We’ll add more market news briefs throughout the day. Check back to read the latest.

Most recent market news

Thursday, October 19

HouseCanary’s Third Quarter Rental Investment Index

- The nationwide Effective Gross Yield (EGY) for U.S. single-family rentals held steady at 8.0 percent, sustaining a strong yield in spite of the continued rise in housing prices.

- Statewide average yields in the Midwest and South continue to show stark differences, where EGY ranges

from 8.3 percent to as high as 12.7 percent. - In the West and New England, no state surpasses 7.0 percent. California, which has the lowest statewide EGY in the country at 5.1 percent, also contains the four lowest yielding MSAs, each with EGYs between 3.5 percent and 4.8 percent.

- While no state reached Mississippi’s nation-leading 12.9-percent EGY from last quarter, two new states eclipsed the 12.0-percent mark: Alabama and West Virginia joined Indiana, Mississippi, and Ohio, each of which held steady above 12.0 percent from last quarter.

Median Effective Gross Yield (EGY) for rentals by state. (PRNewsfoto/HouseCanary)

“HouseCanary’s latest HCRI Index results show that the recalibration of home prices to historic norms is continuing to put overall downward pressure on effective gross yields for the single family rental sector,” noted Alex Villacorta, PhD., HouseCanary’s Executive Vice President of Analytics. “In particular, the accelerated growth in the Western and Northeast regions over the past few years has seen the strongest effect of compressing yields as the cost to acquire continues to increase.

“Of the top 50 metros, only 3 metros have shown positive growth in yields over the last quarter, suggesting that nationwide, the growth of rents is slowing relative to that of home prices,” Villacorta added. “Though the most abundant double-digit opportunities reside in the Southern region of the country, there are still several localized pockets of high-yield opportunities in most markets throughout the country.”

CoreLogic HPI Forecast Validation Report: October 2017

- 12-Month National Index Forecast was within 0.7 percent of the Actual HPI for June 2017

- Of the 50 largest CBSAs, Phoenix, AZ was the most accurately estimated area at 0.4 percent of June’s HPI

- Amongst the 10 most closely watched CBSAs, Washington, D.C. was at the top of the list at 0.5 percent of June’s HPI

Each month, CoreLogic publishes the CoreLogic HPI Price Forecasts (HPIF). The HPIF contains the predicted monthly HPI values for the ensuing 30 years. For example, the June 2016 HPIF contains a predicted HPI value for June 2016, July 2016 to April 2046. HPIF Version 4.4 was first calculated in April 2016 and first published in June 2016. Each month, CoreLogic stores the HPIF for future back testing purposes.

