Are you receiving Inman’s Agent Edge? Make sure you’re subscribed here.

What happens if the DOJ ends commission sharing and the commission pool shrinks from $80 billion to $40 billion? Will Zillow be able to double its revenue by $1.5 billion from its Premiere Agent program as per its 2025 business plan? Will companies like Compass and Opendoor continue to reduce agent commissions to stop hemorrhaging money?

Everyone wants a part of the commission pie you generate. Here are seven reasons not to despair about what’s ahead.

Rocky times ahead for commission interlopers

Mike DelPrete’s session at Inman Connect Las Vegas began with a favorite quote from Richard Branson, “If you want to become a millionaire, start with a billion dollars and start a real estate company.”

DelPrete’s charts showed the massive burn rates at companies like Compass and Opendoor that threaten the solvency of these companies, even as they attempt to shore up their revenue by keeping their listings totally off the MLS or not listing them until two weeks after the listing was first taken.

The big real estate portals are also facing serious headwinds. For example, Zillow plans to double its revenue from its Premiere Agent program (that’s an additional $1.5 billion by 2025).

Moreover, the only reason revenues are holding at current levels is that prices have increased so much over the last year. The volume of transactions is already falling in many markets with an increased number of price reductions as the result. Furthermore, the market has already peaked in most areas, which will soon result in a downturn in prices.

The truth of the matter is that if the DOJ ends commission sharing and/or state and local associations force buyers to negotiate their own commissions as contemplated by the Northwest Multiple Listing Service, all these business models that rely on buyer agent commissions will be seriously disrupted.

The mortgage interest rate situation is better than you may think

Many experts expect the Fed to raise interest rates by another 75 basis points in September. Despite the most recent interest rate increase of 75 basis points, interest rates have actually dropped.

According to Rocket Mortgage, most people assume that the Federal Reserve controls rates and/or they are tied to the 10-year U.S. Treasury note. Instead, they’re actually tied to the bond market.

Mortgage-backed securities, or mortgage bonds, are bundles of mortgages sold in the bond market. Bonds affect mortgage rates depending on their demand. When the demand for mortgage bonds is high (usually when the stock market performs poorly), mortgage rates increase, and when the demand is low, mortgage rates decrease.

Consequently, while rates may tick up again, they’re unlikely to increase an additional 75 basis points.

Agents, not technology, sell houses

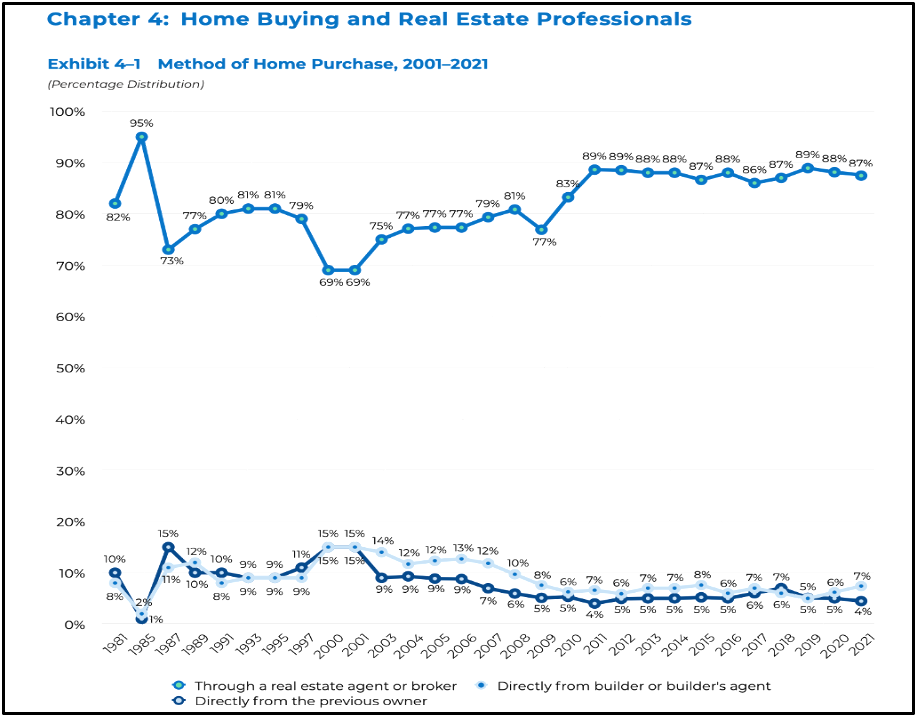

One of the most fascinating charts that DelPrete displayed was from The 2021 NAR Profile of Home Buyers and Sellers. What’s interesting to note is that in 1998 when Realtor.com first launched, only 69 percent of the buyers were represented by a Realtor.

