Jeepers. What a week, and where to begin?

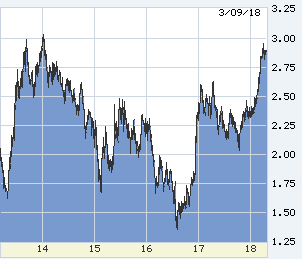

At the end, is where. Long-term rates have ended this week poised for the next step up, markets and Fed-speakers whistling past the graveyard.

Between beginning and end… since the 2016 election, markets have mostly ignored goings-on at the White House. Yes, the stock market tended to general exuberance with a business-friendly administration, but the bond market has behaved like your mother trying not to notice what your brother is up to. You figure his spanking is coming any minute, but your brother escapes again and again.

Until now. The tariffs clobbered stocks and put a lid on rates. Gary Cohn’s resignation did the same. Today stocks have returned to exuberance on the prospect of peaceful resolution with North Korea, and the report of a wild surge in jobs. If the president de-nuclearizes Chubby, all of the president’s sins are forgiven, even if it’s Emperor Xi’s work. Fingers crossed for a genuine stress-reliever.

Employment, unemployment, inflation, wages, Fed — that whole furball is beginning to look like the last time the Fed and federal deficit spending were crosswise. That time: early Reagan, immense deficits and an ultra-tight Fed. The Fed won.

Today’s news, 313,000 new jobs created in short February, half-again the forecast. Do we believe that? The road to bond hell is paved with those who quibble with reports, and the 10-year Treasury yield has touched 2.90 percent, the highest since February 21 but way short of the run through 3.0 percent, which everyone anticipates. These reports are prone to revision, sometimes heavily so. To create that many jobs and leave unemployment unchanged required the entry to the workforce of 800,000 people previously not looking for work and hence not unemployed — the largest number since 1983, oddly concurrent with the last Fed-fiscal collision.

Other aspects of today’s employment report are just as confounding. Despite the jump in the workforce, long-term unemployment remained unchanged, as did “involuntary part-time” workers (looking for full-time but can’t find it). The average workweek nibbled an increase, but nothing fancy.

The clincher holding bond yields down: in February average hourly wages rose four whole cents, an annualized increase of 1.5 percent. If anything, slowing. No wage growth, no inflation. So long as no inflation, unemployment can go to zero for all the Fed should care.

Unless of course momentum is building in the economy, which in some month ahead will overwhelm the Fed’s current “normalization.” That’s what happened before every recession from 1945 to 2001. To lesser degrees in 1992 and 2001, but wages and inflation still rising.

How can wages not grow faster in an economy as hot as this? The Fed has been insistent that the GDP “speed limit” is about 1.8 percent annually — below 2 percent for sure. The twin ISM surveys of purchasing managers are in the strongest sustained pattern in 40 years, the economy is certainly accelerating, somewhere in the 3 percent range for GDP.

On March 7, John Mauldin distributed “An Economic Detective Story” by Jonathan Tepper, trying to solve the no-raise question — i.e., “why American workers aren’t getting a raise.” The article is a comprehensive list of prevailing theories. One at a time here, with my own alternate views.

The article begins with leading indicators for wage growth, but understates the failure of all indicators. The Fed’s inflation forecasts (implicitly wages also) have failed ever since the recovery began in 2010. Unemployment at 6.5 percent was supposed to be the trigger for inflation, but something very strange or new is underway.

- Greedy employers: since 2004 corporate profits have risen from 60 years of fairly steady 6 percent of GDP to an unsteady 8 percent. Meanwhile, employee compensation has fallen from 47 percent of GDP to 42 percent. However, these gaps have been narrowing since 2012. And, although hard-nosed, in a time of exceptional corporate innovation there is no reason moral or otherwise to maintain historical shares — and does not explain why employers still are not competing for workers.

- Wages disconnected from productivity: productivity (output divided by worker numbers) has risen steadily for 70 years, but hourly compensation flattened in the 1970s. This pattern is so durable that it questions what we think we mean by “productivity” and the elasticity of demand for workers. Might we enter periods of worker-plenty, suppressing compensation but meaningless?

- Markups and business concentration: a version of greed. By some measures, markups (profit margins) and concentration of businesses into monopsonies has enabled wage starvation. Okay as a theory for a temporary phenomenon, but the U.S. more encourages formation of new businesses than any other nation, and protects against predatory competition. The consolidation of business is much more likely an IT and global competition (among business and workers) phenomenon than the return of the Robber Barons.

- Lower wages in rural areas: now we’re getting somewhere. An Obviousman! award for this thought. Non-metro area wage growth appears to grow at less than half the rate of large metros.

- CEO compensation: yes, it can be obscene, but we could confiscate all of it and redistribute to employees and not make a material change in worker comp. The S&P500 employs only 500 CEOs (whose quality of life is to me not worth the money).

- The demise of unions: give it up. Unions once were crucial to worker well-being. That day passed long ago, every business adopting the union agenda of 50 years ago, and more. Workers are not stupid. Union organizing is heavily protected, but membership today is only 11 percent of workers and half of those in the public sector. Workers themselves have opted away from traditional unionism.

I am left with two overlapping probabilities: there is something new underway in the employment economy, coinciding with the IT revolution and global trade, and it is impossible to evaluate the Fed’s risk of a very bad shot from the blind side.

Have a nice day, Jay Powell.

U.S. 10-year T-note since December, a nice pause:

The 10-year back five years. Odds are stupendous that the pause near 2.90 percent gives way to a run past 3.00 percent:

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.