents have access to the same market data. You no longer own the data, everyone does, but it’s not as if the buyer ever cared who did.

Marketing gives consumers power

From portals to Pinterest, and from dynamic Facebook advertising to automated marketing, buyers are endlessly inundated with listing and real estate market data. Of course they’re smarter than ever before.

Buyer’s agents should consider marketing on that message. Stop trying to beat the system, and allow buyers the freedom to use the information they’re given to help both parties arrive at a home decision. Call it Socratic client relations.

After all, an agent’s ultimate value comes through the application of the data. Consumers need help understanding contract terms, negotiating tactics and how market dynamics impact offer strategy. Be there for that.

Digital comfort

Buyers’ overall comfort in the digital workspace translates into multiple ways to hasten the deal. Virtual tours, sharing of listings with families and friend groups, online conferences and even online neighborhood research add up to less time in the car, fewer questions and faster offers.

Obviously, electronic signatures and documents are at the heart of the digital transaction.

“Electronic signatures allow buyers to sign offer forms and return them to their agent within minutes,” Ameer wrote. “In today’s ultra-competitive market, minutes matter as agents are on a very short deadline to submit an offer.”

Make that offer shine

No longer concerned as much with what needs to be fixed or who pays the closing costs, offers are completed with less ink than ever before, and that’s not because the majority of them are digital.

That ultra-competitive market Ameer mentions is forcing rapid change in the way buyers conduct business and what sellers will accept. It’s time agents embrace these changes as helpful for all parties.

A clean offer — a term derived from an offer with few contingencies and thus, “less ink,” demonstrates to the seller that the buyer is as committed to a hassle-free sale as they are. Remember, offer contingencies are there to protect the buyer and always give the seller side one more point of contention.

Are inspections still critical?

And again, buyers are smarter than ever, the protections offered by contingencies are getting addressed by what they can learn in due diligence periods and seller disclosures.

When due diligence and seller disclosures are bolstered by the wide array of technology-backed tools and services, there is very little information a buyer can’t learn about a home.

As I wrote in this article on sight-unseen offers, industry vendors have made real estate data its own industry. What agents can learn — and then share — about a home and its location is borderline scary, but in a good way.

Additionally, it’s growing more common for sellers to pay for inspections before going to market, giving buyers a reason to eliminate the inspection contingency. In these instances, encourage your buyer to view that inspection as a few hundred dollars saved, as it’s well past time buyer agents stop encouraging buyers to hire their own inspectors for fear of a seller hiding something or committing fraud.

New companies, new deals

A number of new companies are emerging to help consumers move faster, remove contingencies and increase their buying power. They are quickly simplifying the transaction.

In an Inman Connect Now session entitled, Disruptions in Financing: What’s Coming Next, moderator Clelia Peters discussed the companies leading the coming shift in the way homes are transacted with less hassle, noting Orchard, FlyHomes, Ribbon, Knock and HomeLight.

“There are two models or goals these companies hope to accomplish: They either turn a buyer into a cash buyer, or turn a seller into a buyer,” Peters explained. “They earn their money through spreads, or the value of the home when they buy it versus the value at which they sell it, and fees, or a premium paid for using this service.”

Knock is a company that empowers sellers to buy a home before their existing one sells. It’s called “Home Swap,” and it’s grown to 40 markets in two years, blowing away the company’s original goal to be in 21 markets by 2021.

Its CEO and co-founder, Sean Black, is not shy about what he sees in the future for the real estate transaction. He told Inman’s Matt Carter that he sees a “transaction revolution,” with buyers and sellers demanding — and getting — more transparency, liquidity and convenience.

HomeLight is another entity contributing to Black’s vision.

“HomeLight’s Cash Offer program purchases a home on a homebuyers’ behalf so they won’t miss out on the home of their dreams while securing mortgage financing,” Inman’s Marian McPherson wrote.

Consumers can pair HomeLight Cash Offer with its Trade-In program, which will purchase the seller’s home for 90 percent of the home’s expected value on the open market, according to McPherson.

Knock, HomeLight and others argue they aren’t “iBuyers” by noting they aren’t removing agents from the deal.

Part of the reason Knock is so well positioned, Black said, is that he and COO and co-founder Jamie Glenn have sought to build a platform that makes life easier for real estate agents to serve their clients, but still depends on their input.

Nevertheless, Knock, HomeLight, Ribbon, etc. are contributing to major positive change in the marketplace by flattening the transaction. Most notably, they’re consolidating transaction services to reduce deal friction.

Meet them in the middle

Know that these companies plan on growing; they want to make change where the opportunities are plentiful, and right now, that place is residential real estate, and the biggest opportunity is clearly the way deals get done.

Agents should actively be looking to adjust their marketing with messages that emphasize knowledge of how to get deals done quickly and with little hassle.

Get educated on financing alternatives and other technologies that expedite deal-making. Also, create marketing campaigns that target cash buyers, and position yourself as an expert on sight-unseen offers. Learn as much as you can about what contract structures offer the most protection for buyers and the least amount of hassle for sellers.

Don’t brush off this movement as a pandemic-induced anomaly. Wall Street is betting big on the prospect of making the real estate transaction easier, and so should agents. If Amazon has taught us anything, it’s that the convenience of a transaction drives buying decisions.

Why should buying a home be any different?