Wednesday, October 18

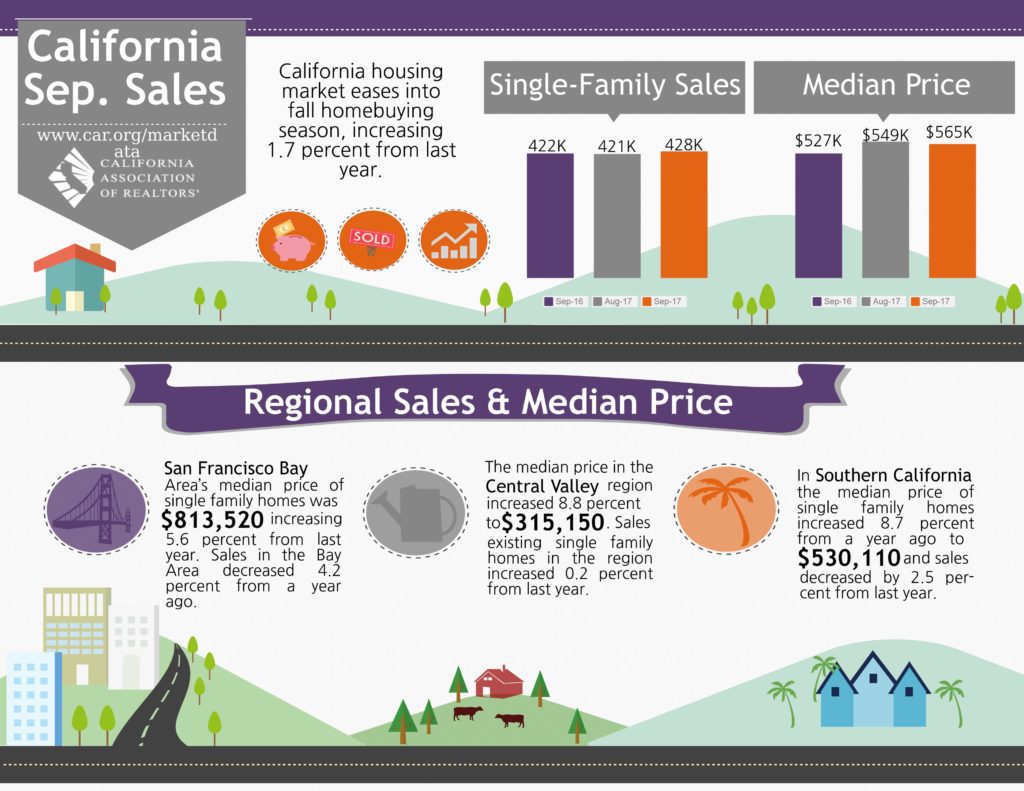

C.A.R. September home sales and price report

- Existing, single-family home sales totaled 436,920 in September on a seasonally adjusted annualized rate, up 2.2 percent from August and 1.7 percent from September 2016.

- September’s statewide median home price was $555,410, down 1.8 percent from August and up 7.5 percent from September 2016.

- Statewide active listings continued to decline in September, dropping 11.2 percent from a year ago.

“While it’s encouraging that statewide home sales improved both monthly and annually, the year-over-year sales rate is losing steam, reflecting the persistent shortage of homes for sale and an easing of concern over a surge in mortgage rates,” said C.A.R. President Geoff McIntosh. “Additionally, for the areas that have been affected by the recent wildfires, we anticipate sales will pull back in those regions as damages are assessed and replacement efforts are coordinated.”

- The 30-year fixed mortgage rate on Zillow Mortgages is currently 3.72 percent, unchanged from this time last week.

- The 30-year fixed mortgage rate fell late last week to about 3.66 percent, then hovered around 3.69 percent before returning to the current rate on Wednesday.

- The rate for a 15-year fixed home loan is currently 3.03 percent, and the rate for a 5-1 adjustable-rate mortgage (ARM) is 3.11 percent. The rate for a jumbo 30-year fixed loan is 3.90 percent.

“Mortgage rates fell late last week on disappointing inflation data and growing uncertainty about who will be appointed as the next chair of the Federal Reserve,” said Zillow senior economist Aaron Terrazas. “But rates recovered early this week and are now almost back were they stood a week ago. This week speculation over the future of the Fed, as well as expected policy news from the European Central Bank, are likely to dominate headlines as there are no major data releases on the calendar.”

News from earlier this week

Monday, October 16

October 2017 Re/Max National Housing Report

September became the fifth month this year to post a decline in home sales compared to a record-setting 2016, while marking the 71st consecutive month of rising sale prices year-over-year, according to the October Re/Max National Housing Report.

- September home sales dropped 4.2 percent year-over-year in the report’s monthly analysis of housing data in 54 metro areas.

- Median sales price increased to $225,000, the lowest since March but 2.3 percent higher than September 2016.

- In the wake of Hurricane Irma in early September, Miami saw home sales drop 35.2 percent year-over-year. Houston, meanwhile, posted a 3.2 percent gain despite the impact of Hurricane Harvey in late August.

- Of the 54 metro areas surveyed in September 2017, the overall average number of home sales decreased 14.9 percent compared to August 2017 and decreased 4.2 percent compared to September 2016.

- In September 2017, the median of all 54 metro median sales prices was $225,000, down 5 percent from August 2017 but up 2.3 percent from September 2016.

- Average Days on Market for homes sold in September 2017 was 49, up two days from the average in August 2017, and down seven days from the September 2016 average.

- Number of homes for sale in September 2017 was down 3.6 percent from August 2017, and down 14.1 percent from September 2016.

- Inventory dropped 14.1 percent year-over-year, with 46 metro areas seeing fewer homes for sale. Year-over-year, inventory has declined every month since November 2008.

“We’re not seeing any relief from the nationwide housing shortage as we enter the typically slower fall and winter selling seasons,” said Re/Max Co-CEO Adam Contos. “Plain and simple, we need more homes, particularly at the entry-level price point. Until then, it will most likely continue to be a seller’s market with homes going from listed to sold quickly.”

Email market reports to press@inman.com.