Check Inman every day for the daily version of this market roundup.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

Friday, October 21:

First American Financial Corporation Q3 2016 Real Estate Sentiment Index:

- Title agent market production increased 7.6 percent this past quarter as compared with a year ago.

- Title agents are forecasting residential price growth of 5 percent for the year ahead.

- Title agents surveyed remain optimistic about transaction volumes, with a 7.2 percent increase in optimism over a year ago.

Campbell/Inside Mortgage Finance HousingPulse Tracking Survey for September 2016:

- The three-month average for non-distressed properties dropped to $302,600 in September from $310,100 in August.

- The three-month moving average sales-to-list-price ratio was 98.0 percent in September, down from 98.6 percent in August.

- The first-time homebuyer share of purchases in September was 34.8 percent.

Thursday, October 20:

National Association of Realtors’ Existing-Home Sales Data for September 2016:

- Existing-home sales were up 3.2 percent in September month-over-month.

- This was propelled by a 34-percent share of first-time buyers.

- The median existing-home price for all housing types in September was $234,200.

Wednesday, October 19:

Mortgage Bankers Association’s Weekly Applications Survey:

- Mortgage applications increased 0.6 percent from one week earlier for the week ending Oct. 14, 2016.

- The refinance share of mortgage activity decreased to 61.5 percent of total applications from 62.4 percent the previous week.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.73 percent from 3.68 percent.

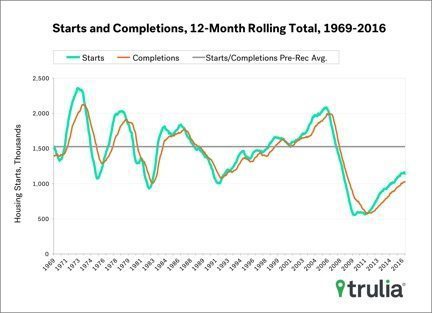

- Single-family authorizations in September were at a rate of 739,000, 0.4 percent above August 2016’s revised figures.

- Single-family housing starts in September were at a rate of 783,000, 8.1 percent above August 2016’s revised figures.

- Single-family housing completions in September were at a rate of 687,000, 8.8 percent below August 2016’s revised figures.

Ellie Mae’s Origination Insights Report for September 2016:

- The average time to close all loans increased to 48 days in September 2016 from 46 days in August 2016.

- The 30-year note rate declined to 3.750.

- Closing rates experienced a slight decrease to 71.8 percent.

Tuesday, October 18:

Houzz Renovation Barometer for Q3 2016:

- The barometer (which tracks industry optimism in market improvements) posted high readings for Q3 across all industry groups.

- Architects reported a five-quarter decline in confidence in market gains.

- Remodelers and design-build firms reported that labor shortages are driving cost increases.

First American Financial Corporation’s Potential Home Sales Model for September 2016:

- Potential existing-home sales increased to a 5.8 million seasonally adjusted, annualized rate (SAAR).

- In September, the market potential for existing-home sales grew by 6.5 percent compared with September 2015.

- The potential existing-home sales is 351,000 (SAAR) or 6.0 percent below the pre-recession peak of market potential, which occurred in July 2005.

Monday, October 17:

Re/Max’s October 2016 National Housing Report:

- Home sales fell 11.7 percentage points from August to September.

- However, home sales were up 2.0 percentage points form September 2015 to September 2016.

- The median sales price in September was $219,780, 5.1 percent above one year ago.

Email market news to press@inman.com.