Check Inman every day for the daily version of this market roundup.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

[graphiq id=”kPkTJrAnX5r” title=”Average Home Equity Loan Bank Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/kPkTJrAnX5r” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Bank Rates by State | Credio”]

Friday, October 7:

Bureau of Labor Statistics Employment Report for September 2016:

- Nonfarm payroll employment increased by 156,000 jobs in September 2016.

- The unemployment rate was 5.0 percent in September 2016, up slightly from 4.9 percent in August.

- The professional and business services sector and health care sector saw employment gains in September.

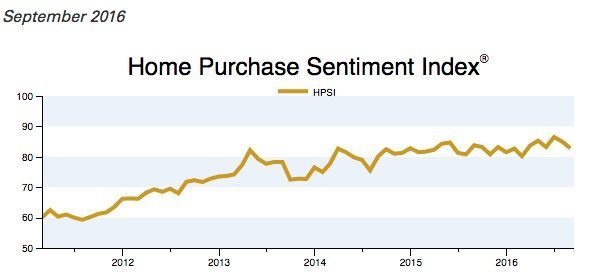

Fannie Mae’s Home Purchase Sentiment Index (HPSI) for September 2016:

- The HPSI fell to 82.8 in September 2016.

- This is a 2.2 percentage point decrease from August 2016.

- In September 2015, the HPSI was 83.8.

Thursday, October 6:

Freddie Mac’s Primary Mortgage Market Survey:

- The 3o-year fixed-rate mortgage (FRM) averaged 3.42 percent with an average 0.5 point for the week ending October 6, 2016.

- This rate is unchanged from last week’s.

- A year ago at this time, the 30-year FRM averaged 3.76 percent.

Wednesday, October 5:

CoreLogic Home Price Insights (HPI) Report for August 2016:

- The CoreLogic HPI is up 1.1 percent.

- Year-over-year, the HPI is up 6.2 percent.

- CoreLogic forecasts that the HPI will be up 0.4 percent month-over-month in September 2016 and 5.3 percent year-over-year in August 2017.

Tuesday, October 4:

ProTeck’s Home Value Forecast for August 2016:

- In July, nearly 70 percent of the core-based statistical areas (CSBAs) tracked were listed as “normal” or above.

- In August, that number rose to more than 76 percent.

- Only 1.4 percent of CBSAs tracked came in at “weak” or “distressed” in August.

S&P/CoreLogic/Case-Shiller Home Price Indices for July 2016:

- There was a 5.1 percent annual gain in July.

- This is higher than the June 2016 gain of 5.0 percent.

- The 20-City Composite reported year-over-year gains of 5.0 percent, down from June’s 5.1 percent.

Monday, October 3:

U.S. Census Bureau/U.S. Department of Commerce’s August 2016 construction data:

- Construction spending during August 2016 was estimated at a seasonally adjusted annual rate of $1,142.2 billion.

- This is 0.7 percent below the revised July estimate of $1,150.6 billion.

- This is also 0.3 percent below the August 2015 estimate of $1,145.2 billion.

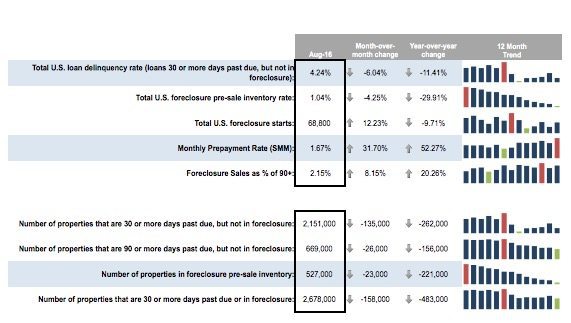

Black Knight Financial Services’ Mortgage Monitor for August 2016:

- The national delinquency rate fell by just over 6 percent month-over-month in August 2016.

- Delinquencies were at 4.24 percent in August 2016.

- The inventory of loans in active foreclosure continued its 19-month consecutive downward trend.

Black Knight Financial Services July 2016 Home Price Index:

- The HPI in July 2016 was $266,000.

- This represents a 0.4 percent increase from last month.

- One year ago, the HPI was 5.3 percent.

Email market news to press@inman.com.