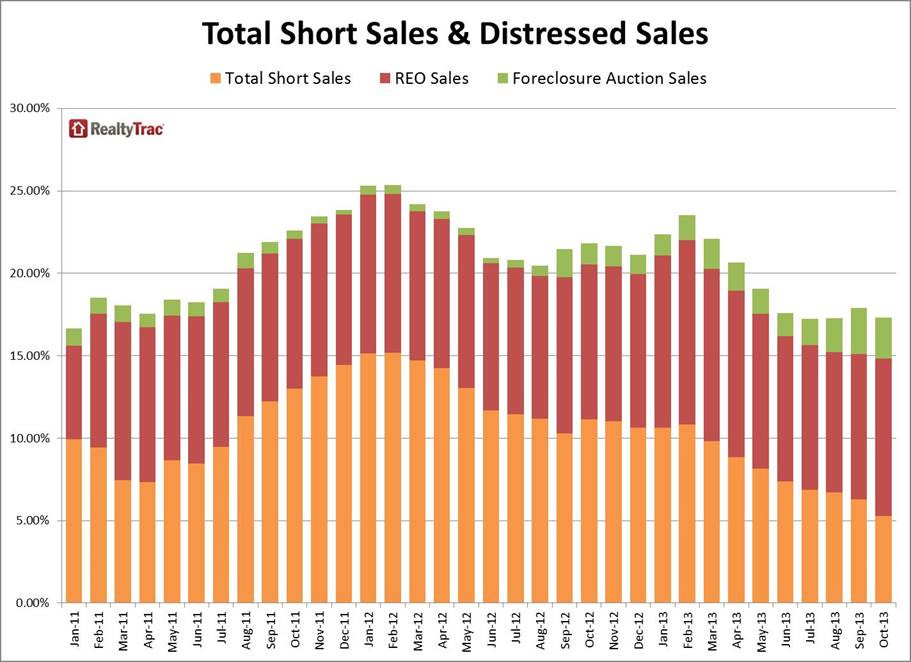

Short sales were all the rage in late 2011 and early 2012, but surging demand has loan servicers with distressed properties on their hands going back to traditional foreclosure auction sales and bank-owned sales, where cash is often king, according to the latest report from data aggregator RealtyTrac.

“The combination of rapidly rising home prices, along with strong demand from institutional investors and other cash buyers able to buy at the public foreclosure auction or an as-is REO home, means short sales are becoming less favorable for lenders,” said RealtyTrac Vice President Daren Blomquist in a statement.

Inventory shortages are part of the picture — last week Lender Processing Services reported that after 18 straight months of declines, U.S. foreclosure inventory is now at its lowest point since the end of 2008, falling nearly 30 percent from a year ago to 1.28 million in October.

RealtyTrac said short sales represented 5.3 percent of all sales in October, down from 6.3 percent in September and 11.2 percent at the same time a year ago.

Foreclosure auction sales to third parties (a new category, separated out in the report for the first time) represented 2.5 percent of all sales, down from 2.8 percent in September but nearly twice the 1.3 percent seen at the same time a year ago.

Sales of “real estate owned” (REO) homes repossessed by banks accounted for 9.6 percent of October sales, up from 8.9 percent in September and 9.4 percent a year ago.

With banks favoring cash buyers, it’s not surprising that cash sales represented 44.2 percent of all residential sales in October, up from 33.9 percent a year ago. States with percentage of cash sales above the national average included Florida (65.6 percent), Nevada (55.5 percent), Georgia (55.4 percent), South Carolina (53.9 percent), North Carolina (49.9 percent), Michigan (49.5 percent), and Ohio (49.2 percent).

Talk of institutional investors being scared away by rising prices appears to have been overstated, at least in some markets.

Markets with the highest percentage of institutional investor purchases included Memphis (25.4 percent), Atlanta (23 percent), Jacksonville, Fla., (22.2 percent), Charlotte (14.5 percent), and Milwaukee (12 percent).

Short sales haven’t gone away altogether — states with the highest proportion of short sales in October included Nevada (14.2 percent), Florida (13.6 percent), Maryland (8.2 percent), Michigan (6.7 percent), and Illinois (6.2 percent).

Tight inventories and rising home prices hampered home purchases in October,the National Association of Realtors reported last week.

Although the U.S. is still seeing “significant supply shortages,” inventories are “stabilizing” compared to the dramatic annual declines seen earlier this year, realtor.com said in releasing October data.

Source: RealtyTrac.com