Join the exceptional and become a Sotheby's International Realty agent.

Learn More

Luxury real estate has the potential to be a lucrative investment for those who acquire properties in the right locations at the right time. So where are savvy investors setting their sights — and how can agents leverage their industry knowledge to be true partners in this process?

Three experts convene here to discuss the trends they’ve witnessed among today’s luxury real estate investors.

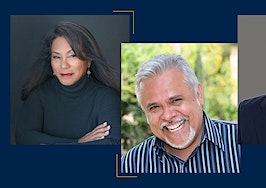

Brad Dahler, Real Estate Professional with Scenic Sotheby’s International Realty; Daniela Sassoun, Senior Global Advisor and Associate Broker with Sotheby’s International Realty – East Side Manhattan Brokerage; and Eric Iantorno, Global Real Estate Advisor at Pacific Sotheby’s International Realty

Brad Dahler, Real Estate Professional with Scenic Sotheby’s International Realty; Daniela Sassoun, Senior Global Advisor and Associate Broker with Sotheby’s International Realty – East Side Manhattan Brokerage; and Eric Iantorno, Global Real Estate Advisor at Pacific Sotheby’s International Realty

To start off, can you provide a broad overview of what the luxury real estate investment landscape looks like at the moment?

Eric Iantorno: I work with real estate investors looking to build spectacular, one-of-a-kind properties, so they look for locations that are unique. When my investors see opportunities that are hard to duplicate, they become buyers, and they will pay a little extra to get it. The luxury market also remains strong for new construction.

Daniela Sassoun: In particular, foreign investors are back in my New York markets, albeit in a more cautious capacity, and looking to park their cash. Often, they’re ready to move quickly if an opportunity arises, but they’re still finding a disconnect with sellers — and a strong dollar is a bit of a deterrent.

Daniela Sassoun and Mark Mistovich – Sotheby’s International Real Estate-East Side Manhattan Brokerage

How often do investment opportunities occur? Are they increasing in frequency or are they still fairly scarce?

Brad Dahler: Here on Florida’s Emerald Coast, the current market has been a lot more fair for both buyers and sellers compared to six months ago. Having more available inventory has helped alleviate investors’ “fear of missing out” and enabled easier negotiations. As a result, my investors are willing and able to pull the trigger on a sale.

EI: It’s true that in the luxury segment, investors are still looking, and they continue to buy when opportunities present themselves. But in a lot of markets — including my region of coastal San Diego — inventory remains very low, the demand for luxury homes is strong, and buyers continue to outnumber sellers. This can be a challenge for investors, but it also means there’s potential for strong returns on the properties they do acquire.

DS: A similar dynamic is at play in my market. I think investors are still bullish in viewing New York real estate as a conservative investment since vacancies are still so low, even if the cost of entry with mansion tax is higher. I expect to see more investors looking for deals if we experience an economic recession or correction in the near future.

What are luxury investors thinking right now as they strive to purchase properties?

EI: Let’s start by asking what buyers are thinking about. Typically, they want a turnkey solution. They want to move in with all the furniture and start living. That means real estate investors are looking for buying opportunities that allow them to create that finished product.

BD: On a similar note, more inventory and an increase in days on the market has definitely changed a few things for investors. A lot of them are looking for better deals on C+ properties and below, which allow them to invest a little bit of capital and see a really good return. They’re also looking for a good capitalization (CAP) rate with an opportunity for appreciation — the main focus is to get the highest gross rental income compared to the purchase price.

DS: This is another example of how much variation there is between specific regions and markets. In New York, a C+ property won’t cut it — investors care deeply about building support and maintenance, as well as the developer track record and building history over time in order to realize a strong rate of return. Conversely, they don’t generally care only about CAP rates. So investors’ priorities often depend on where they’re investing.

Once investors have acquired real estate, how do their priorities shift as they sell or rent these properties out to buyers?

EI: Investors want to make sure their product is unlike the rest in terms of design and technology, as modern, turnkey smart homes are in demand. An ordinary seller may not have such a product to showcase, or they may lack the funds necessary to transform their home, so they focus on minimal changes such as carpet, paint, and furniture staging.

DS: Other considerations include any long-term financial impacts — mortgage rates, changes in tax law, and future changes in neighborhood status — along with practical factors such as building age and assessments.

BD: At this moment, time is also of the essence. In my Emerald Coast market, the priority is to get properties on the market sooner rather than later. As interest rates rise, the buyer pool shrinks for certain price points.

EI: But when all is said and done, the luxury investor remains confident in the market. They feel the market changing, so many formulate backup plans such as renting the homes out for big money should they not sell. I encourage investors to continue looking and buying at every opportunity they can — there’s never a bad time to pursue a property because there will always be demand.

Experience the latest from Sotheby’s International Realty on Instagram, Facebook, Twitter, Linkedin, YouTube, and now on TikTok.