After a strong February, this month’s U.S. Bureau of Labor Statistics employment situation report fell a bit short– an unwelcome piece of news for the housing industry, which was hoping last month’s construction jobs boom would be the key to solving the inventory shortage.

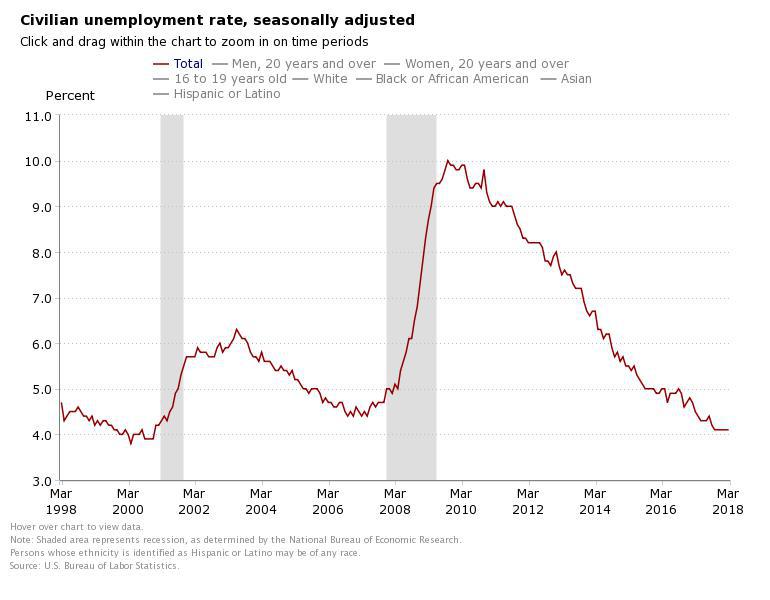

The report shows that total non-farm payroll employment rose by 103,000 jobs last month, and the unemployment rate remained unchanged at 4.1 percent. The number of unemployed persons also remained flat at 6.6 million.

Fannie Mae Chief Economist Doug Duncan said March’s report was a “step back” from the previous month, which showed significant growth in the construction, retail, manufacturing, mining and business services sectors.

“The headline payroll increase weakened to the poorest showing since September, job gains in the prior two months were revised lower on net, and the labor force participation rate ticked down for the first time since October,” said Duncan in an emailed statement. “Some aspects of the labor market haven’t changed, however. The unemployment rate has remained flat for six straight months, and the average workweek held on to the increase in the prior month.”

Duncan also noted that wage growth (+2.7 percent year-over-year) has remained within a tight margin since late 2017, and the 15,000 drop in construction employment shows the previous month’s exceptional growth was simply “weather-induced noise.”

Despite those factors, Duncan says the mortgage rate hikes are expected to continue as predicted.

“Despite hiccups in some economic activity amid increasingly heated rhetoric on trade, our growth outlook and our call of three Fed hikes this year have not changed, though downside risks appear to be intensifying.”

On the other hand, First American Chief Economist Mark Fleming wasn’t too concerned about the drop in job creation — he says the prime-age labor force participation rate (the total number of employed and unemployed 25- to 54-year-olds as a share of the total number of 25- to 54-year-olds) is a better indicator of where wage growth and the economy as a whole will go next.

“As this participation rate rises, competition for workers increases and leads to higher wages,” Fleming said in an emailed statement.

“The prime-age labor force participation rate hit a post-recession low in September 2015. Since then, it has been rising steadily to its current level of 82.1 percent and is much closer to its pre-recession level,” he added.

“As more prime-age workers choose to enter the labor force, competition among firms increases, and wages will rise faster. 82.1 — the prime-age labor force participation rate. That’s the most important number to know this month.”

Digging into the details

In March, the pool of unemployed individuals was unchanged at 6.6 million.

- The unemployment rates for adult men and women were at 3.7 percent.

- Teenager unemployment was at 13.5 percent.

- Black (6.9 percent), Asian (3.1 percent), Hispanic (5.1 percent) and White (3.6 percent) unemployment rates were essentially unchanged from February.

The number of long-term unemployed individuals (1.3 million), the labor force participation rate (62.9 percent) and the employment population ratio (60.1 percent) all remained flat.

Workers employed part-time for economic reasons — in other words, individuals who would prefer to find full-time employment — remained at 5.0 million.

Last month, there were 1.5 million people considered marginally attached to the labor force, meaning they are available for work and want a job, but are not currently in the labor force.

The number of discouraged workers, who have indicated that they are not looking for work because they do not believe jobs are available for them, is also unchanged from the previous year at 450,000.

The BLS surveys approximately 146,000 businesses and government agencies each month as part of its Current Employment Statistics (CES) program. These businesses and agencies represent approximately 623,000 individual worksites, and the CES collects data on employment, hours and earnings of workers on nonfarm payrolls.