In 2006 and 2007, when Zillow and Trulia came on the scene, that number was 83 percent. Since 2019, that number has ranged from 87 percent to 89 percent. Furthermore, seven percent purchased directly from a builder.

The big takeaway is that agents are still getting the lion’s share of leads and that the commission interlopers actually have a smaller pie from which to draw revenues.

Referrals are the name of the game

According to The 2021 NAR Profile of Home Buyers and Sellers, 60 percent of the buyers and 68 percent of the sellers found their agent through a referral from a friend, neighbor, or relative or used an agent they had worked with before to buy or sell a home.

Consequently, spend at least 60 percent to 70 percent of your marketing dollars staying in contact with your referral database. On average, one out of 10 will list in the next 12 months.

A fantastic resource that currently will cost you nothing is the “Database Refresh” from Likely.AI. Merely upload your database, and it will generate a list of the people who are most likely to transact in the next 90 to 180 days. Here’s an example from one of their clients:

In this scenario where the agent had 2,633 contacts, the algorithm located 216 sales in the last nine months as well as 231 “likely sellers” who will be likely to sell in the next 90 to 180 days.

Concentrating your efforts on those high-probability contacts is a smart use of your time and money.

The No. 1 advantage you have over all the commission interlopers

According to The 2021 NAR Profile of Buyers and Sellers, 73 percent of the sellers and a whopping 82 percent of the sellers hired the first agent they met with face-to-face once they decided to transact.

Regardless of whether it’s a portal, an iBuyer, or another real estate company you’re competing against, you must make being face-to-face with your database your most important priority as we move through this shifting market.

Three steps to make sure you’re top-of-mind include:

- Plan on interacting with the top 150 contacts in your database at least once a month with a personal message or comment on their social media posts. This message must be about their interests, not your business.

- Second, make sure that you see them face-to-face at least quarterly, whether it’s for a cup of coffee, a client appreciation event or just dropping off a coupon, flowers or some other token of your appreciation. If it saves them money, all the better.

- Supplement these tools with an Equity Checkup that includes the latest reports from NAR’s Real Property Resource (NARRPR.com), HomeDisclosure.com and your CMA. Do this twice annually, especially before tax time so that if their property has declined in value, they can go after a reduction in their property taxes.

Wage war on pocket listings

Here’s a simple way to combat all the TV advertising and those companies who take pocket listings merely to line their pockets at the expense of the consumer. Use all of your marketing strategies, whether it’s on social media, in print, on billboards or podcasts to ask one simple question:

Which way do you believe you will get the highest price in the shortest amount of time for your home?

Listing with ONE company that only gives you access to their company’s buyers or to all the companies who use our Multiple Listing Service? [Be sure to provide the number of companies that are in your MLS.]

Market where your competition never goes

Did you know that 75 percent of real estate searches are in languages other than English? If you think this doesn’t apply to your market, think again. In Los Angeles, 72 percent of the population consumes TV and internet in languages other than English.

Immobel, the company that powers real estate search sites in 19 different languages for many of the Anywhere brands plus numerous MLSs, has launched a new service called XOMIO.

XOMIO provides you with 19 different websites in 19 different languages, plus 19 different pages on Googles foreign language search sites such as Google.fr (Google France), Google.jp (Japan), and Google.mx (Mexico.)

If your MLS already provides Immobel with an IDX listing feed, the base price is $159 per month. If your MLS does not provide them with IDX, then there’s an additional pass-through fee to add IDX listing feed to your sites.

Using XOMIO is a huge opportunity to tap into a market that the commission interlopers are missing entirely since they’re completely focused on marketing using “Google.com,” the U.S. English version of Google. Even more importantly, it’s a tremendous tool for converting your listing appointments into signed listings.

Agents still hold the upper hand

The bottom line is that agents still hold the upper hand. Mike DelPrete summed it up like this:

With all the billions of dollars in investment coming in and all these new models such as iBuying, Power Buying, and all the portals, but if you go another layer deep, you realize that agents are still central to the transactions with all of this. With all this change, all of the investment, and all of this capital, that’s still true.

Bernice Ross, president and CEO of BrokerageUP and RealEstateCoach.com, is a national speaker, author and trainer with more than 1,000 published articles. Learn about her broker/manager training programs designed for women, by women, at BrokerageUp.com and her new agent sales training at RealEstateCoach.com/newagent.