In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Despite surprising strength in employment and housing demand, the U.S. economy continues to decelerate and Federal Reserve tightening is likely to lead to a “modest recession” in the final three months of 2023, economists at Fannie Mae predict.

In a forecast released Monday, economists with Fannie Mae’s Economic and Strategic Research (ESR) Group said that it’s hard to say precisely when a recession will hit. But forecasters at the mortgage giant say by the time Fed policymakers see data showing inflation has cooled enough to bring rates back down, a recession will probably be unavoidable.

“Our baseline expectation is that the Fed will keep monetary policy tighter until core inflation is clearly subdued, which is not likely to occur until there is clear evidence of labor market softening,” Fannie Mae forecasters said. “By the time that happens a recession will have likely been set in motion. We therefore see the Fed’s decision regarding how high and long to keep rates as a major risk over the next year, with the question of a downturn more a matter of ‘when’ than ‘if.'”

Since March 2022, the Fed has approved 10 rate increases, bringing the short-term federal funds rate to a target of between 5 percent and 5.25 percent. At their June 14 meeting, Fed policymakers held off on another rate hike but left the door open to future tightening.

Fed policymakers projected that the benchmark federal funds rate will need to come up by another half a percentage point before inflation is vanquished, and futures markets currently put the odds of a 25-basis point increase in July at 77 percent.

But the question is not only how high the Fed will raise rates, but how long it will keep them elevated. Fannie Mae forecasters say they suspect the Fed’s guidance that more rate hikes could be in store was also intended as a warning that policymakers will be in no hurry to cut rates.

“One of the historical lessons of the 1970-80s inflationary era was that inflation can easily come roaring back if monetary policy easing begins prematurely,” Fannie Mae economists said, noting that a rebound in oil prices or home prices could reignite inflation. “Until there is strong evidence of core inflation being contained, the worry of reaccelerating inflation via too-early policy easing will remain present.”

But if the economy does continue to slow, the Fed is expected to reverse course on rates this year or next — particularly if the U.S. enters a recession. The so-called “dot plot” from the Fed’s June 14 meeting shows most Fed policymakers don’t expect to cut rates this year, but they do see the federal funds rate coming down next year.

The CME FedWatch Tool, which tracks bets placed on futures markets, predicts a 66 percent chance that the Fed will have lowered rates by at least half a percentage point by this time next year.

Mortgage rates expected to ease

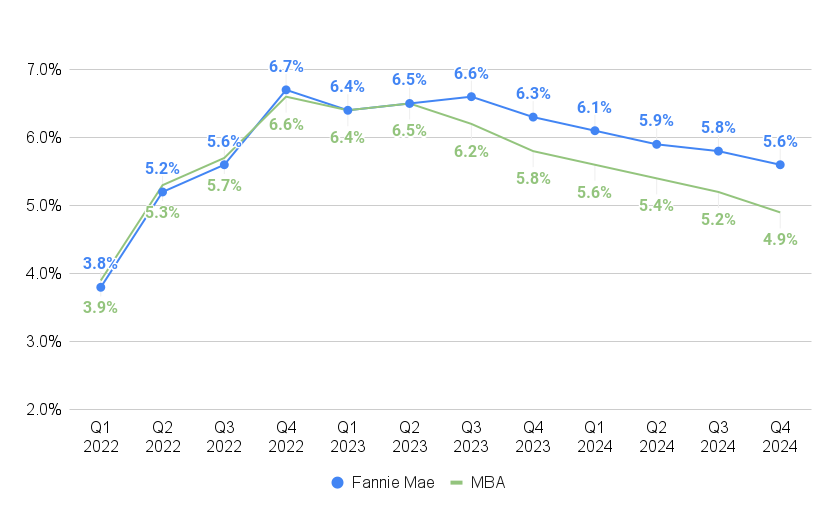

Source: Fannie Mae and the Mortgage Bankers Association forecasts

That explains why economists at Fannie Mae and the Mortgage Bankers Association (MBA) expect mortgage rates will ease this year and next. In a June 20 forecast, MBA economists predicted rates on 30-year fixed-rate mortgages will drop to an average of 5.8 percent during the final three months of this year. In their latest forecast, Fannie Mae economists don’t see that happening until the third quarter of 2024.

Doug Duncan

Core inflation remains sticky, “making it likely in our view that it maintains a restrictive posture for longer than most market participants initially anticipated,” said Fannie Mae Chief Economist Doug Duncan in a statement.

“Meanwhile, housing prices continue to show stronger growth than what was previously expected given the suddenness and significant magnitude of mortgage rate increases,” Duncan said. “Housing’s performance is a testimony to the strength of demographic-related demand in the face of Baby Boomers aging in place and Gen-Xers locking in historically low rates, both of which have helped keep housing supply at historically low levels.”

New-home sales showing strength

Source: Fannie Mae June 2023 housing forecast

While homebuilders continue to add to that supply, “years of meager homebuilding over the past business cycle means the imbalance will likely continue for some time,” Duncan said. “We do expect housing will be supportive of the overall economy as it exits the modest recession.”

The lack of inventory and last year’s surge in mortgage rates created affordability issues that are now predicted will drive a 14.3 percent drop in 2023 home sales to 4.86 million.

“The housing market continues to have an extremely limited supply of homes for sale, in part because of the ongoing lock-in effect, in which existing owners are disincentivized to list their homes due to not wanting to give up a mortgage rate much lower than current market rates,” Fannie Mae forecasters said. “Tight inventories are causing a slow pace of existing home sales, while also reanimating house price growth and demand for new homes.”

While Fannie Mae expects sales of existing homes will fall by 16.2 percent this year to 4.213 million, new-home sales are projected to grow by 1 percent, to 647,000.

New-home sales could finish the year even stronger, given what Fannie Mae economists characterized as a “blowout housing starts report” released after their forecast was completed. That report shows housing starts in May posted their biggest increase in seven years.

“We believe that some of this jump is likely statistical noise in a notoriously volatile series and will likely pull back or be revised going forward,” Fannie Mae economists said. “Single-family housing permits, which tend to be more indicative of the underlying trend, also rose, but by a smaller 4.8 percent.”

Nevertheless, “the permits data points to a clear upward trend in recent months, and this coincides with improvement in homebuilder sentiment,” and builders have the capacity to ramp up construction to an annual pace of 1 million homes in the months ahead.

Next year, Fannie Mae forecasters see sales of existing homes picking up by 3.2 percent to 4.348 million, as mortgage rates retreat.

Falling rates expected to revive mortgage refinancing

Fannie Mae’s latest forecast is for mortgage loan originations to grow by 19.7 percent next year to $1.901 trillion, driven by an 83 percent boost in refinancing volume to $493 billion as mortgage rates ease.

Purchase loan originations are also expected to grow by 7 percent in 2024 to $1.408 trillion. That’s $60 billion less than forecast in April, thanks largely to recent data that shows more homebuyers are paying cash instead of taking out mortgages.

“In a high-rate environment, it makes economic sense for some prospective homebuyers to avoid taking out a mortgage altogether,” Fannie Mae forecasters noted.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.