Nothing is more disturbing in markets than a freeze while a lot is going in the real world. The implication: Tension is building for a substantial move, but in the absence of movement nobody can tell which way, which drives us all nuts.

The 10-year T-note has held within a short putt of 1.9 percent for a month, mortgages steady in the high threes. The dynamic tension holding the bond market in place has been the Fed in “hold-us-back” mode, meeting-to-meeting on hair-trigger to lift off from zero — but in conflict with distinctly weak economic data.

Today’s trading adds a delicate but excruciating element: Inflation may have turned upward. Consumer price index (CPI) in March rose 0.2 percent both overall and core, stripped of energy and food. The Fed has been insistent that inflation would do so, but no mainstream person in markets agreed: We had faith that falling energy prices would pull down the general price level, and even more confidence that the rocketing dollar would undercut also.

The two principal components of rising CPI seem impervious to either energy or dollar: The year-over-year cost of shelter (rent) is rising at a steady 3 percent clip, and services at 2.4 percent.

A modest rise in inflation to the 2 percent mark is gratifying to the Fed, removing risk of deflation. But because of lags in the effect of Fed rate hikes, even 2 percent makes the Fed fearful that it is falling behind the future curve, one or two years out. Count on this: If the Fed thinks inflation is jumping the box, it will tighten no matter how weak the economy may be.

The stock market is having a bad Friday, the Dow off 336 at this writing. U.S. stocks have tanked mostly because of CPI, but partly in sympathy with stocks overseas last night, down because of Greece (again, good grief), and way overbought. A stock panic normally drives down the 10-year T-note, money running to bonds for safety, but today only from 1.9 percent to 1.85 percent. Pfft. European Central Bank qualitative easing (QE) and Greek fear overnight took the German 10-year to a new record low 0.06 percent, all shorter maturities below zero. A drop like that usually pulls down the U.S. 10-year. Not today. Piffle pfennig.

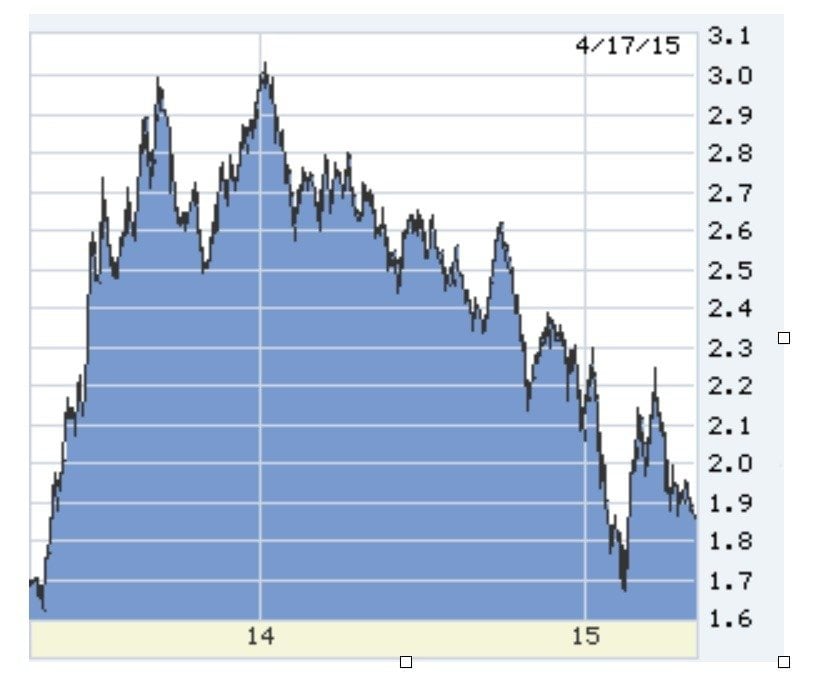

The propeller-heads of markets watch nothing but charts of markets. Don’t bother us with the economy, or Fed this-and-that. The chart decline of the 10-year began 16 months ago at 3 percent and has followed a gorgeous glide path ever since. In chartism, for the glide path to continue it must continue. If it stops continuing, everyone will expect a violent countermove, which will happen because everyone expects it. Thus the extended flat spot near 1.9 percent is troublesome — we must break through 1.86 percent going down, or the downtrend will be broken.

