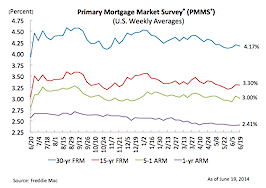

For the second straight week, homebuyers enjoyed rates on 30-year fixed-rate mortgages that were lower than they were at the same time last year, Freddie Mac reported.

Rates on 30-year fixed-rate mortgages averaged 4.12 percent with an average point of 0.5 for the week ending July 3, down from 4.14 percent last week and 4.29 percent a year ago, according to Freddie Mac’s latest Primary Mortgage Market Survey.

Frank Nothaft, vice president and chief economist at Freddie Mac, said the rock-bottom rates should help with home affordability in many markets.

“Housing data was better with pending home sales up 6.1 percent in May and overall construction spending showing a slight improvement with private residential spending now up 7.5 percent on a yearly basis,” Nothaft said in a statement.

Rates on 15-year fixed-rate mortgages and five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) loans were unchanged, while rates on one-year Treasury-indexed ARMs declined.