Anyone who has ever applied for a mortgage knows just how slow, old-fashioned, and paper-driven the process can be. But now, San Francisco mortgage tech company Blend has joined the fray of companies offering ever-new ways to automate the process.

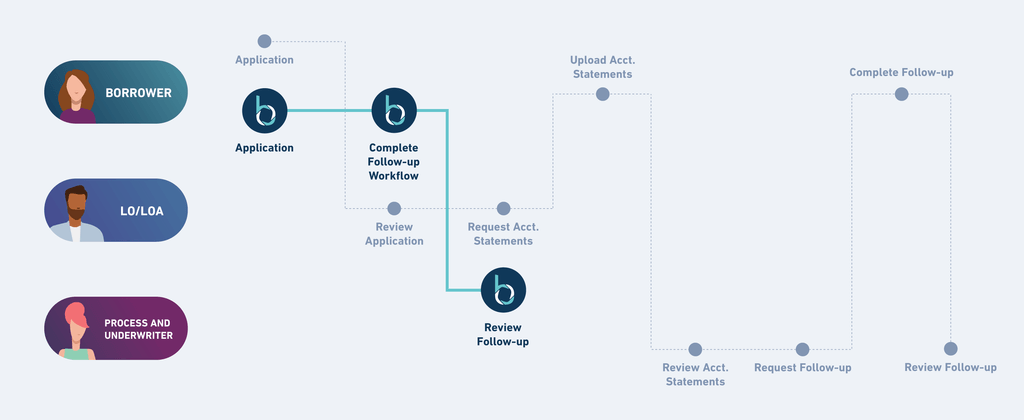

Launched on Tuesday, the company’s product is aimed at lenders and uses machine learning and artificial intelligence to process mortgage applications from homebuyers. Called Blend Intelligence, the product works by requesting documents like pay stubs and employment contracts and then automatically runs “health” checks and flags bad data to lenders.

The idea, according to the company, was to get rid of all the unnecessary manual steps while showing lenders who has the best odds of repayment. Blend, backed by a host of notable Silicon Valley investors including controversial PayPal co-founder Peter Thiel, currently works with over 120 lenders, among which are giants like Wells Fargo and credit unions like Mountain America.

“We use this added layer of machine learning because we know that basic rules aren’t enough for the complex loan industry,” Blend Intelligence Product Manager Grace Qi wrote in a blog post. “We also know that this technology will help lenders achieve lower costs and more efficient loan processing because there is less need for loan team intervention.”

Blend Intelligence also suggests follow-up documents for the borrower to submit and keeps an updated timeline of the process. As the new service is built into Blend’s digital lending platform, it will not have any additional costs.

Over the last few years, numerous companies have released products aimed at automating and improving the notoriously paper-heavy mortgage application process. As homebuyers increasingly expect the same automation they see in industries such as transportation and smart home technology, lenders are looking to offer tools that make this possible.

Blend Intelligence said that it distinguishes itself by using past user activity and application statistics to make more accurate and effective predictions. This year, it has collected over $150 billion in loan applications.

“Because the Blend engine helps power 25% of the mortgage market, it can learn from a significant amount of activity and provide the meaningful evolution that the industry desperately needs,” Qi said.