We’ll add more market news briefs throughout the day. Check back to read the latest.

The Federal Housing Finance Agency’s second-quarter Foreclosure Prevention Report:

- Fannie Mae and Freddie Mac completed 63,593 foreclosure prevention actions in the second quarter (Q2) of 2015.

- The real estate-owned inventory for both government-sponsored enterprises declined 14 percent during Q2.

- The number of 60-plus-day delinquent loans declined 6 percent during Q2.

NAR’s August Pending Home Sales:

- Pending home sales decreased 1.4 percent to 109.4 in August 2015 from July 2015.

- Pending home sales are still up 6.1 percent year-over-year.

- The national median existing-home price is expected to increase 5.8 percent in 2015 to $220,300.

Black Knight July 2015 Home Price Index Report:

- U.S. home prices were up 0.4 percent month-over-month in July 2015.

- They were up 5.3 percent year-over year.

- This is 5.5 percent below the June 2006 market peak.

Weekly mortgage rates:

Powered by MortgageCalculator.org

Powered by MortgageCalculator.org

Last week’s most recent market news:

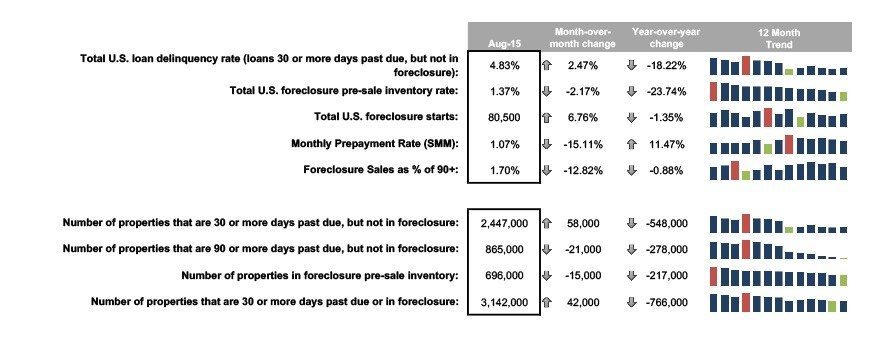

Black Knight Financial’s “First Look” at August 2015 mortgage data:

- The total loan delinquency rate in the U.S. was 4.85 percent, up 2.47 percent month-over-month but down 18.22 percent year-over-year.

- The total foreclosure pre-sale inventory rate was 1.37 percent, down 2.17 percent month-over-month and 23.74 percent year-over-year.

- The total foreclosure starts numbered 80,500, up 6.76 percent month-over-month but down 1.35 percent year-over-year.

Inside Mortgage Finance’s Housing Pulse survey:

- In August 2015, current homeowners accounted for 49.3 percent of purchases.

- The first-time homebuyer share in August was 36.4 percent of purchases. The investor share was 14.4 percent.

- The sales-to-list price ratio for non-distressed properties was 98.3 percent in August, a slight 0.2 percent decline from July.

Send market reports to press@inman.com.