In these times, double down — on your skills, on your knowledge, on you. Join us August 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Add U.S. Bank and United Wholesale Mortgage (UWM) to the growing list of mortgage lenders offering special purpose credit programs designed to boost lending in minority communities and to other underserved borrowers.

Special purpose credit programs (SPCPs), which received a ringing endorsement from federal regulators last year, allow lenders to create programs that are designed to benefit economically disadvantaged groups without violating the Equal Credit Opportunity Act.

In other words, lenders can explicitly consider characteristics, such as race, national origin or sex if that benefits a class of people who would otherwise be denied credit or offered less favorable terms, the Consumer Financial Protection Bureau said in a 2021 advisory opinion.

Mortgage giants Fannie Mae and Freddie Mac have launched SPCPs in select U.S. cities that are aimed at boosting lending by expanding borrower eligibility criteria, reducing closing costs and providing flexibility in the form of down payment assistance. Lenders can participate in Fannie and Freddie SPCPs or develop their own programs.

This week U.S. Bank announced it will commit $100 million over the next five years to its own SPCP, Access Home Loan, which provides up to $12,500 in down payment assistance and up to $5,000 in additional lender credits.

The U.S. Bank Access Home Loan will initially be available in pilot markets where the minority population is more than 50 percent, including Las Vegas, Little Rock, Milwaukee, Minneapolis and St. Louis. The loans are also available in six California cities — Sacramento, Los Angeles, Oakland, Fresno, San Diego and Riverside-San Bernardino.

U.S. Bank says it hopes to address “some of the historical obstacles that communities of color face in the homeownership process” by providing improved access to credit, financial education and mortgage professionals that represent the communities they serve.

Lenny McNeill

“We know that homeownership is the No. 1 way to build long-term wealth, but far too many minority families and individuals simply can’t come up with the upfront costs to buy a home,” U.S. Bank executive Lenny McNeill said in a statement.

This week the nation’s biggest mortgage lender, Pontiac-Michigan-based wholesaler UWM, announced it’s offering an SPCP that utilizes Fannie Mae’s HomeReady loan in select markets. UWM also offers loans that meet the requirements of Freddie Mac’s BorrowSmart Geo-Targeted assistance program, which is not an SPCP. UWM does not participate in Freddie Mac’s SPCP, BorrowSmart Access.

UWM said borrowers can qualify for up to $10,000 toward their down payment and closing costs with the Freddie Mac BorrowSmart program or up to $6,000 with HomeReady.

Other lenders that offer mortgages through special purpose credit programs include:

- AnnieMac Home Mortgage

- Bank of America

- Chase

- CrossCountry Mortgage

- Guaranteed Rate

- Movement Mortgage

- Rocket Mortgage

- TD Bank

- U.S. Bank

- Wells Fargo

Fannie and Freddie lead the charge

In publishing annual updates to their equitable housing finance plans, Fannie Mae and Freddie Mac detailed their goals for promoting SPCPs in the years ahead.

Freddie Mac is “actively pursuing the purchase of loans originated through SPCPs, both lender SPCPs and Freddie Mac’s own designed SPCPs,” the mortgage giant said in its 2023 plan.

Having launched its first SPCP in 2022, BorrowSmart Access, Freddie Mac said this year it hopes to purchase up to 10,000 SPCP loans originated by at least 10 lenders.

BorrowSmart Access is available to first-time homebuyers in 10 cities: Atlanta, Chicago, Detroit, Memphis, Miami, Philadelphia, St. Louis, Houston, El Paso and McAllen, Texas.

Danny Gardner

“BorrowSmart Access is an important component of Freddie Mac’s mission-driven work to create a more affordable, sustainable, and equitable housing finance system,” Freddie Mac executive Danny Gardner said in a March perspective piece. “As our first SPCP, we intend to use this offering to serve traditionally underserved communities, while also learning valuable lessons that will inform potential future SPCP offerings.”

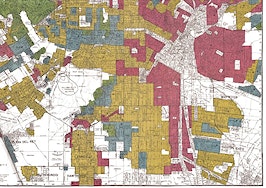

Fannie Mae’s latest Equitable Housing Finance Plan notes that last year the mortgage giant launched SPCPs in majority Black census tracts in Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia. Fannie Mae executives said they plan to expand their SPCP pilot markets to include specified majority Latino census tracts.

“Interest in SPCPs across the mortgage landscape has continued to grow, and several industry participants are actively developing their own programs that have similar goals and communities in mind,” Fannie Mae’s plan notes. “In addition to our SPCP program, Fannie Mae is engaged with lenders and other industry stakeholders to support their SPCP efforts focused on enabling underserved borrowers to overcome obstacles rooted in historical inequities that are highly specific to local markets or populations.”

Editor’s note: This story has been updated to correct that UWM’s special purpose credit program (SPCP) is offered through Fannie Mae’s HomeReady loan program. Although UWM also offers loans that meet the requirements of Freddie Mac’s BorrowSmart Geo-Targeted assistance program, that program is not an SPCP. UWM does not participate in Freddie Mac’s SPCP, BorrowSmart Access.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.