We’ll add more market news briefs throughout the day. Check back to read the latest.

Mortgage Bankers Association’s weekly application rates:

- Mortgage applications decreased 6.0 percent from one week earlier for the week ending October 7, 2016.

- The refinance share of mortgage activity decreased to 62.4 percent of total applications from 63.8 percent the previous week.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 3.68 percent from 3.62 percent the previous week.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

[graphiq id=”kPkTJrAnX5r” title=”Average Home Equity Loan Bank Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/kPkTJrAnX5r” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Bank Rates by State | Credio”]

[graphiq id=”dP0v3iYOnH” title=”Average Home Equity Loan Credit Union Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/dP0v3iYOnH” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Credit Union Rates by State | Credio”]

Most recent market news:

Quicken Loans Home Price Perception Index (HPPI) for September 2016:

- Appraisals lagged behind homeowner estimates by 1.26 percent in September.

- This is a smaller gap than recorded in August 2016 — a 1.56 percent gap between perceptions.

- This is the third consecutive month wherein appraiser and homeowner estimates became more closely aligned.

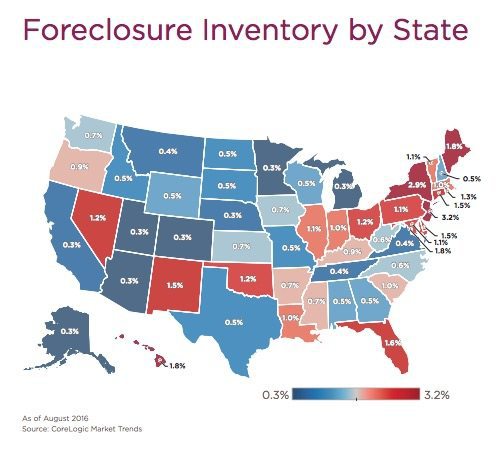

CoreLogic’s National Foreclosure Report for August 2016:

- Foreclosure inventory was down 3.2 percentage points in August 2016 from July 2016.

- Foreclosure inventory fell by 30 percentage points year-over-year.

- This was the 58th consecutive month of year-over-year foreclosure declines.

Email market reports to press@inman.com.