And we are exactly at that threshold today.

Until this week, I thought the preponderance of data supported a gradually improving economy and Fed liftoff by late summer. Two weeks ago, we did get a lousy report on March jobs, but the economy has underperformed in several recent first calendar quarters and then rebounded strongly. However, this week’s data have been awful. Even the uptick in CPI is not necessarily good news — how are we helped by rising rents and prices if incomes are not rising enough to cover?

The other poor data: March retails sales 0.9 percent versus 1.1 percent forecast, and ex-autos (the overdone bright spot) only 0.4 percent versus 0.6 percent forecast. New purchase mortgage applications sank, reversing a hopeful rise. If mortgage rates in the threes won’t ignite housing, just how strong is this economy, really? March starts of new homes rose 2 percent, but pitiful considering the 15.3 percent crater in February. March new-home permits are up an anemic 2.9 percent year over year. New York and Philly Fed economic indices are barely on positive ground. And the charts following are troublesome … confounding.

Stitch it together … no matter what imperative the Fed feels to lift off, encouraged by CPI, a June hike is off the table and everyone knows. “Data dependent” we and they are, but to lift off they’ll need a lot better data and for longer, now. And if the 10-year breaks 1.85 percent going down, it will be a vote of economic anti-confidence.

The 10-year T-note two years back. Add 1.8 percent to get typical no-point mortgage rate.

Ten-year T-note this week, late afternoon on Friday, ever so slightly through the magic 1.86 percent — but wait for confirmation on Monday.

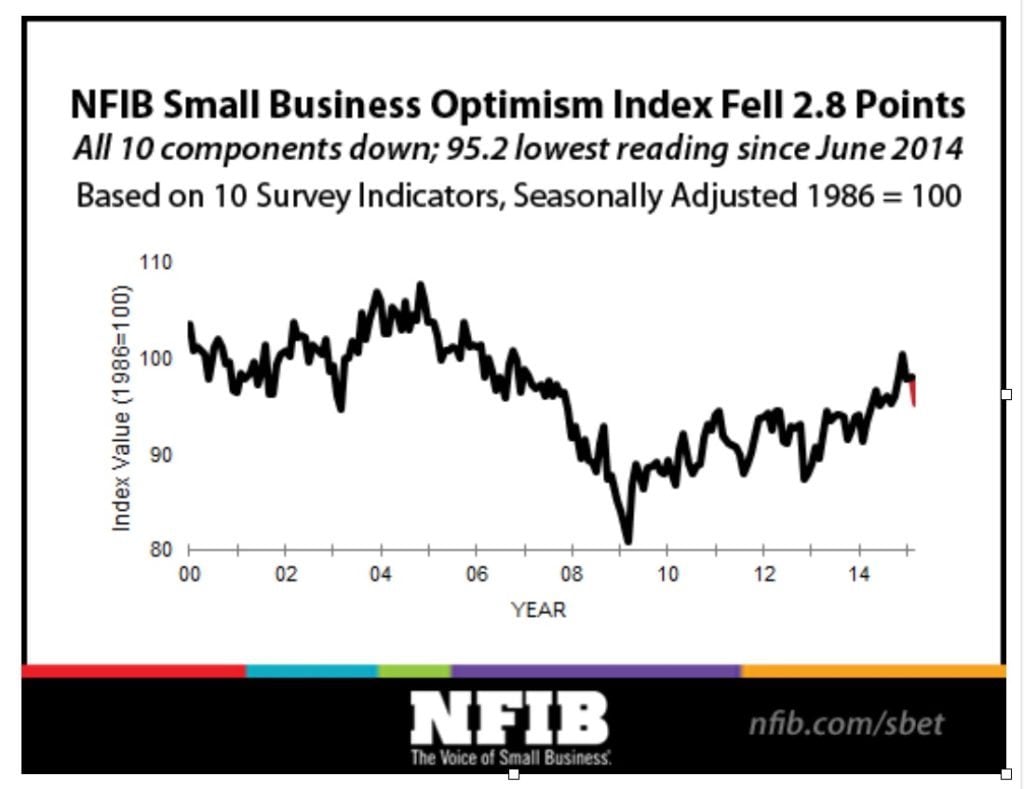

The NFIB has surveyed small business all the way back to the early ’70s. It’s index value from 2009 to mid-2014 had been roughly equal to the worst of the prior two recessions. Its upward breakout is now reversing and in unambiguous fashion: In a very rare event for the index, all 10 components fell in the early-April survey.

