Check Inman every day for the daily version of this market roundup.

Weekly mortgage rates:

Powered by MortgageCalculator.org

Powered by MortgageCalculator.org

Thursday, Sept. 17:

First American Financial Corp.’s Existing Home Sales Capacity (EHS-C) model:

- The EHS-C rate increased by 0.4 percent in August 2015 compared with July and decreased by 1.1 percent year over year.

- The EHS-C increased by 26,000 (seasonally adjusted, annualized rate) in August.

- In 2015 (through July), existing-home sales have increased by almost 800,000 sales.

U.S. Census Bureau new residential construction starts for August 2015:

- Building permits for privately owned housing units in August were at a seasonally adjusted annual rate of 1.17 million, 3.5 percent higher than the revised July 2015 rate and 12.5 percent above the August 2014 estimate.

- Single-family authorizations were at a rate of 699,000 in August, 2.8 percent above the revised July figure of 680,000.

- Single-family housing starts in August were at a rate of 739,000, 3 percent below the revised July figure of 762,000.

Zillow’s student debt and housing analysis:

- Student debt does not significantly reduce the chance of owning a house — as long as the student graduates.

- The chances of a married couple with no student debt owning a home are about 69.8 percent if at least one of them has a bachelor’s degree. If the same couple has $30,000 in student debt, their homeownership chances drop 2.1 percent to 67.7 percent.

- The people least likely to own homes are those with student debt and no degree.

Student Loans and Homeownership (PRNewsFoto/Zillow)

Fannie Mae’s Mortgage Sentiment Survey for 3Q 2015:

- Lenders report easing credit standards during 3Q across all loan types.

- Lenders who reported increased purchase demand fell slightly in 3Q 2015 from 2Q 2015 but remains high compared with 2014.

- Lenders reporting an increased profit margin outlook over the next quarter fell quarter over quarter but was similar to 2015 levels.

Freddie Mac’s Primary Mortgage Market Survey:

- For the week ending Sept. 17, 2015, 30-year fixed-rate mortgages averaged 3.91 percent with an average 0.6 point, up from 3.9 percent last week.

- 15-year fixed-rate mortgages averaged 3.11 percent with an average 0.6 point, up from 3.1 percent last week.

- 5-year Treasury-indexed hybrid adjustable-rate mortgages averaged 2.92 percent with an average 0.5 point, up from 2.91 percent last week.

Re/Max’s September 2015 National Housing Report:

- August 2015 home sales were 5 percent higher than sales in August 2014.

- August sales were also 27.6 percent greater than sales in August 2008.

- Completed transaction in August were lower than July 2015 by 11.4 percent.

Wednesday, Sept. 16:

FNC’s July 2015 residential price index:

- Home prices rose at 0.2 percent month over month, a much slower pace than the January through May price increases.

- This is the weakest June-to-July seasonal growth in the past 3 1/2 years.

- Final sales for foreclosed and REO properties comprised 9 percent of all total existing-homes sales, down from 9.7 percent in June 2015 and 10.4 percent in July 2014.

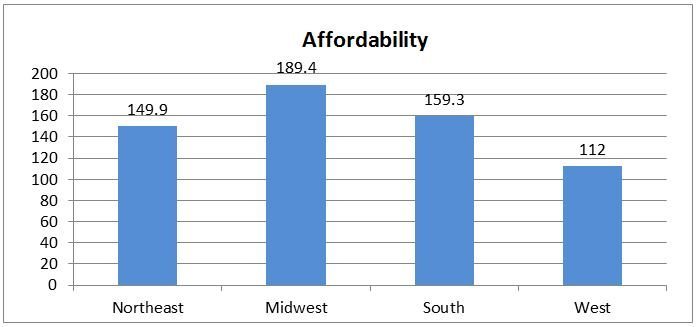

Trulia’s housing affordability research:

- Affordability has fallen in 89 of the 100 largest housing markets.

- Ohio is the most affordable state; California is the least affordable.

- Some affordable metros become less affordable when transportation and utility costs are factored in.

Tuesday, Sept. 15:

NAR’s housing affordability numbers for July:

- The median single-family home price is $235,500, up 5.8 percent from July 2014.

- The West had the biggest increase in price at 8.4 percent; the Northeast saw price increases of 1.8 percent, making this region the slowest-growing in the U.S.

- Nationally, affordability indices are down from 155.4 in July 2014 to 151.2 in July 2015.

Monday, Sept. 14:

CoreLogic’s second quarter Market Condition Indicators report:

- With home prices rising steadily since 2013, homes have become less affordable for some buyers — and, therefore, less sustainable, says CoreLogic in its Market Condition Indicators report for the second quarter.

- As home prices have continued to rise, the gap between home prices and sustainable values has narrowed to 3.6 percent below the long-run sustainable level — and could shrink even further to 1.5 percent by 2017, according to CoreLogic’s forecast.

- The trend is especially prevalent in Texas, where home prices in five local markets are well above their historical peak levels.

Email market updates to press@inman.com.