Weaker housing and economic news is offsetting the impacts of Fed tapering, keeping a lid on mortgage rates even as the government gradually scales back its massive purchases of Treasurys and mortgage-backed securities that helped keep borrowing affordable during the downturn.

A weekly survey by Freddie Mac shows rates on 30-year fixed-rate mortgages this week posted their first annual decline in more than a year, in the wake of Commerce Department estimates that the economy grew at the slowest pace in five years during the first quarter.

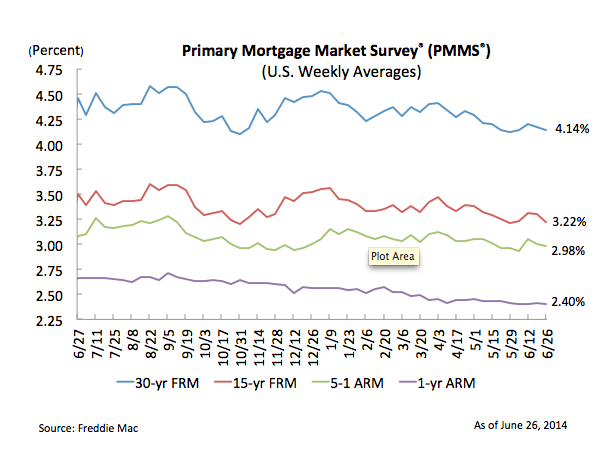

Rates on 30-year fixed-rate mortgages averaged 4.14 percent with an average point of 0.5 for the week ending June 26, down from 4.17 percent last week and 4.46 percent a year ago. Rates on 15-year fixed-rate mortgages, five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) loans and one-year Treasury-indexed ARMs also all fell.

The last time rates 30-year fixed-rate mortgages posted an annual decline was the week ending May 23, 2013, according to Chad Wandler, a spokesman for Freddie Mac. “You have to remember [mortgage rates] were falling consistently since the end of 2011,” he said.

Rates on 30-year fixed-rate mortgage hit an all-time low in Freddie Mac records dating to 1971 of 3.31 percent during the week ending Nov. 21, 2012. Mortgage rates have been well below historic norms during the downturn in part because investors have viewed mortgage-backed securities (MBS) issued by Fannie Mae and Freddie Mac as a safe place to park their money during times of uncertainty.

The Federal Reserve has also been buying long-term Treasurys and MBS to stimulate the economy by keeping borrowing costs low. Investor demand for Treasurys and mortgage-backed securities pushes their prices up and yields down.

With the exception of a few months in 2010, the Fed has been a major buyer of Fannie and Freddie-backed MBS since 2008.

Before it began “tapering” its purchases in January, the Fed was buying $40 billion in Fannie and Freddie-backed MBS a month. Next month, the Fed will continue dialing back its purchases of Fannie and Freddie-issued MBS to $15 billion per month, down from the current $20 billion per month.

The Fed had telegraphed its intention to begin tapering in 2013, but postponed the move on worries that the economic recovery was stalling. Bonds and MBS nevertheless fell out of favor with investors who feared the impacts of the Fed’s reduced role in bond markets, a “taper tantrum” that sent interest rates higher.

“I think the big point is mortgage rates have leveled off finally since the taper tantrum of a year ago on weaker housing and economic news despite the fact that the Fed is now actually tapering,” Wandler said.