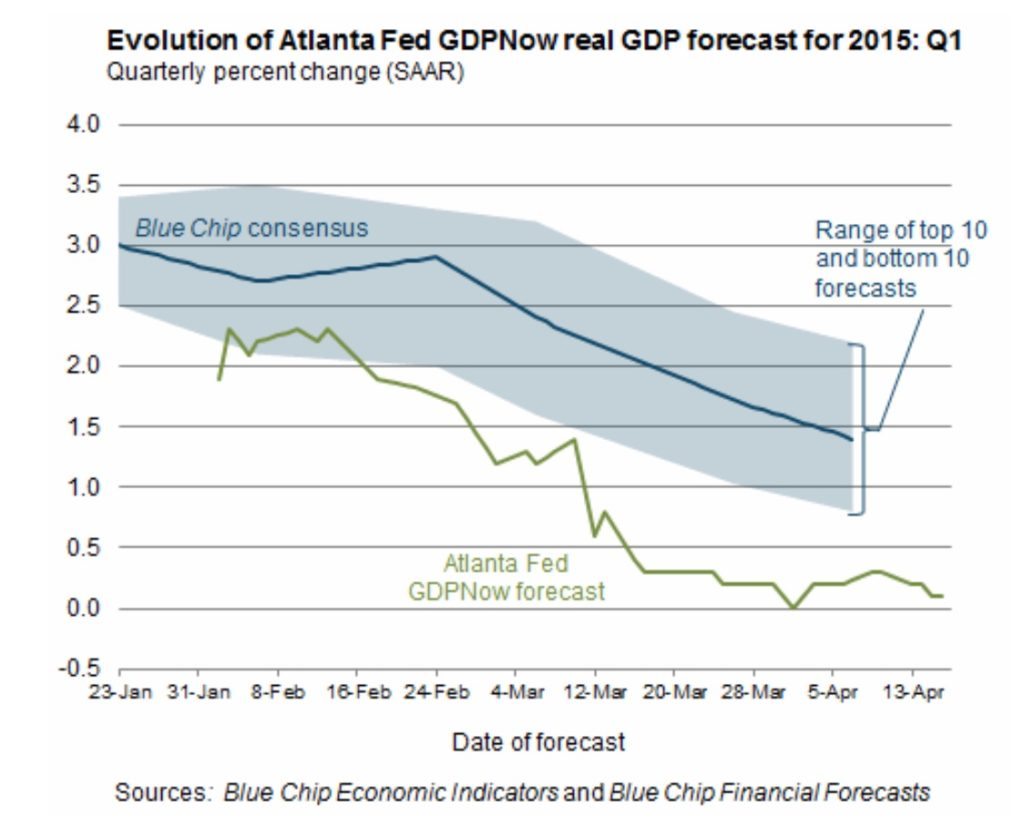

The Atlanta Fed publishes a real-time GDP estimator, and it is not happy at all.

Until this week I did not know there was a “National Association of Credit Management,” nacm.org, let alone a survey index with considerable predictive power. The association’s report is in plain sight, and its stunned concern that both manufacturing and services credit indicators have nose-dived. I have no idea if it is a false signal, and the association does not seem to know what to make of it, either — but believes in its data.

The NACM finding does not crossfoot with bank credit, which resumed near-10 percent growth in March and early April, nor M-3, which should be an indicator of credit growth.

However, the road to hell is paved with “should be” — and there is so much cash flashing around the planet that it’s hard to tell what the monetary aggregates mean.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.