Millennials aren’t just a trendy group to rant about as you see some young people immersed in their phones during a speechless dinner. They’re also one of the largest demographics of homebuyers and borrowers in the nation.

With the new Ellie Mae Millennial Tracker, real estate professionals can track closed loan application trends among millennials (homebuyers born between 1980 and 1999) throughout markets across the country. Here are some takeaways from the latest report:

- The average closed loan amount among millennials in the U.S. is $179,618.

- Purchase accounted for 83 percent of those loans. Refinance accounted for 16 percent.

- 66 percent of millennial loan applicants are male and 32 percent are female, with 52 percent being married.

- The average days it took for a loan to close was 44.

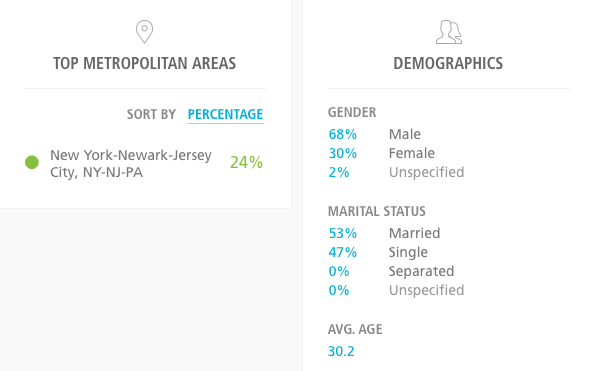

New York City’s average closed loan rate came in slightly under then national average at 24 percent. Like other major metros, males make up a majority of borrowers, but the average age for a millennial borrower in NYC is more than a full year older than the rest of the country.

As one might expect, the average loan amount in NYC is considerably higher than the rest of the country (but still more than $150,000 lower than San Francisco), at $312,843. Unlike the Bay Area, a majority of borrowers in NYC took out a loan for purchasing, not to refinance.

At 64 days to close, the average days to close on a loan for millennials in NYC is 20 days more than the national average.