Most Realtor-affiliated real estate brokerages have a single office, are independent, and use fewer technology tools than their larger brethren, according to a report released today by the National Association of Realtors.

The report, NAR’s 2013 Profile of Real Estate Firms, includes the results of an online survey fielded in August with 6,671 responses from Realtor executives at real estate firms nationwide. Results were broken down by whether a firm specialized in residential or commercial brokerage and by the size of the firm: one, two, three, or four or more offices.

Eight out of 10 real estate brokerages surveyed operated out of just one office — employing a median of two full-time licensees. Only 8 percent of brokerages had four or more offices.

In terms of technology, the largest firms reported that 20 percent of their customer inquiries or business leads and an equivalent share of the firm’s sales volume were generated from the firm’s website, and that 5 percent of leads and sales volume came from social media.

By contrast, single-office firms reported 10 percent of their leads and sales volume came from the firm’s website and that less than 1 percent of both came from social media.

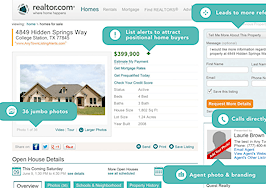

While more than 90 percent of all firms reported using a multiple listing service website to market their firm’s listings, single-office firms were less likely than the largest firms to use any other websites for marketing. This includes NAR’s official website, realtor.com, which is used by 90 percent of the largest firms but only 78 percent of the smallest firms.

The largest firms are also more likely to use other websites to advertise, including:

- Third-party aggregators: 79 percent vs. 59 percent of the smallest firms.

- A real estate company website: 85 percent vs. 58 percent.

- Real estate agent websites: 74 percent vs. 50 percent.

- Social networking sites like Facebook and Twitter: 69 percent vs. 41 percent.

- Search engines: 56 percent vs. 30 percent.

- Video hosting websites like YouTube: 53 percent vs. 18 percent.

- Mobile or tablet applications: 37 percent vs. 11 percent.

Smaller firms were also somewhat less likely to provide or encourage agents and brokers to use specific software. For instance, 83 percent of single-office firms encouraged use of the MLS compared with 89 percent of the largest firms. While the MLS was the most highly encouraged software among the smallest firms, electronic contracts and forms software was the most highly encouraged software among the largest firms, at 91 percent.

The largest firms were also more likely to encourage comparative market analysis (89 percent vs. 78 percent at the smallest firms); contact management (80 percent vs. 53 percent); e-signature (74 percent vs. 54 percent); and document preparation and management (70 percent vs. 51 percent).

More than half of the largest firms also promoted use of graphics and presentations; transaction management; social media management tools; home visualization (such as virtual tours or staging); customer relationship management; and video, compared to a third or less of single-office firms. Agent ratings were the least popular among all firms, garnering support among 17 percent of the largest firms and 7 percent among the smallest.

The differences in tech use are correlated with a more than 800 percent difference in spend. The smallest firms typically spent a median $150 per month on technology (this is also the median for all firms overall given the dominance of single-office firms) while the largest firms spent a median $1,225 per month on tech.

The largest firms had a median 100 full-time licensees compared with two full-time licensees at the smallest firms. Single-office firms reported a median 15 transaction sides and $3.6 million in sales volume in 2012 compared with 750 transaction sides and $145.6 million in sales volume among the largest firms.

Nearly half, 45 percent, of real estate firms overall reported they were actively recruiting sales agents in 2013, though this also varied by firm size: 38 percent of the smallest firms said they were recruiting compared with 88 percent of the largest brokerages.

The vast majority of firms of all sizes reported their reason for recruiting was to grow their primary business, but the largest firms were also more likely to cite a desire for younger agents (60 percent vs. 29 percent) and to replace agents leaving the firm (62 percent vs. 25 percent).

The vast majority, 84 percent, of real estate firms were independent, nonfranchised companies, and 13 percent were independent, franchised companies. Single-office firms were most likely to be independent, nonfranchised companies: 89 percent vs. 46 percent for firms with four or more offices. Among the largest firms, 37 percent were independent, franchised companies, and 10 percent were franchise subsidiaries of a national or regional corporation.

Nearly 7 in 10 of the firms overall expect their profitability to increase in the next year with the largest firms expressing the most optimism: 85 percent expect a jump in net income compared with 67 percent among single-office firms.

Nonetheless, firms of all sizes expect profitability to be among the biggest challenges they will face in the next two years. Other worries include local or regional economic conditions, keeping up with technology and maintaining sufficient inventory. More than half of the largest firms also worried about recruiting younger agents and agent retention.

Survey respondents were least concerned about industry consolidation and data security issues such as scraping, protecting client data, and listing data security.

While two-thirds of all firms expect competition from both traditional and nontraditional entities in the marketplace to increase in the next two years, only about a quarter of firms cited competition as one of the biggest challenges they expect to face.

“Because real estate is an entrepreneurial field, some experimentation in business models is likely when the market is in a recovery phase,” said Paul Bishop, NAR vice president of research, in a statement.

Among franchise firms, the most commonly offered in-house ancillary service was business brokerage (the buying and selling of businesses such as retail stores), at 27 percent of firms. That’s followed by relocation services (15 percent) and mortgage lending (5 percent).

Franchise firms with four or more offices were considerably more likely to offer ancillary services: relocation services, 56 percent; business brokerage, 47 percent; mortgage lending, 27 percent; title or escrow services, 24 percent.

![How the customer relationship has changed in the social era [VIDEO]](https://inman-www.imgix.net/wp-content/uploads/2013/05/social_connections_shutterstock_111385067.jpg?fit=crop&crop=entropy&w=266&h=188&usm=20&usmrad=4&auto=format)

![How the customer relationship has changed in the social era [VIDEO]](https://inman-www.imgix.net/wp-content/uploads/2013/05/social_connections_shutterstock_111385067.jpg?fit=crop&crop=entropy&w=70&h=70&usm=20&usmrad=4&auto=format)